WHY AUSSIES CHOOSE SUPERHERO

Primed for performance

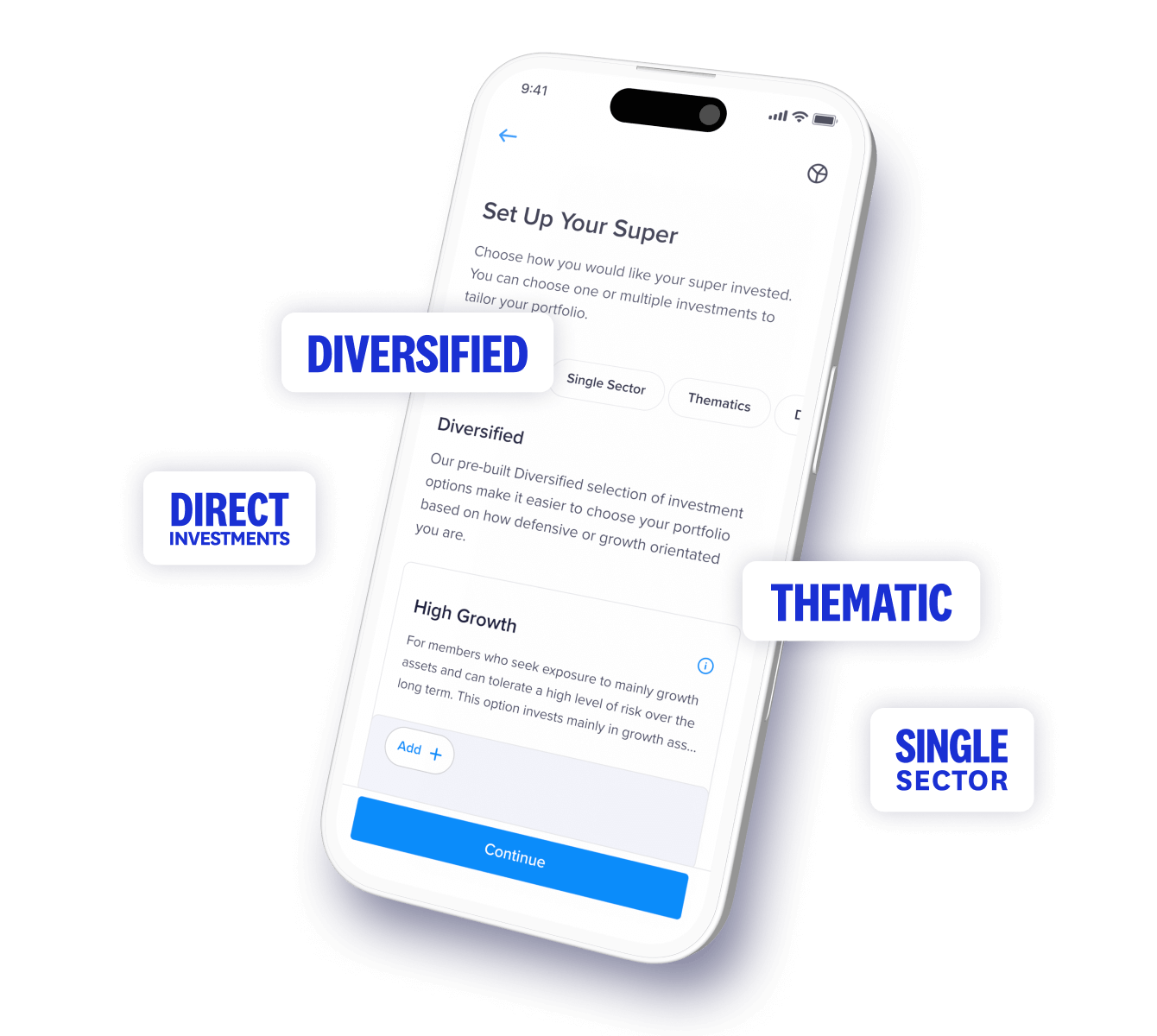

A wide range of investment options including professionally managed portfolios, thematic, and direct investments, all accessible in an intuitive app.

low fees1

We're opening doors with lower fees and costs than 75% of super funds.1

Tailor your

tomorrow

You earned your super, we're here to give you the access, flexibility and support to grow it on your terms.**

01

we’re offering more flex and less stress

We’re giving you the flex to build a super portfolio to your own specifications. Meaning you can have as much or as little involvement as you want with a variety of investment types.**

02

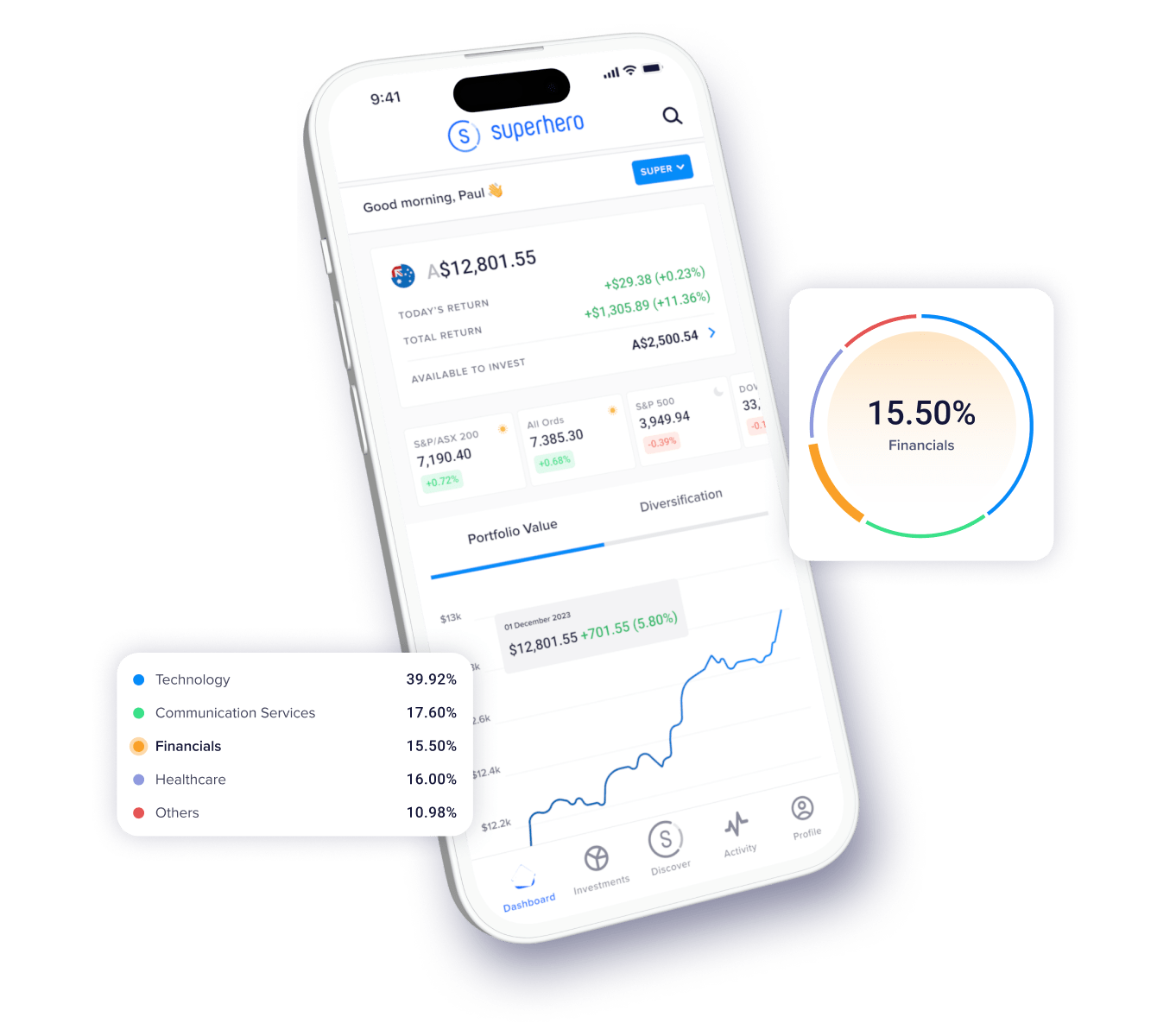

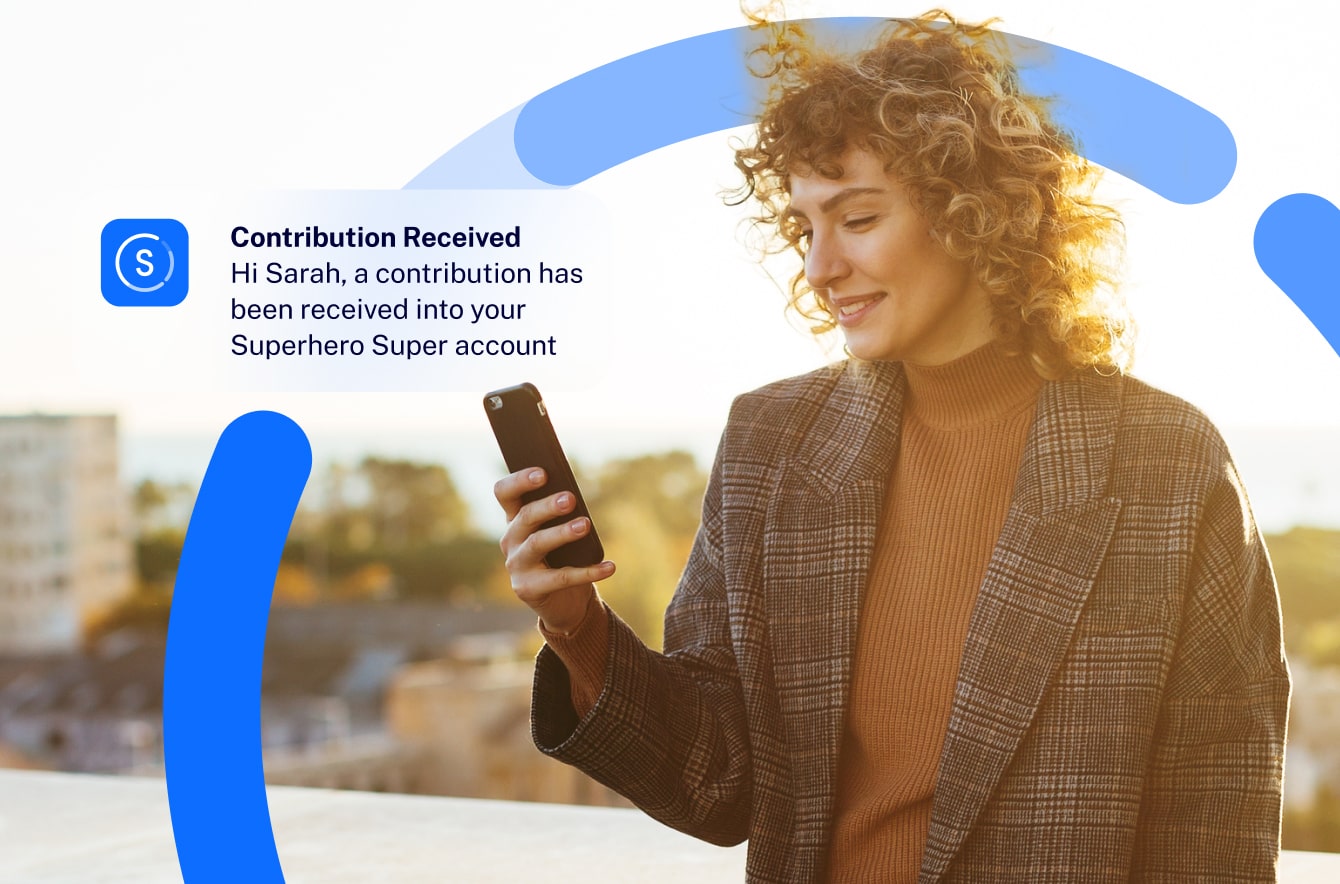

Your fund at your fingertips

Our highly intuitive, easy-to-use app makes managing and customising your super a breeze and gives you the tools to manage your wealth.

03

YOUR growth is our goal

Discover our range of investment options with a variety of strategies and risk profiles that aim to deliver above average returns, year on year.3

Past performance is not indicative of future performance.

04

Award-winning fees and flexibility

Winner of the Excellent Rates and Fees and Best for Direct Investment categories in the WeMoney Superannuation 2024 Awards.

05

Experts in Investment Management

Our managed investment options are professionally managed by Mercer, a global investment specialist with more than 75 years of investment expertise. Mercer advise on US$16.45 trillion* in global assets, working with professional investors of all sizes to help them reach their investment goals.

*as at 30 June 2022

06

It's time to liberate your super

Superhero Super has been designed to offer you an easier way to build the future you want. Choose investment options that let you set and forget, or take more action and invest in direct shares without the need for a self managed super fund.**

07

Insurance that has you covered

In the event of the unexpected or unthinkable, our insurance offers you and your loved ones peace of mind and a more secure future.2

Simple to join

Create your account

Fill in your details and create your secure Superhero profile.

Choose your investments

Tailor your super with managed or direct investment options.**

Consolidate your funds

If you’ve got other funds out there, its easy to consolidate them in our app.

Apply for insurance

Get the right cover to protect you and your loved ones financial future.

feeling super curious?

1Low Fees - Findings based on Superhero’s analysis of SuperRatings’ Fee Report - October 2024, accessed 5 December 2024. Fees for Superhero Super’s Growth and High Growth investment options are in the top quartile based on Total Fees and compared against the SR50 Balanced (60-76) and SR50 High Growth (91-100) Indices respectively. Refer to the Superhero Super PDS for more information on investment options.

Awarded -Winner: Excellent Rates and Fees, Winner: Best for Direct Investments in the WeMoney Superannuation Awards 2024

2Eligibility criteria applies to insurance products. For more information please refer to our insurance guides.

3Performance returns are calculated net of investment fees and investment tax. Administration Fees and Costs are not included. Please refer to our Product Disclosure Statement for more information. Past performance is not a reliable indicator of future performance. Performance for periods greater than one year is annualised. Investment returns are not guaranteed.

**Holding limits apply to investments held by members in Superhero Super. Please refer to the Superhero Super Product Disclosure Statement, Additional Information Guide and Direct Investment Guide for more information.

Ready to give

your super

powers?

Sign up now for a super fund that gives you the accessibility and flexibility to manage your wealth your way.**