What is a stop loss order?

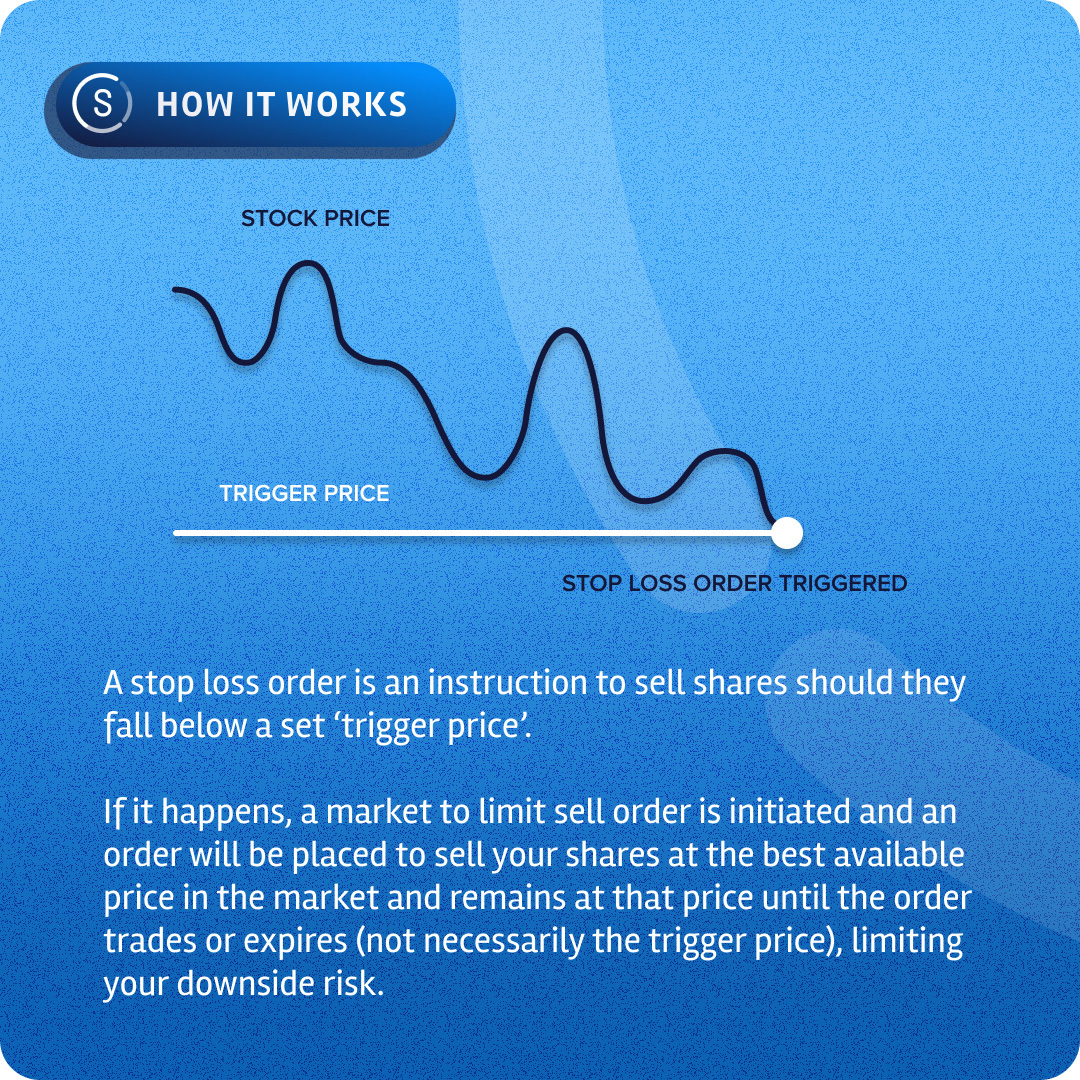

A stop loss order is an order to commence selling a stock once the share price reaches a specified price, known as the ‘stop’ or ‘trigger’ price.

When the ‘stop’ or ‘trigger’ price is reached, a stop loss order becomes a market to limit sell order. For market to limit sell orders, an order will be placed at the price set by the highest buyer in the market at the time the order is placed and remains at that price until the order trades, or expires.

Stop loss orders are most commonly used by investors to assist in limiting downside risk.

Note, that because the trigger order will be a market to limit sell order, the price you receive may not be the exact price you set the trigger price at.

Example: You purchase a stock at $10 per share and you set a stop loss order at $8 to protect yourself from further losses. The trigger price is reached and your stop loss order is sent into the market as a market to limit order and to sell your shares at the best available price in the market and remains at that price until the order trades or expires.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.