welcome to

intuitive investing

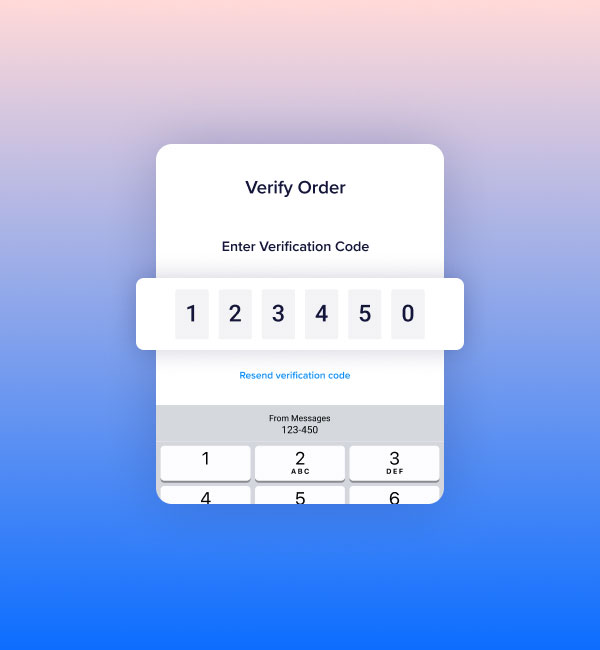

- Sign up in minutes, trade in seconds

- Easy to use, intuitive design

- An award-winning investing experience

Award Winning

Value

- Rated Best Value Share Trading Platform

- Premium features at no additional cost

- Low brokerage and investment minimum

Australia’s Happiest Investors

- Voted Canstar’s most satisfied customers

- Trusted by over 400,000 investors

- $3bn in customer assets

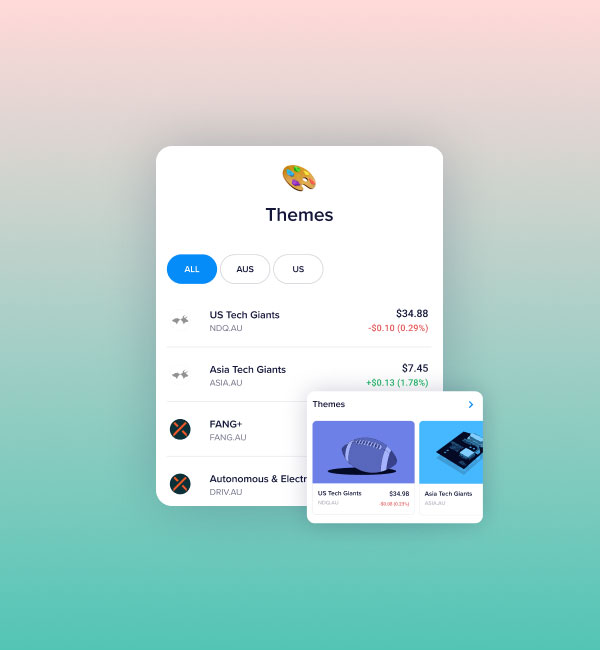

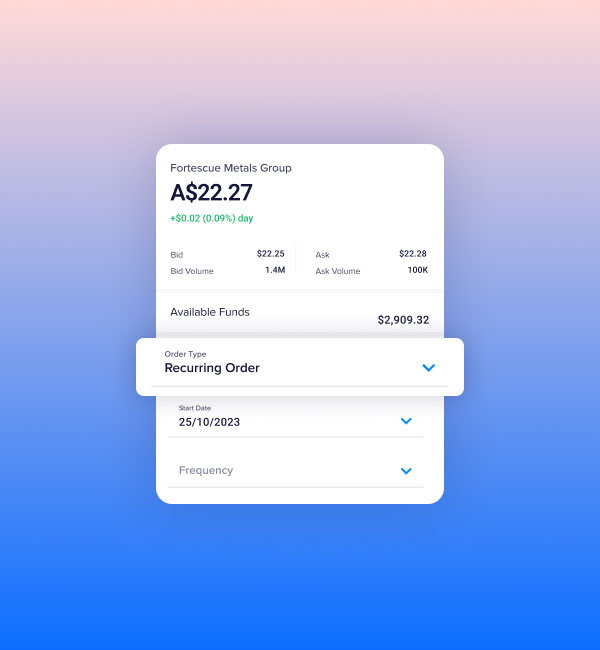

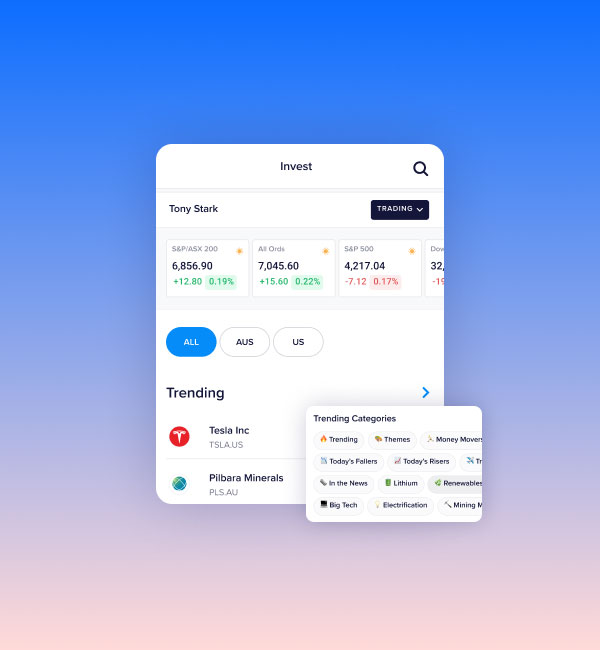

EFFORTLESS ASX INVESTING

Enjoy low cost trading across all Aussie listed shares and ETFs. Get invested with A$2 brokerage up to A$20k.

Start investing with just A$10 (min. trade size).

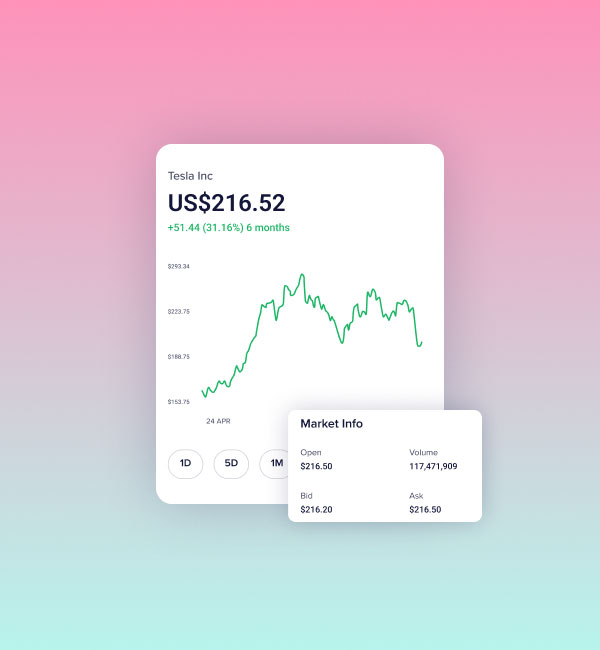

TRADE WALL ST IN SECONDS

Seamlessly trade U.S. shares and ETFs with US$2 brokerage on trades up to US$20k and instant FX transfers.

T&Cs apply.

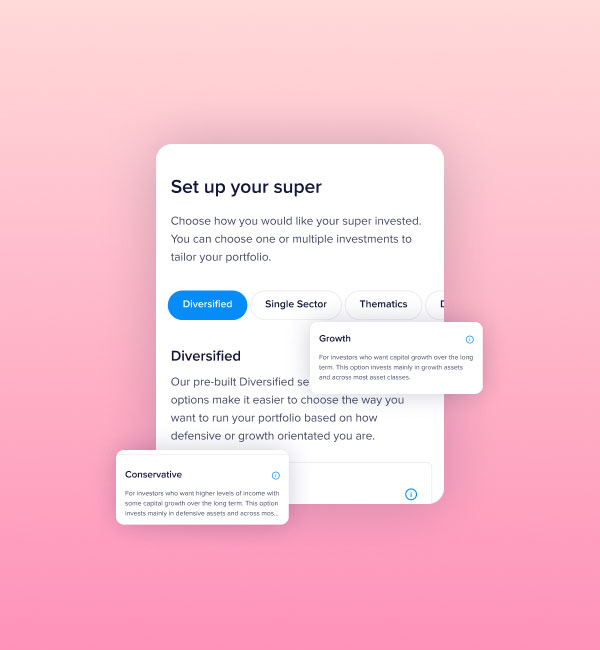

Super, SIMPLIFIED.

Designed to offer you an easier way to build the future you want. With Superhero Super choose investment options that let you set and forget, or take more action and invest in direct shares without the need for a self managed super fund.

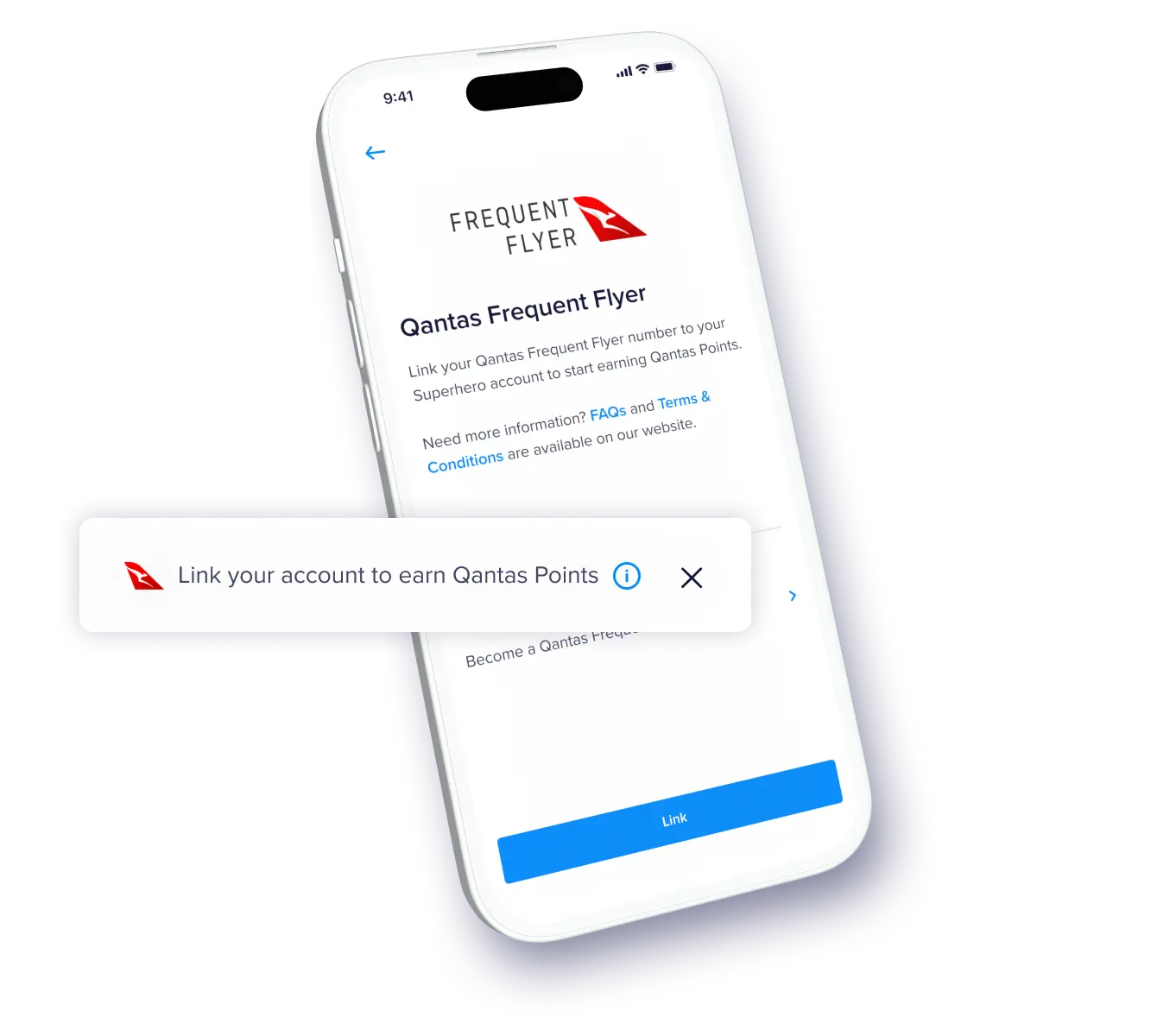

EARN QANTAS POINTS WITH SUPERHERO

Earn Qantas Points on eligible trades with your Superhero trading account.

Over 9,000 Aussie and U.S. shares & ETFS to choose from

Meta

Tesla

Apple

Visa

Airbnb

AMD

Microsoft

Alphabet

Amazon

Alibaba

ARK

Bank of America

Boeing

Booking.com

Cisco

Citi

Delta Air Lines

Disney

eBay

Expedia

HSBC

JP Morgan

Mastercard

Morgan Stanley

NVIDIA

Procter & Gamble

PayPal

Target

Unilever

Wallmart

Rivian Automotive

AGL

Air New Zealand

BHP

Brainchip

Coles

Core Lithium

CSL

Endeavour

Flight Centre

Lake Resources

Liontown Resources

NOVONIX

Paladin Energy

Pilbara Minerals

Qantas

Rio Tinto

Sayona Mining

Telstra

Woodside Energy

Woolworths

Get all the superpowers in 2 minutes

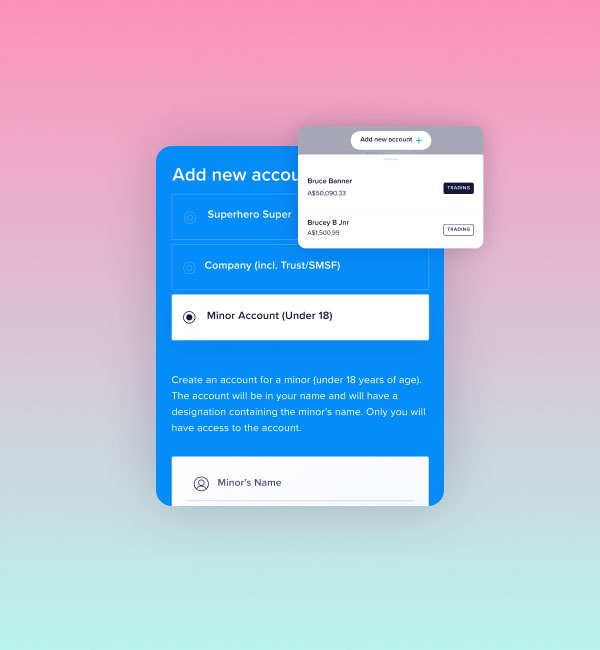

Sign up in minutes

Open a Superhero trading or super account and get access to award-winning features and perks from the get-go.

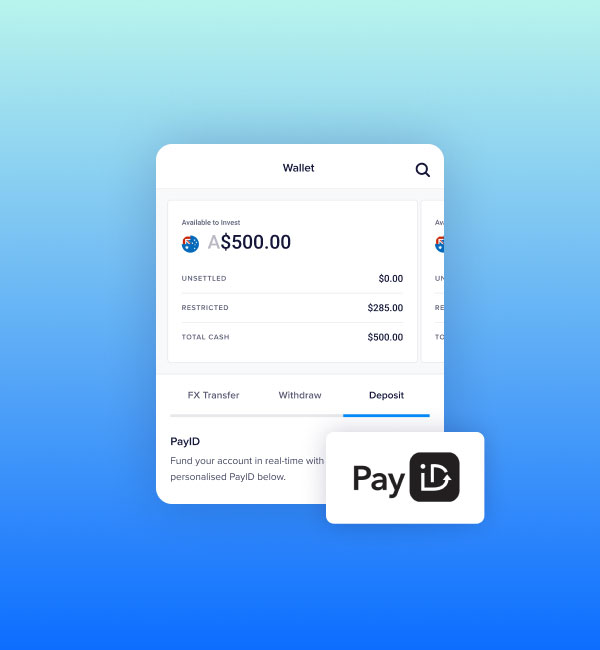

Fund your account instantly with PayID

Be in the market in seconds, not days. Don’t get caught out by market fluctuations and sneaky top-up fees.

Link your Qantas Frequent Flyer account

Start earning Qantas Points on eligible trades to put towards your next holiday. You’ve got this.

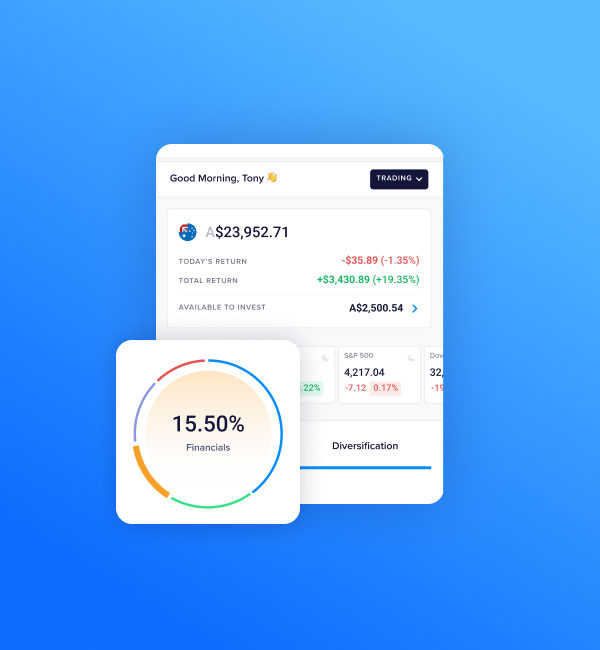

Power up your portfolio

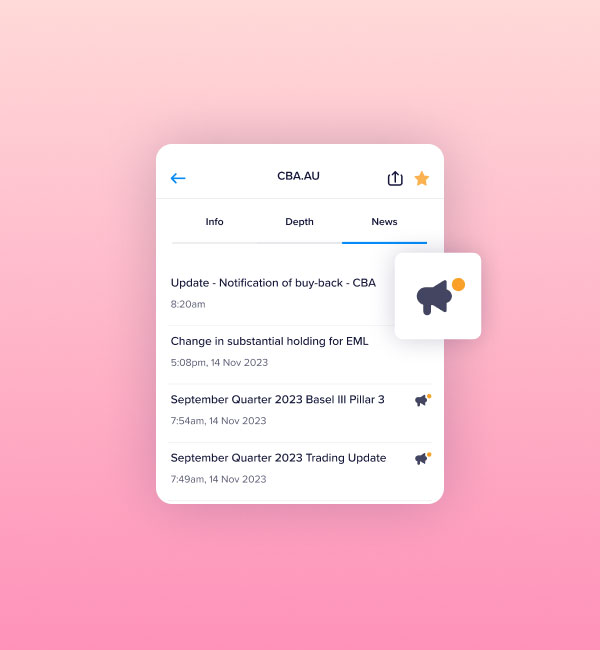

Invest in 9,000+ ASX-listed and Wall Street securities, or ASX300 shares and ETFs with Superhero Super.

Become one of Australia’s happiest investors

Join a vibrant community of 400,000+ Aussie investors, where accessibility and empowerment lead the way.

Control and confidence for any experience level

Superhero is your effortless investing sidekick. Our easy-to-use app puts the power back in your hands, no matter your bank balance or know-how.

Superhero by the numbers

0

Join over 400k Superheroes

$3bn

Trusted by Superheroes with over $3bn of customer assets

As Featured In

1Low Fees - Findings based on Superhero’s analysis of SuperRatings’ Fee Report - October 2024, accessed 5 December 2024. Fees for Superhero Super’s Growth and High Growth investment options are in the top quartile based on Total Fees and compared against the SR50 Balanced (60-76) and SR50 High Growth (91-100) Indices respectively.

Awarded -Winner: Excellent Rates and Fees, Winner: Best for Direct Investments in the WeMoney Superannuation Awards 2024

2Eligibility criteria applies to insurance products. For more information please refer to our insurance guides.

3Performance returns are calculated net of investment fees and investment tax. Administration Fees and Costs are not included. Please refer to our Product Disclosure Statement for more information. Past performance is not a reliable indicator of future performance. Performance for periods greater than one year is annualised. Investment returns are not guaranteed.

**Holding limits apply to investments held by members in Superhero Super. Please refer to the Superhero Super Product Disclosure Statement, Additional Information Guide and Direct Investment Guide for more information.

INVEST LIKE A

SUPERHERO

Say goodbye to complexity and hello to a streamlined, easy to use experience.

Sign up and claim ownership of your financial future.