Scan this article:

It’s the beginning of a new financial year.

You’re sipping your morning coffee and looking at your bank balance.

Or maybe you spent last night preparing and lodging your tax return.

And now, you’re determined to put your hard-earned money to work.

We, at Superhero, understand that feeling.

That’s why we conducted a survey with our incredible Superheroes to uncover the goals real investors like you are setting out to achieve in FY24.

Spoiler alert: taking a passive role in investing isn’t helping our Superheroes crush their financial goals.

These are the resolution trends we uncovered

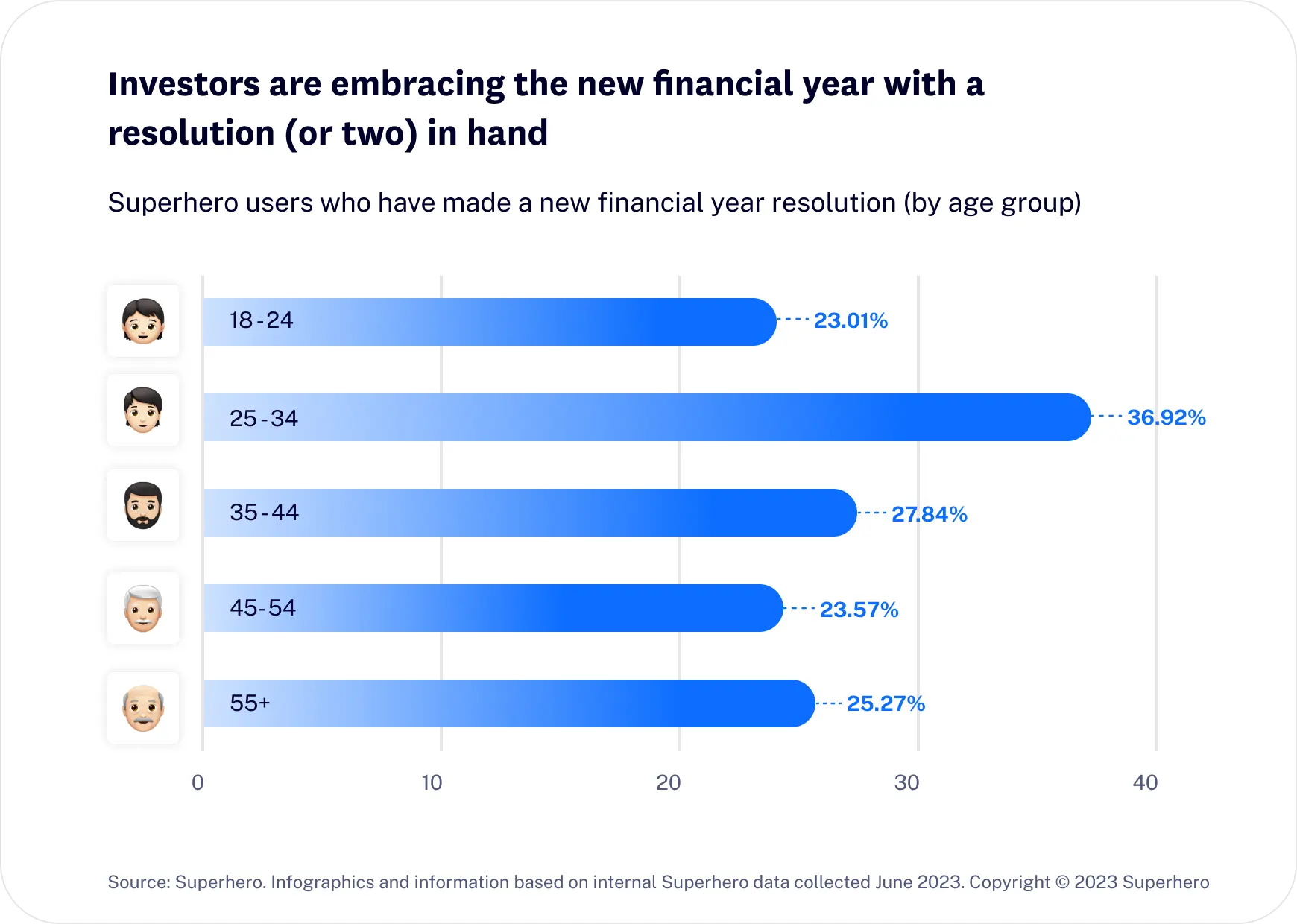

First things first: So you know which real investors we’re talking about here, we analysed the survey responses of 1,400 of our Superhero customers.

Almost a third of you (29%) told us you’d made a New Financial Year resolution. We also found that our female-identifying Superheroes between the ages of 25 and 34 were the most likely to start the year with some new goals.

Below we reveal what those goals were. Get ready to be inspired.

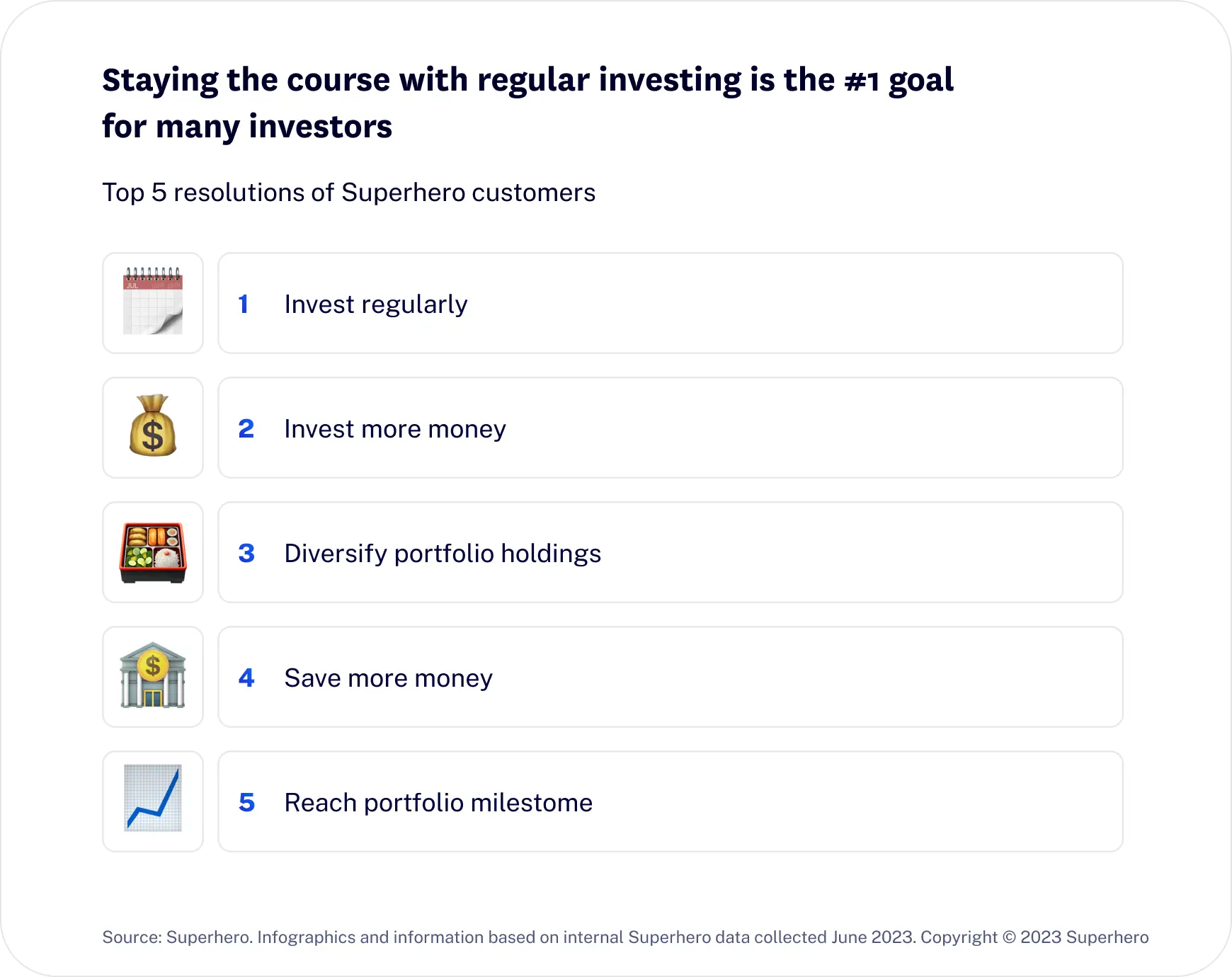

1. Committing to more regular investing

Just like hitting the gym regularly leads to a healthier body, regularly investing can lead to a healthier portfolio.

So it’s no surprise that themes like dollar-cost averaging (also known as DCA) and staying on track with your investing goals (e.g. investing every week) shone through in our data.

Ever heard of investing legend Warren Buffett?

Well, Buffett is also an advocate for regular investing and strategies like dollar-cost averaging. He famously said, “If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.”

His endorsement is music to the ears of all those time-poor individuals out there.

With this strategy, you choose your stocks, decide on your investment amount and stick to a set schedule regardless of market fluctuations.

Remember, consistency is the key to achieving your long-term goals.

Psst. Did you know you can put your investing strategy on cruise control? Check out our auto-invest features for recurring investments, so you can crack on with literally anything else.

2. Allocating more funds (and time) to your investments

Another big portion of you were considering allocating more funds to your investments. You know that small investment increases can lead to big financial strides.

We also found that many of you are ready to seize control of your finances by paying closer attention to your portfolio.

While passive investing has its merits for busy people, it’s refreshing to see so many Superheroes refusing to settle for the status quo. You’re ready to roll up your sleeves and devote extra time to seeking out stocks that have the potential to thrive in any market.

Which brings us to our next resolution trend…

3. Diversifying your portfolio for stability and opportunity

As the saying goes, don’t put all your eggs in one basket.

So we’re happy to see that you’re not just allocating more time and money for your investments this FY. You’re eyeing variety and minimising your risk exposure, too.

OK — so you may not stand to gain as much in a short space of time. But on the other hand, diversifying your portfolio can protect you from market turbulence and smooth out your returns.

Investments like exchange-traded funds (ETFs) can help you gain exposure to hundreds (even thousands) of stocks. But if you’re new to the concept, here’s an article that explains how ETFs can take the admin out of diversification.

4. Saving more today for a brighter financial future

Saving isn’t always the most exciting part of the financial journey, but many of you know it’s like eating less ice cream and more fruits and vegetables for a healthier, longer life.

In FY24, you’re looking at practical ways to boost your cash savings. Even if it’s saving an extra $50 a month, you’re $50 ahead of where you would have been otherwise (and that’s without the compounding growth potential over time if you invest it wisely.) And for that, saving is worth it.

5. Setting clear goals to reach a certain portfolio milestone

You’re lining up the goalposts this FY. Because you know the allure of a dangling carrot can work wonders for your portfolio 😉

It’s great to hear you’re defining measurable goals and creating a roadmap that will keep you focused and driven to invest consistently.

With your eyes fixed on the prize, we’ll be right there with you as you chase your portfolio milestones.

6. Trimming expenses to unlock more funds for investing

Another trending resolution of yours: cutting back on expenses to make room for your investments.

It’s not about sacrificing all the fun stuff. It’s about being smart with your spending so you can put your hard-earned paycheck to work.

And with the current cost-of-living challenges, it’s easy to see why Superheroes are committing to divest more of their “good life” expenses now — for their future selves.

By being mindful of your discretionary spending and finding ways to save, you’re looking to free up extra funds that can go straight into your investment portfolio. Nice one!

7. Expanding your knowledge and research for informed investing

Picking stocks or the right time to buy is like shopping for a car — but with greater consequences. That’s why it’s no surprise that expanding your knowledge and research was one of the top financial year resolutions we uncovered.

So if you’re keen to do better in FY24, how do you separate the solid investments from the potential duds?

Well, there are no guarantees. That said — doing your homework is a great place to start.

Doing your investing homework

Just like you’d assess your personal needs and style before buying a car, evaluating investments requires a similar approach. Whether you’re considering a single stock or a diversified portfolio, remember to look under the hood:

- Establish your investment goals.

- Evaluate different investment options, analysing their performance, market trends and potential returns.

- Dive deeper into the financials (revenue, earnings and industry stability).

- Test the waters by monitoring market conditions and historical performance.

PSA: If you’re a Superhero customer, make sure you check out our Follow feature to keep tabs on your favourite stocks.

Do these things, and you’ll feel much more empowered in the new financial year.

8. Transforming your investment outlook to play the long game

Sometimes, a fresh perspective can make all the difference in your investments.

So, naturally, many of you want to adjust your expectations to align with your long-term goals this FY — things like minimising your risk exposure through DCA or investing in ETFs.

You understand that building wealth is a marathon, not a sprint.

9. Increasing your income with dividend stocks and ETFs

Wouldn’t it be great if your investments grew and generated a steady income stream along the way? Another trend we uncovered among our Superhero community.

You told us you wanted to incorporate things like dividend stocks and ETFs into your portfolio to boost your income potential.

Lucky for you, this resolution is totally doable. Superhero has over 300 Aussie and 900 U.S. ETFs across multiple sectors for you to choose from and invest in right now.

10. Creating a budget that works for you (and sticking to it)

Creating a budget might not sound thrilling. But you told us it was important. Besides, it really is the only way you’ll ever know where your money is going and how much income you have after all your expenses are accounted for.

So pull out the big spreadsheet guns, ask one of your finance nerd friends for a favour, or try this free budget planner from Money Smart. Your bank balance and portfolio will thank you for it.

Thank you, Superheroes!

There’s been a lot to celebrate lately — so we’re starting the new financial year with even bigger and better intentions than the last.

And, with the collective wisdom of our amazing community, let’s make the new financial year one filled with more triumphs.

We’re so grateful for your switched-on mindset and continued support.

This blog does not constitute financial advice that considers your personal objectives, financial situation or particular needs. The advice provided is intended to be of a general nature only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)