Scan this article:

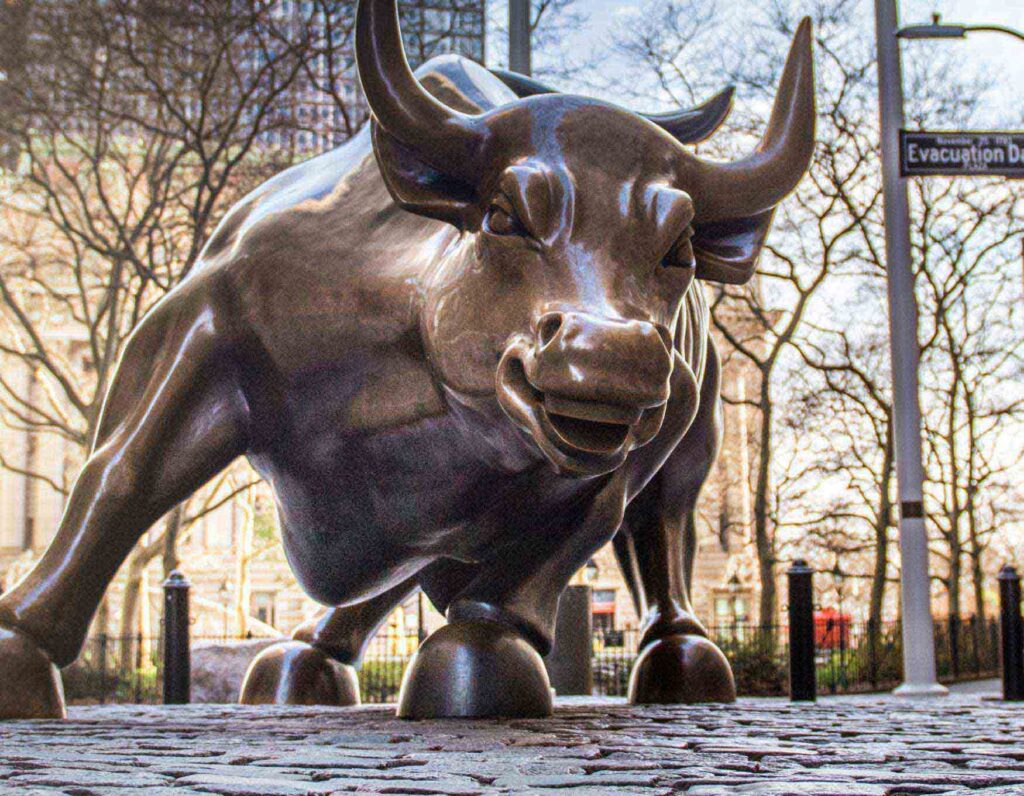

Australia is leading the global charge as the largest lithium producer. Now, with the surge of electric vehicles (EVs) and the skyrocketing demand for high-performance batteries for renewable energy storage, all eyes are on ASX lithium stocks.

With that said, you may be thinking about getting some skin in the lithium game (if you haven’t already). But with so many players on the ASX, how do you choose which lithium stocks to invest in?

We’ve rounded up the top 10 most traded Australian lithium stocks (including producers and explorers) on our platform in 2023 and put their market capitalisation and company performance under the microscope.

✍️Editorial note: Just to be clear, this article is designed to provide a general overview based on current financials, share price and trading volume, and is not a recommendation to buy or sell any stock. Make sure you conduct your own thorough research and analysis.

The facts:

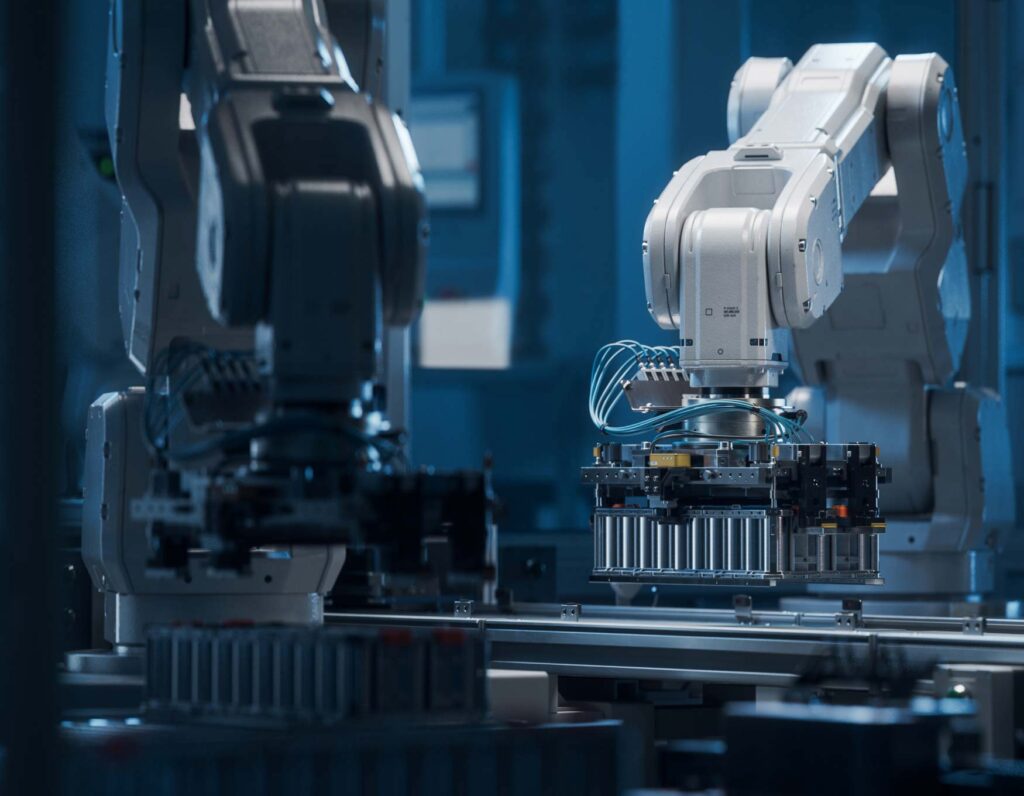

- Lithium is crucial for rechargeable batteries which are essential in the global effort to reduce carbon emissions.

- By 2030, the world will need more than double the amount of lithium compared to 2025, reaching over 2 million tonnes of lithium carbonate equivalent.

- The growing popularity of electric vehicles will significantly contribute to the increased need for lithium in the next 10 years.

- Interestingly, even though Australia is the largest producer of lithium in the world, it receives only a tiny fraction (around 0.5%) of the total value from the mineral it exports.

What are the top lithium stocks on the ASX?

Below are the top 10 lithium stocks available for public trading on the Australian Stock Exchange, ordered by trade volume on Superhero.

| Rank | Company Name | Ticker | Share Price | 12-Month Change (%) | Market Capitalisation | |

|---|---|---|---|---|---|---|

| 1 | Core Lithium | CXO | $1.00 | -21.88% | $1.92 billion | |

| 2 | Pilbara Minerals | PLS | $4.63 | +64.77% | $14.11 billion | |

| 3 | Sayona Mining | SYA | $0.21 | 0.00% | $1.97 billion | |

| 4 | Liontown Resources | LTR | $2.70 | +110.94% | $6.05 billion | |

| 5 | Lake Resources | LKE | $0.54 | -63.01% | $797 million | |

| 6 | Allkem Limited | AKE | $15.00 | +11.19% | $9.75 billion | |

| 7 | Rio Tinto | RIO | $105.40 | -4.86% | $153.46 billion | |

| 8 | Mineral Resources Ltd | MIN | $69.59 | +15.56% | $14.02 billion | |

| 9 | Argosys Minerals Ltd | AGY | $0.44 | +1.14% | $642 million | |

| 10 | Ioneer Ltd | INR | $0.34 | -35.85% | $713 million | |

Data as of 25 May 2023 at 4pm close.

📣PSA: In order to buy lithium stocks, you’ll need an online brokerage account. Superhero users enjoy some of the lowest prices available, minimising their brokerage fees with $2 trades on all ASX-listed shares (and it’s free to join).

$2 brokerage applies for trades up to $20k.

1. Core Lithium (CXO)

Company Overview

At the top of the list and a favourite lithium stock of Superhero users is Core Lithium. No surprises here, as CXO undoubtedly benefits from a home-ground advantage, being ASX-listed with an all-Aussie resource.

Its flagship Finniss hard-rock lithium project is just one hour’s drive from Darwin in the Bynoe Pegmatite Field. Mining kicked off in late 2022 with a couple of deposits, but the company has big ambitions in the area with over 500km2 of tenements and an eye on value-adding downstream activities at some point in the future. (Not to mention exploration elsewhere beyond the lithium sphere.)

Project Portfolio and Resources

Major Projects

Project name: Finniss Lithium Project

Location: 80km south-west of Darwin, Northern Territory

Deposit type: Hard rock

Resource size: 15 megatonnes @ 1.3% lithium oxide

Stage: Production from December 2022

Other Projects

Core Lithium also has other projects underway, mainly at the exploration stage, for (more) lithium, zinc, copper, lead, silver, gold and uranium across the Northern Territory and South Australia.

Financial Performance (FY22)

Net profit (loss) after tax: ($7.5 million)

Net assets: $238.7 million

Cash in hand (as of 31 March 2023): $97.8 million

2. Pilbara Minerals (PLS)

Company Overview

Pilbara Minerals, the don of the Aussie lithium mafia, has long been a darling of the savviest ASX investors (long in lithium terms, anyway). Its Pilgangoora lithium project shipped its first batch of spodumene concentrate way back in 2018.

Its main hard-rock deposits are 120km inland from Port Hedland in — you guessed it — the Pilbara region of WA. Like Core, its primary focus is on expanding its main project, and with $2.7 billion cash at last count (March 2023), it’s well-positioned to self-fund its growth.

Project Portfolio and Resources

Major project

Project name: Pilgangoora Lithium Project

Location: Pilbara region, Western Australia

Deposit type: Hard rock

Resource size: 159 megatonnes @ 1.2% lithium oxide

Stage: Production

Other projects

Lithium exploration in the Pilbara region, Western Australia.

Financial Performance (FY22)

Net profit (loss) after tax: $562 million

Net assets: $1.29 billion

Cash in hand (as of 31 March 2023): $2.7 billion

3. Sayona Mining (SYA)

Company Overview

Sayona Mining is one of the newest entrants to the ASX lithium production club, with mine operations at its North American Lithium project going live in March this year. SYA has several lithium projects at various stages of development clustered around two hubs in Quebec: a region of Canada better known for producing poutine and Celine Dion.

It hopes its proximity to the American car manufacturing industry makes it a supplier of choice for the EV revolution. Meanwhile, and closer to its registered home in Australia, Sayona is also involved in exploration for lithium, gold and graphite.

Project Portfolio and Resources

Major project

Project name: North America Lithium

Location: Quebec, Canada

Deposit type: Hard rock

Resource size(s): Abitibi hub 75.4 megatonnes @ 1.18% lithium oxide, Northern hub 51.4 megatonnes @ 1.31% lithium oxide

Stage: Production from March 2023

Other projects

Lithium, gold and graphite exploration in Western Australia.

Financial Performance (FY22)

Net profit (loss) after tax: $83.7 million

Net assets: $570.8 million

Cash in hand (31 March 2023): $98.2 million

4. Liontown Resources (LTR)

Company Overview

This pre-production lithium contender shot to fame in early 2023 when U.S. lithium giant Albemarle propositioned Liontown shareholders with a juicy $5.5 billion takeover bid, a 63% premium on the pre-bid share price.

Despite its Kathleen Valley lithium project being way off from production and in the cash-burning development stage, Liontown managed a profit in FY22 by spinning out its non-lithium assets into a newly listed company (ASX:MI6) and selling off a vanadium project. The company is also seeking to ice its lithium cake with a second mine in WA’s Goldfields region.

Project Portfolio and Resources

Major project

Project name: Kathleen Valley

Location: Kathleen Valley, Western Australia

Deposit type: Hard rock

Resource size: 156 megatonnes @ 1.4% lithium oxide

Stage: Expected production from Q2 2024

Other projects

Buldania Lithium Project in the Eastern Goldfields Region of Western Australia.

Financial Performance (FY22)

Net profit (loss) after tax: $40.9 million

Net assets: $466.8 million

Cash in hand (31 March 2023): $305 million

5. Lake Resources (LKE)

Company Overview

One popular ASX-listed lithium stock that’s not sipping at the hard rock cafe is Lake Resources. LKE is currently developing lithium brine projects in the lauded Lithium Triangle region, which stretches across neighbouring corners of Argentina, Chile and Bolivia.

Lake is adamant that its approach will be one of the cleanest in the world, a potential value-add if it can pull it off, given the demand for lithium is largely driven by the global environmental agenda.

Project Portfolio and Resources

Major project

Project name: Kachi Project

Location: Catamarca Province, Argentina

Deposit type: Brine

Resource size: 5.3 megatonnes lithium carbonate equivalent

Stage: Development, definitive feasibility study expected mid-2023

Other projects

Four other smaller lithium brine projects in the Lithium Triangle.

Financial Performance (FY22)

Net profit (loss) after tax: ($5.7 million)

Net assets: $218.8 million

Cash in hand (31 March 2023): $113.3 million

👉Explainer #1: Lithium can be found in two forms: pegmatite (or hard rock) and brine (in salt flats). While most, if not all, Australian producers mine it out of the ground, lithium deposits in other parts of the world like South America and the U.S. are often extracted in brine form by pumping water into the ground.

👉Explainer #2: Not all lithium is created equal however. Different uses need different forms of it. Hard rock can be turned into either carbonate or hydroxide, whereas brine can only be (directly) turned into lithium carbonate and needs further processing if hydroxide is the end goal.

6. Allkem Limited (AKE)

Company Overview

Allkem Limited, an established ASX player on the lithium scene, is diversified across brine in Argentina and hard-rock in Australia and Canada.

But what sets it apart from pure-play miners is its (future) downstream processing capabilities at its 75% owned Naraha lithium hydroxide plant in Japan. Who owns the other 25%? None other than the Toyota Tsusho Corporation. Yes, that Toyota. With mines already in production, Allkem turned a healthy profit in FY22, despite construction and commissioning still being underway on the Naraha facility.

Project Portfolio and Resources

Major project

Project name: Olaroz Lithium Project

Location: Jujuy Province, Argentina

Deposit type: Brine

Resource size: 20.7 megatonnes lithium carbonate equivalent

Stage: Production

Other projects

Hard rock lithium mine in production in Western Australia.

Financial Performance (FY22)

Net profit (loss) after tax: $337.2 million

Net assets: $3.1 billion

Cash in hand (31 March 2023): $577.9 million

7. Rio Tinto (RIO)

Company Overview

Now here’s an Aussie mining behemoth you’d already be familiar with. Despite Rio Tinto being the second-largest mining company in the world (behind BHP also known as the Big Australian), Rio sits further down the list on the ASX lithium stock power rankings. And that’s because its current exposure to lithium is a drop in the ocean compared to its established product lines of iron ore, aluminium, copper, diamonds, energy and minerals.

To fast-track its strategy, it acquired Rincon Mining’s Argentinian lithium brine project (next door to Argosy) in December 2021 and promptly signed a supply memorandum of understanding (MOU) with Ford Motor Company the year after.

Now, with its wallet fat with cash, Rio is well placed to add more of the same to its shopping cart. But with its other big asset at Jadar, Serbia on ice due to public opposition, some buyer’s remorse could start to set in.

Project Portfolio and Resources

Major project

Project name: Rincon Lithium Project

Location: Salta Province, Argentina

Deposit type: Brine

Resource size: TBC

Stage: Exploration

Other projects

Jadar Lithium Project in Serbia – licences revoked in 2022 due to public opposition.

Financial Performance (FY22)

Net profit (loss) after tax: $13.1 billion

Net assets: $52.3 billion

Cash in hand (30 June 2022): $6.8 billion

8. Mineral Resources Ltd (MIN)

Company Overview

Mineral Resources is another veteran of the (relatively) young Aussie lithium industry and pitches itself first and foremost as a mining services company.

In reality, it has plenty of skin in the game with big equity stakes in established Western Australian lithium and iron ore mines. It owns 50% of the Mt Marion Lithium Operation in partnership with Chinese industry titan, Jiangxi Ganfeng Lithium, and holds a 40% minority interest in the Wodgina Lithium Operation (with Albemarle).

While its iron ore division generated most of its revenue in FY22, low ore prices squeezed margins and the majority of MIN’s profit came instead from its Mining Services and Lithium divisions.

Project Portfolio and Resources

Major projects

Project name: Mt Marion Lithium Operation

Location: Goldfields region, Western Australia

Deposit type: Hard rock

Resource size: 71.3 megatonnes @ 1.37% lithium oxide

Stage: Production since February 2017

Project name: Wodgina Lithium Operation

Location: Pilbara region, Western Australia

Deposit type: Hard rock

Resource size: 151.9 megatonnes @ 1.17% lithium oxide

Stage: Production since April 2017

Financial Performance (FY22)

Net profit (loss) after tax: $350.8 million

Net assets: $3.3 billion

Cash in hand (31 December 2022): $1.7 billion

9. Argosy Minerals Ltd (AGY)

Company Overview

Argosy Minerals is another locally-listed, overseas-operating lithium specialist, with its site in Argentina on the cusp of production and exploration underway in the U.S.

Not to be confused with Rio Tinto’s Rincon project next door (or Argentina Lithium’s Rincon West project, for that matter), Argosy’s own Rincon project is working towards continuous production by mid-2023 to get hard cash in the door for its lithium carbonate.

Don’t call it ‘nearology’, but AGY clearly likes riding shotgun with the majors. Its Tonopah lithium project in Nevada is a stone’s throw from Albemarle’s Silver Peak brine operation.

Project Portfolio and Resources

Major project

Project name: Rincon Lithium Project (next door to Rio Tinto’s)

Location: Salta Province, Argentina

Deposit type: Brine

Resource size: 0.5 megatonnes lithium carbonate equivalent (exploration target)

Stage: Exploration/development

Financial Performance (FY22)

Net profit (loss) after tax: ($0.2 million)

Net assets: $94.3 million

Cash in hand (31 March 2023): $30.7 million

10. Ioneer Ltd (INR)

Company Overview

Ioneer Limited is all-in on its Rhyolite Ridge project in Nevada, U.S. Like Argosy, it too is neighbours with Albemarle’s Silver Peak and just three hour’s drive from Tesla’s Reno Gigafactory (or less if you back your Model S to outrun the State Police).

Ioneer’s definitive feasibility study (DFS) was completed in April 2020 and mine development is progressing towards production in 2026. A key factor underpinning Rhyolite Ridge’s profitability is the presence of boron, which can be extracted alongside lithium and sold off as boric acid for use in glass, ceramics and other materials.

Project Portfolio and Resources

Major project

Project name: Rhyolite Ridge Lithium-Boron Project

Location: Esmeralda County, Nevada

Deposit type: Brine

Resource size: 3.4 megatonnes of lithium carbonate equivalent

Stage: Development stage, production expected in 2026

Financial Performance (FY22)

Net profit (loss) after tax: ($12.6 million)

Net assets: $295.4 million

Cash in hand (31 March 2023): $60.4 million

What should you look for when investing in Australian lithium stocks?

Like any investment, lithium comes with its fair share of risks and rewards. When conducting your own research, be sure to look into:

- Current and future market demand

- Supply projections relative to demand (this will influence lithium prices)

- Company financials and stability

- Production capacity and expansion plans

- Partnerships and offtake contracts (i.e. who’s signed up to buy their product)

We’ve collated a lot of this information above, but you can dive deeper with financial reports and other project information available on each company’s website.

💪Pro tip: Be sure to check out their latest presentation decks for easier-to-digest summaries.

Which Australian lithium companies supply Tesla?

Tesla has multiple players involved, like Albermarle, Livent and Sichuan Yahua Industrial Group. But one prominent supplier listed on the ASX is Liontown Resources (LTR).

The company has inked a significant deal to provide Tesla with lithium spodumene concentrate sourced from its Kathleen Valley project (valued at an impressive $473 million).

The agreement is set to kick off in 2024. But there's one condition: Liontown must achieve commercial production capabilities by 2025 — highlighting the dynamic landscape of companies shaping the EV industry.

Ready to gain exposure to some ASX lithium stocks?

Superhero was born out of the need to make investing affordable and accessible for everyone. With $2 brokerage on ASX-listed lithium stocks up (for trades up to $20k), our customers enjoy some of the lowest prices available. Create a free account and start investing in minutes.

This blog does not constitute financial advice that considers your personal objectives, financial situation or particular needs. The advice provided is intended to be of a general nature only. Please do your own research before investing in lithium or other ASX stocks.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)