Scan this article:

Hey Superheroes,

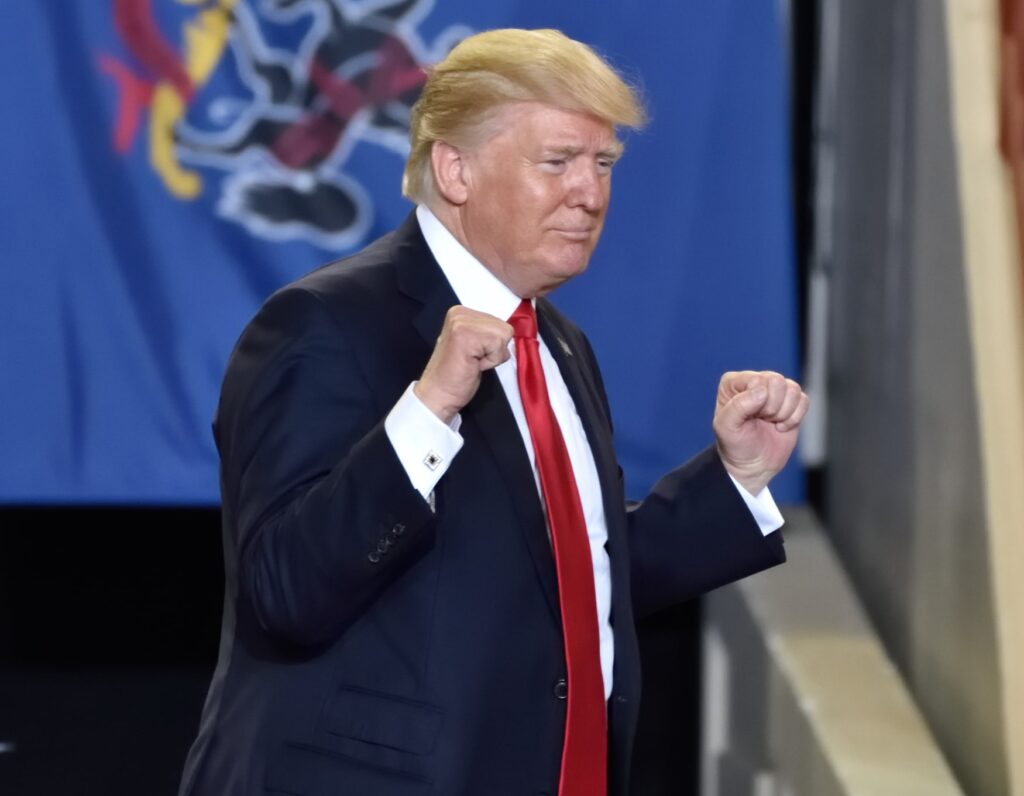

Markets were on edge this week after Donald Trump signed an executive order imposing sweeping new tariffs on global imports.

Goods from every country are now subject to a 10% minimum tax, with higher rates slapped on 92 nations – including a jump from 25% to 35% on Canadian goods after Canada recognised Palestine as a state. Investors fear a renewed era of tariff-fuelled volatility, echoing the trade shocks of 2018.

Meanwhile the Fed held interest rates steady signalling a cautious path forward. U.S. earnings season kicked into high gear with Meta leading the pack (more on that below), while the ASX 200 stayed flat amid local reporting season and commodity softness.

Let’s dive into this week’s biggest stories.

Figma’s IPO Breaks the Drought

The IPO freeze might finally be over and Figma just lit the match.

Shares in the design software company soared 250% on debut, closing at US$115.50 after listing at US$33. It marks the biggest first-day pop for a billion-dollar US IPO in over 30 years.

📈 Public markets are back?

Before the float, Figma was valued at US$19 billion. By day’s end, it was sitting above US$65 billion, overtaking Canva’s US$32 billion valuation. That kind of performance has investors asking whether more high-growth tech names are about to hit the runway.

Canva, which quietly moved its HQ from Sydney to Delaware earlier this year, has long said it’s “IPO ready.” And while its founders are in no rush Figma’s success could change the narrative.

💸 The numbers behind the hype

Figma generated US$749 million in revenue in 2024, up 48% year-on-year. In Q1 2025 alone, it booked US$228 million in revenue and US$44.9 million in net income with massive 91% gross margins.

Its Rule of 40 score was 63 – a rare feat that puts it in the top 5% of SaaS companies globally. Enterprise customer growth hit 47%, while net revenue retention came in at 132%, signalling strong upsell momentum and product stickiness.

🇦🇺 What this means for Aussie investors

Canva’s early backers are staying patient but the appetite for fast-growing software stocks is clearly back.

A successful Figma listing could reopen the IPO floodgates especially for Aussie-founded tech names with global scale. We’ll keep you posted.

Meta’s AI Megapush Delivers

Meta came out swinging this week with a bold Q3 forecast and markets loved it.

Shares in the Facebook parent jumped almost 12% last night after the company projected 16% revenue growth and lifted full-year spending guidance to as much as US$118 billion.

🧠 Superintelligence is the strategy

Meta isn’t just riding the AI wave – it’s reshaping the company around it.

The tech giant has overhauled its AI division under the name “Meta Superintelligence,” led by Alexandr Wang, formerly CEO of data-labelling startup Scale AI. Meta acquired a 49% stake in Wang’s company for US$14.3 billion, adding deep technical talent and infrastructure to its arsenal.

Behind the scenes, it’s building out multi-gigawatt data centres to train and deploy large-scale AI models.

These investments are now central to Meta’s infrastructure roadmap, with capex guidance raised to US$66-72 billion.

📲 Real-world impact is already showing

Meta says its generative AI tools are already improving ad performance across Instagram and Facebook, delivering a 5% lift in ad conversions on Instagram and 3% on Facebook this quarter.

The company is also investing in creative tools, smart assistants and customer support automation, laying the groundwork for Zuckerberg’s vision of “personal superintelligence.”

With AI now embedded across products, infrastructure and strategy, Meta is showing investors it’s not just building hype – it’s delivering outcomes.

📊 Meta vs Wall Street

Here’s how Meta stacked up against expectations:

- Earnings per share: US$7.14 vs. US$5.92 expected

- Revenue: US$47.52 billion vs. US$44.80 billion expected

- Advertising revenue: US$46.56 billion vs. US$43.97 billion expected

- Daily active users (Family of Apps): 3.48 billion vs. 3.45 billion expected

Q2 net income rose 36% year-on-year to US$18.34 billion, while total expenses increased 12% to US$27.08 billion. Reality Labs posted a US$4.53 billion operating loss, slightly ahead of estimates.

🔦 Some other things we’re shining the Spotlight on:

MICROSOFT CLOUD SURGES: Microsoft posted US$76.4 billion in quarterly revenue, up 18% year-on-year and ahead of forecasts. Strong enterprise demand, AI-linked products, and higher cloud spend drove the beat. Capital expenditure jumped 27% to US$24.2 billion as Microsoft continues to scale its AI infrastructure.

CHIPS ON THE TABLE: Tesla has signed a US$16.5 billion deal with Samsung for the latter to supply AI chips for Tesla’s next-gen vehicles. The chips will be made at Samsung’s new Texas facility, marking a turning point for its U.S. foundry business.

HONEYMOON’S OVER: Boss Energy (ASX:BOE) shares crashed 49% over the last week after its FY26 guidance showed costs and capex well above forecasts. An expert review is now underway to determine whether its flagship Honeymoon project remains economically viable.

TRAVEL TURBULENCE: Flight Centre (ASX:FLT) cut its FY25 profit forecast to A$285-295 million, missing even its downgraded April guidance. Weak U.S. demand and higher costs hit Q4 performance. On the upside, it’s partnering with Anthropic to roll out AI toolsy. The stock fell over 7% yesterday on the news.

Keep up to date on the markets by following us on Instagram @superheroau.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.