Scan this article:

This article is sponsored by ETF Securities.

We are just six weeks into the new year and it already looks like a very different beast to 2021. A near two-year recovery appears to have finally faltered as markets come off their recent all-time highs.

It’s not to say there isn’t still growth ahead but there may be a few more bumps along the way in 2022 as investors get ready for whatever is to come next.

Helpfully, you’re not alone. Kanish Chugh from ETF Securities joined Superhero this week to discuss the trends to keep an eye out over the next 12 months. You can watch a recording of the webinar below.

Chugh says these themes will dominate markets in 2022.

1. The next stage of COVID-19

Since it was declared, the market has been entirely driven by the whims and waves of the COVID-19 pandemic. From selling off sharply in March 2020 to rebounding strongly in the months since, the market has moved based on the ebbs and flows of restrictions and stimulus.

Almost two years on, we’re now seeing the normalisation of everyday life and (hopefully) the transition of the pandemic to an epidemic.

There are a few baseline expectations about what that could mean. Principally that the support measures we have enjoyed will continue to be wound back. and that people will begin returning to old habits, including spending less time at home and more time socialising.

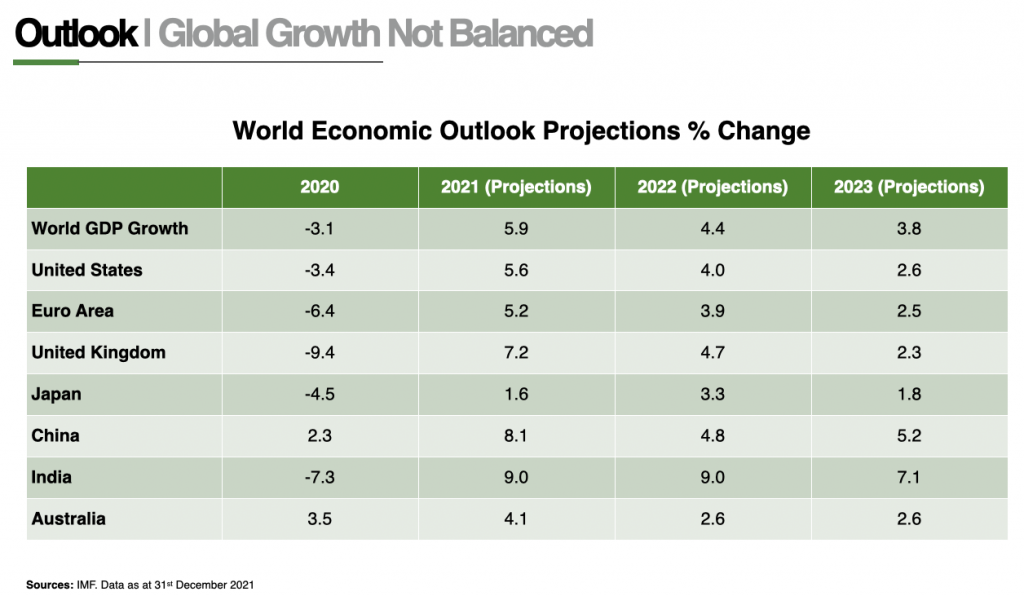

This large change will of course affect different assets, sectors and companies in unique ways as the world adjusts to the so-called ‘new normal’. So too will some countries be better positioned to take advantage of that recovery.

2. Rising inflation

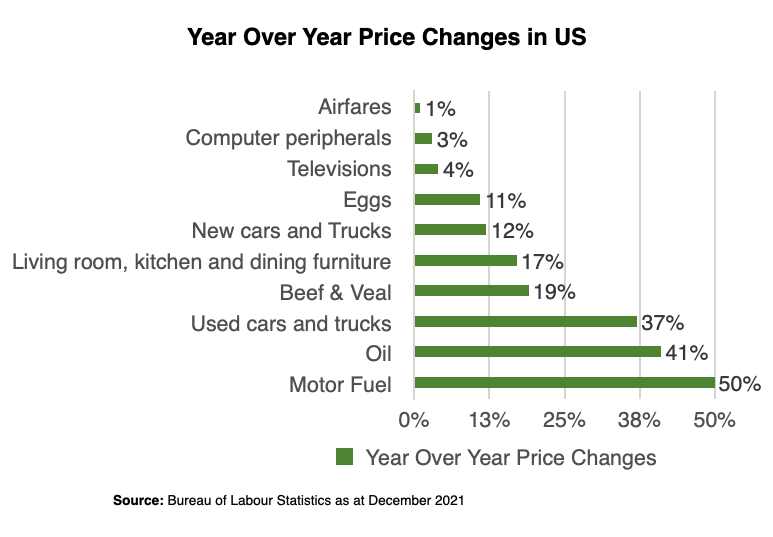

As the immediate threat of the pandemic subsides, economies are reopening and households are flush with cash – in Australia, to the tune of $260 billion.

As support measures are cut, this money is beginning to flood into businesses and push prices up. As this happens the value of the dollar declines, meaning we can buy less with our dollars. This is commonly referred to as inflation.

This is a concern for central banks like the RBA in Australia and the Federal Reserve in the United States. As a result, both are expected to start hiking interest rates this year. Here is how that could affect your portfolio.

3. Disrupted supply chains

Linked to that inflation are ongoing supply disruptions. IMF figures suggest those constraints are causing inflation to rise 1% higher while slowing down economic growth about 0.5% lower as a result.

Significantly, Chugh points out that while disruptions present a challenge to companies, they may also present an opportunity for investors. Technology such as robotics and artificial intelligence (AI) for example might be relied on to ease those pressures.

“Roughly around 40% of companies from industries right around the world expect robotic process automation to have a big impact on supply chains by 2023,” he said.

4. The hunt for value

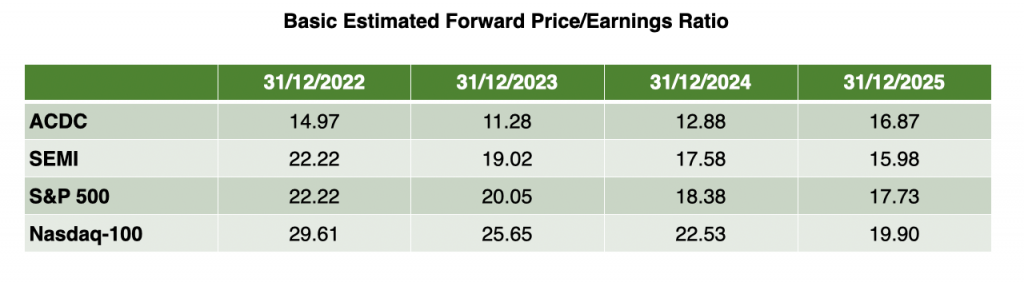

All three of the factors above are helping drive one of the most dramatic changes in 2021, the rotation out of growth and into value.

This broadly means that some investors are selling the kinds of growth companies that have done very well the last few years, namely in the tech sector, and buying good companies that haven’t seen their share prices take off.

This trend may lead to investors taking a closer look at blue chip stocks that may stand up to volatility or dividend stocks that will continue to provide returns even as growth sectors are shaken up.

Again there has been an enormous divergence in how different sectors have performed over the last 12 months. Yet despite the run-up in share prices, there’s still plenty of value to be found in thematics, Cheugh says.

Take for example, ACDC, an ETF Securities fund that holds battery technology companies, including automakers, and lithium producers. Despite the fact that Tesla finished 2021 50% higher and lithium stocks boomed, Chugh points out that valuations within the fund itself aren’t actually looking so high.

More to the point, if you’re a long-term investor that believes in the potential of a certain technology, whether it is energy storage or semiconductors, then you may not be worried by short-term price fluctuations.

“Thematics are a long-term trend. They’re going to have some volatile periods, they’re going to go up and down,” he said.

“People need to look at these thematics with a long-term lens [whether it’s across] 3, 5, or 10 years.”

5. Heightened volatility

If the first two months of 2022 are anything to go by, however, this year is certainly shaping up to a volatile one. Year to date, the Nasdaq is down 10% with daily moves of 2% not uncommon.

Companies like Meta have already sold off US$200 billion in 25 minutes this month, while disappointing earnings have been enough to trigger large selloffs elsewhere.

Throw in geopolitical tensions in Ukraine, hot inflation and supply disruptions and it seems like there’s a different reason every day that investors find to be nervous. As such there may again be greater appetite for stable returns from ‘safe haven’ assets like gold to help stabilise portfolios, Chugh said.

Conclusion

Despite the risks and challenges the market may face this year, there are also plenty of opportunities to protect and grow your wealth in 2022. While markets can go through periods of volatility, holding a diversified portfolio for the long-term remains a solid investing strategy for whatever the market throws up.

Read more: 5 ways to kickstart your investing in 2022

Become a part of

our investors' community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.