How do I set a stop loss order with Superhero?

- Choose a holding from your portfolio and set ‘Order Type’ to ‘Stop Loss Order’.

- Set the trigger price. This is the price at or below which your shares or ETF units will begin to sell.

- Choose the number of units you would want to sell in case the price falls to or below the trigger.

- Tap ‘Review’ and check the details of your new Stop Loss Order.

- If you’re happy with it, submit it. You can always edit or delete the order later from your dashboard under the ‘Pending’ tab.

If you wish to change or cancel your stop loss order, log into your Superhero account and click on the ‘Dashboard’ tab followed by ‘Pending’.

You will be able to view and make changes to your stop loss order/s once you click on the order/s that you wish to amend.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

What is a stop loss order?

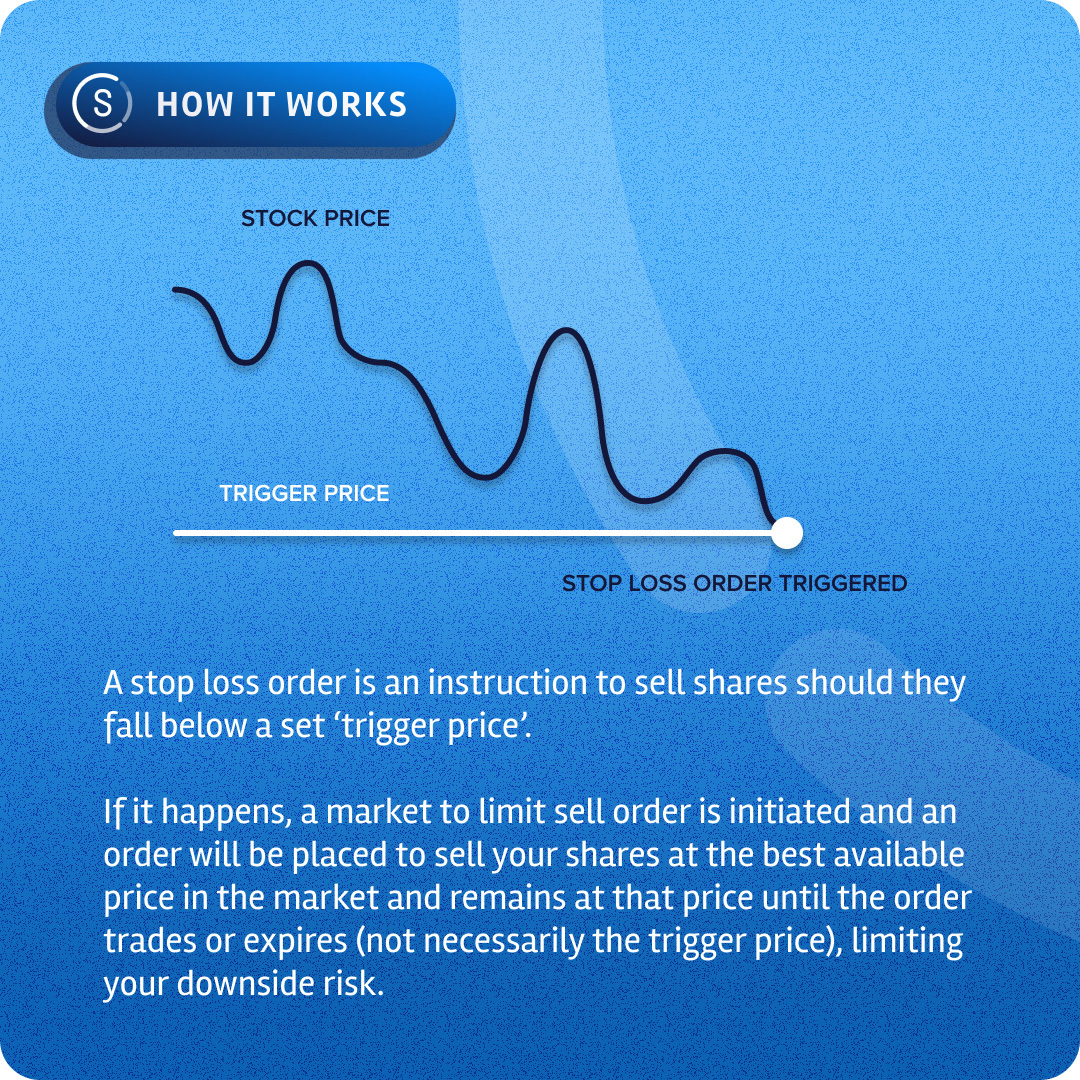

A stop loss order is an order to commence selling a stock once the share price reaches a specified price, known as the ‘stop’ or ‘trigger’ price.

When the ‘stop’ or ‘trigger’ price is reached, a stop loss order becomes a market to limit sell order. For market to limit sell orders, an order will be placed at the price set by the highest buyer in the market at the time the order is placed and remains at that price until the order trades, or expires.

Stop loss orders are most commonly used by investors to assist in limiting downside risk.

Note, that because the trigger order will be a market to limit sell order, the price you receive may not be the exact price you set the trigger price at.

Example: You purchase a stock at $10 per share and you set a stop loss order at $8 to protect yourself from further losses. The trigger price is reached and your stop loss order is sent into the market as a market to limit order and to sell your shares at the best available price in the market and remains at that price until the order trades or expires.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

What are recurring orders?

Recurring orders allow you to schedule automatic buy order(s) on a regular schedule.

You can set up a recurring order for any share or ETF (Australian or U.S.) on the Superhero platform:

- Log in to your Superhero account.

- Deposit funds into your Wallet (you can set up a recurring payment from your bank to your Superhero BSB and Account Number to automate this step).

- Find the share you want to invest in from the ‘Invest’ tab or the search bar and select ‘Buy’.

- Select the ‘Recurring Order’ option and set up your investment amount and schedule.

- Confirm your order.

You’ll be able to see your recurring orders in the ‘Pending Orders’ tab of your Dashboard.

Australian shares have a minimum of A$10 and cannot be bought as fractional shares and U.S. shares have a minimum of US$10 per trade. You will need to have these minimums available in your Wallet in the correct currency before you set up recurring orders.

You can also set up automatic deposits from your bank account to your Superhero account to ensure you always have funds to cover your recurring orders.

How do I change/cancel my recurring order?

If you wish to change or cancel your recurring order, log into your Superhero account and click on the ‘Dashboard’ tab followed by ‘Pending’.

You will be able to view and make changes to your recurring order/s once you click on the order/s that you wish to amend.

What time of day will my recurring order trade?

Your recurring order/s will be placed as a market order as soon as the market opens on a regular market-open trading day.

Keep in mind that for recurring orders of Australian shares the minimum order size is A$10 or one whole share, whichever is greater, as Australian shares cannot be bought in fractional units.

For recurring orders of U.S. shares the minimum order size is US$10 and you will need to have funds already converted into U.S. dollars.

If you do not have sufficient funds in your account, we will attempt to retry your order/s on each subsequent day, until the order is placed.

Why didn’t my recurring order trade?

The main reason your recurring order/s may fail is because you don’t have enough funds in your Superhero Wallet on the day your recurring order is due to execute.

If you do not have enough funds in your account, we will attempt to re-submit your order on each subsequent day, until the order is placed.

Keep in mind that for recurring orders of Australian shares the minimum order size is A$10 or one whole share, whichever is greater, as Australian shares cannot be bought in fractional units.

For recurring orders of U.S. shares the minimum order size is US$10 and you will need to have funds already converted into U.S. dollars.

What is a Market Order (U.S. Trading)?

A Market Order in the U.S. is an order to buy or sell securities at the prevailing market price.

Market Orders are based on the dollar amount you wish to invest. This may result in the volume of shares being a fractional amount (i.e. a volume of shares less than 1).

Market Orders are placed at market, meaning that:

- if the Market Order is a Buy order, whether during U.S. Market Hours or when the market is closed, you agree to pay the prevailing market price at the time the market order is executed; and

- if the Market Order is a Sell order, whether during U.S. Market Hours or when the market is closed, you agree to receive the prevailing market price at the time the market order is executed.

All Market Orders placed for U.S. listed securities will likely trade immediately. Where this is not the case these orders will expire 30 days after you place the order via the Superhero Platform.

What is a Limit Order?

A Limit Order is an order to buy or sell a certain number of shares for a specified price (or better).

Limit Orders expire 30 days after you place the order.

How do I place a trade?

You need to add funds to your Superhero Wallet before you can trade.

Once your Wallet is funded, you can search for a share or go to the ‘Invest’ tab to find and click on the share you wish to buy or sell.

How will I know when my order has been placed?

Once your order has been executed we will send you a text message or push confirmation.