Can I transfer shares out of Superhero?

Yes. To transfer shares from Superhero, you’ll need to contact the broker you want to move the shares to. The receiving broker will initiate the transfer on your behalf.

What do I do if my broker isn’t on the list to transfer my shares in?

Don’t worry – if your broker isn’t listed, tap Chat with us in your account and we’ll guide you through the next steps.

How do I track my transfer?

You can track the status of your transfer in the Share Transfers section of your Superhero account. You’ll find this in your Profile tab. There, you’ll see updates such as Submitted, In Progress, Completed or Rejected.

What information do I need to provide to transfer shares in?

For digital share transfers in, you’ll need:

- Your broker account details (e.g. HIN or account number)

- A valid government-issued photo ID

- A signature upload

Your account details must exactly match between brokers. If they don’t, the transfer may be rejected.

If your account has more than one signatory, you’ll be redirected to a form upload flow before your transfer can be processed.

Where can I see my franking credits?

The location of your franking credit information depends on the type of investment you hold:

Shares: Franking credit information is displayed in the Income Report (AUS), found in the Reports tab

Managed Investment Products (such as ETFs, LICs and REITs): Your franking credits will be detailed in the Attribution Managed Investment Trust Member Annual Statements (AUS).

The AMMA Statement will be updated in your account once the information has been received from the individual funds. For most funds, this data is available within 3 months of the end of the financial year; however, with some funds, it may be longer. If you do not see data in the AMMA/AMIT report, it’s likely that the fund(s) have not provided this information to Superhero yet. Customers will receive an email notification once their AMMA/AMIT report has been finalised. Please note, this may be as late as October.

To access your reports, please follow the steps below.

Website:

1) Click on the “Reports” tab

2) Select the appropriate financial year

3) Download the appropriate report (Income Report (AUS) / Attribution Managed Investment Trust Member Annual Statement (AUS))

Mobile App:

1) Select “Profile”, then “Tax Reports”.

2) Select the appropriate financial year.

3) Download the appropriate report (Income Report (AUS) / Attribution Managed Investment Trust Member Annual Statement (AUS))

If you are uncertain whether a particular investment’s tax information will be included in your AMMA report, we recommend contacting the fund or a tax professional. They can help clarify your specific tax obligations.

How do I set a stop loss order with Superhero?

- Choose a holding from your portfolio and set ‘Order Type’ to ‘Stop Loss Order’.

- Set the trigger price. This is the price at or below which your shares or ETF units will begin to sell.

- Choose the number of units you would want to sell in case the price falls to or below the trigger.

- Tap ‘Review’ and check the details of your new Stop Loss Order.

- If you’re happy with it, submit it. You can always edit or delete the order later from your dashboard under the ‘Pending’ tab.

If you wish to change or cancel your stop loss order, log into your Superhero account and click on the ‘Dashboard’ tab followed by ‘Pending’.

You will be able to view and make changes to your stop loss order/s once you click on the order/s that you wish to amend.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

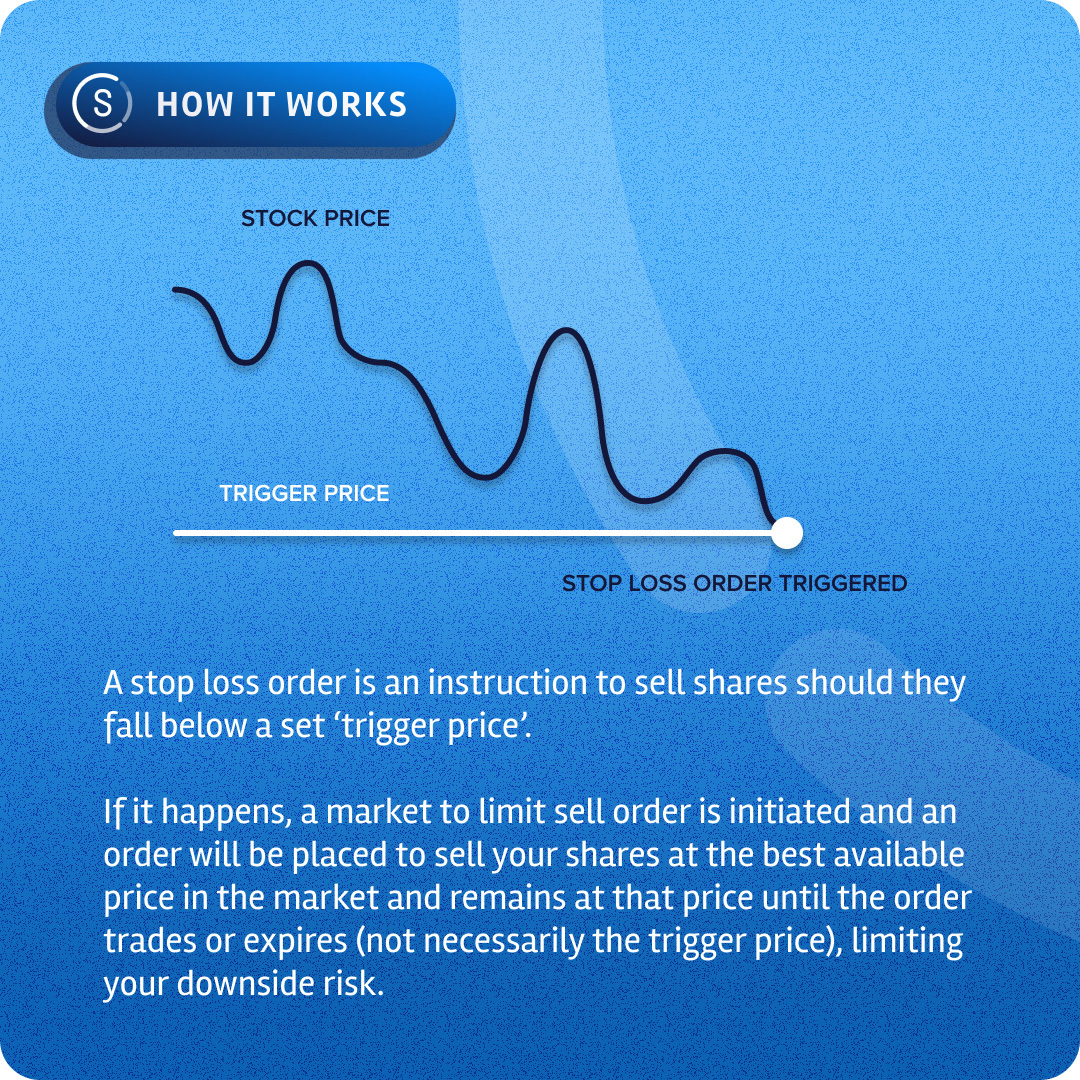

What is a stop loss order?

A stop loss order is an order to commence selling a stock once the share price reaches a specified price, known as the ‘stop’ or ‘trigger’ price.

When the ‘stop’ or ‘trigger’ price is reached, a stop loss order becomes a market to limit sell order. For market to limit sell orders, an order will be placed at the price set by the highest buyer in the market at the time the order is placed and remains at that price until the order trades, or expires.

Stop loss orders are most commonly used by investors to assist in limiting downside risk.

Note, that because the trigger order will be a market to limit sell order, the price you receive may not be the exact price you set the trigger price at.

Example: You purchase a stock at $10 per share and you set a stop loss order at $8 to protect yourself from further losses. The trigger price is reached and your stop loss order is sent into the market as a market to limit order and to sell your shares at the best available price in the market and remains at that price until the order trades or expires.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

What are recurring orders?

Recurring orders allow you to schedule automatic buy order(s) on a regular schedule.

You can set up a recurring order for any share or ETF (Australian or U.S.) on the Superhero platform:

- Log in to your Superhero account.

- Deposit funds into your Wallet (you can set up a recurring payment from your bank to your Superhero BSB and Account Number to automate this step).

- Find the share you want to invest in from the ‘Invest’ tab or the search bar and select ‘Buy’.

- Select the ‘Recurring Order’ option and set up your investment amount and schedule.

- Confirm your order.

You’ll be able to see your recurring orders in the ‘Pending Orders’ tab of your Dashboard.

Australian shares have a minimum of A$10 and cannot be bought as fractional shares and U.S. shares have a minimum of US$10 per trade. You will need to have these minimums available in your Wallet in the correct currency before you set up recurring orders.

You can also set up automatic deposits from your bank account to your Superhero account to ensure you always have funds to cover your recurring orders.

How do I change/cancel my recurring order?

If you wish to change or cancel your recurring order, log into your Superhero account and click on the ‘Dashboard’ tab followed by ‘Pending’.

You will be able to view and make changes to your recurring order/s once you click on the order/s that you wish to amend.

What time of day will my recurring order trade?

Your recurring order/s will be placed as a market order as soon as the market opens on a regular market-open trading day.

Keep in mind that for recurring orders of Australian shares the minimum order size is A$10 or one whole share, whichever is greater, as Australian shares cannot be bought in fractional units.

For recurring orders of U.S. shares the minimum order size is US$10 and you will need to have funds already converted into U.S. dollars.

If you do not have sufficient funds in your account, we will attempt to retry your order/s on each subsequent day, until the order is placed.