This article is sponsored by ETF Securities.

It might have been the Year of the Ox in the Chinese Zodiac, but in the world of investing, 2021 was undeniably the year of the exchange-traded fund (ETF).

While they have had a big few years, nothing compares to the last 12 months with excitement reaching a fever pitch over the last 12 months.

In October, there were more than 240 products available across the Australian market valued at $126.8 billion with money continuing to flow strongly into the market heading towards Christmas.

The growth is an encouraging sign as new investors flood into the market. Around one million Australians started trading for the first time in the last 18 months with ETFs enabling them to gain instant diversification.

Thematic ETFs Soar

But it is the boom of thematic ETFs that is particularly noteworthy.

To put it in perspective, more money flowed into thematic ETFs in the first seven months of 2021 than over the whole of 2020, previously the largest year on record. In fact by the time February rolled around, 2021 had already eclipsed 2019 and every year before that.

It is easy to see the appeal to retail investors with funds covering some of the most exciting sectors in the world. Whether you want to buy the biggest tech and healthcare companies or invest your money in robotics and hydrogen, there is an ETF for you.

Tech Takes Off

Many have paid off for investors in 2021.*

As personal and professional lives move increasingly online, it’s clear tech has been one of the biggest winners of the pandemic. FANG, an ETF which wraps up the biggest household names in tech including Amazon, Apple, Alphabet and Meta into a single package, is up 25% this year. Similarly, TECH which holds global companies with significant competitive advantages is up 20%.

Electric Vehicles Roar

Electric vehicles (EVs) was one of the hottest sectors of the year, with market darling Tesla putting the theme on the world map. It has been followed into the market by Rivian, which had the biggest U.S. IPO since Facebook back in 2012, as well as luxury automaker Lucid. All three ranked as the most-traded stocks on Wall Street this year among Superhero investors.

Projected to represent two in three new car sales by 2040, it’s easy to see why so much money is moving into the automakers who may just be building your next ride.

Backing the Energy Transition

Zooming out, a similar trend is emerging around battery technology more broadly, with US$40 trillion expected to be required to fund the global energy transition as countries look to hit their zero-emission targets. It’s no surprise that ACDC – a fund which tracks battery and lithium companies – has proved to be a market favourite, ranking as the fourth-most traded Aussie ETF of the year.

Certainly in 2021 investors are casting their eyes forward to what could be next, with ETFs a simple way to back specific sectors. On the energy front, hydrogen continues to be another hyped industry. Able to produce three times more energy pound-for-pound than petrol without any of the carbon emissions, investors see plenty of promise.

Future Tech

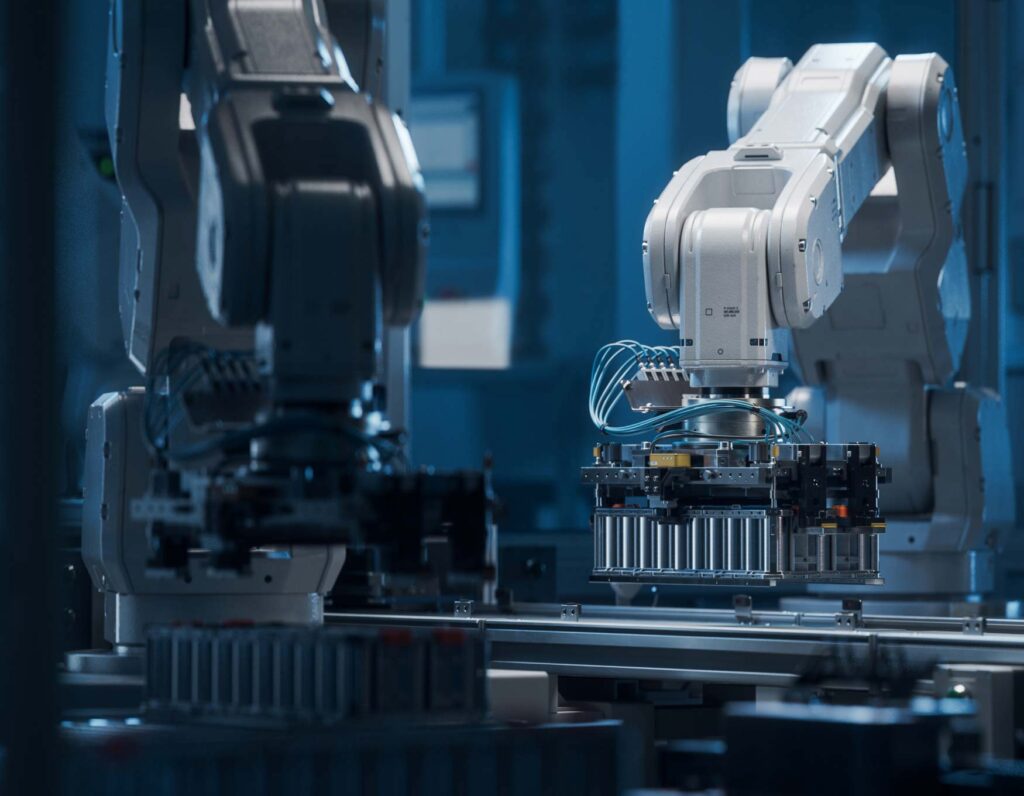

ROBO has been another beneficiary of this future-gazing. Tracking global automation companies, it was up 22% going into the end of the year with $82 million flowing into the Australian ETF.

Similarly, semiconductors stole headlines this year as supply chain disruptions highlighted just how crucial computer chips have become to our everyday lives, whether they are powering our appliances, laptops, cars or medical devices. The SEMI ETF saw around $80 million flow into it through 2021, returning 13% to investors this year.

Of course, it would be impossible to end a review of 2021 without talking about crypto. Entering a bull market at the end of 2020, cryptocurrencies specifically and the blockchain generally have enjoyed a charmed run for much of this year. As the use case of the technology continues to shine, and companies from Meta and Block to Adidas and Coinbase get increasingly involved, some investors are sensing an opportunity.

The arrival of FTEC, the first blockchain ETF on the Australian market, this year encapsulates the trend. While a sell-off hit the broader crypto market in December, recognition of blockchain technology across industries only continues to grow.

As we enter a new year, it’s up to investors to decide what 2022 will bring.

*(Returns are year-to-date as of 3 December 2021)

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)