Scan this article:

There are few things as revered or as discussed as property in Australia and yet REA Group has managed to (almost) monopolise the national conversation. Beginning as an online version of the classified pages, the company has expanded into a property juggernaut that has aggressively pushed into nearly every corner of the property market. In doing so, REA has made itself an inextricable part of it and blown many of its competitors away.

The origins of REA Group

Like all good startup success stories, REA Group’s begins in a shabby garage, this one out the back of Melbourne’s eastern suburbs.

Its founders Karl Sabljak, along with his wife Carmel, brother Steve and business partner Martin Howell started the company in 1995 based on a simple hypothesis: the internet was going to transform how we bought and sold property.

In hindsight, it seems obvious that listings and advertising would almost entirely go online but back then it was hard to fathom how much things would change when it came to Australia’s first love: property.

Nor was it going to be an easy road to success. Listing on the ASX in 1999, REA got wrecked in the dot-com bust two years later and lost 90% of its value seemingly overnight.

It was at this point that News Corp stepped in and made one of the deals of the century. It bought 44% of the company for just $2 million, throwing in $8 million of free advertising to boot. Today, the same size stake would be worth around $7 billion.

But you didn’t have to be Rupert Murdoch to make a motza out of the company, nor did you need to buy at the very bottom. Had you invested $10,000 into the company just ten years ago, your shareholding would be worth roughly $100,000 today – and that’s after a few rough months on the market more recently.

It’s hardly a stretch then to call REA Group one of the biggest standout successes on the ASX. Now let’s dive into the company itself.

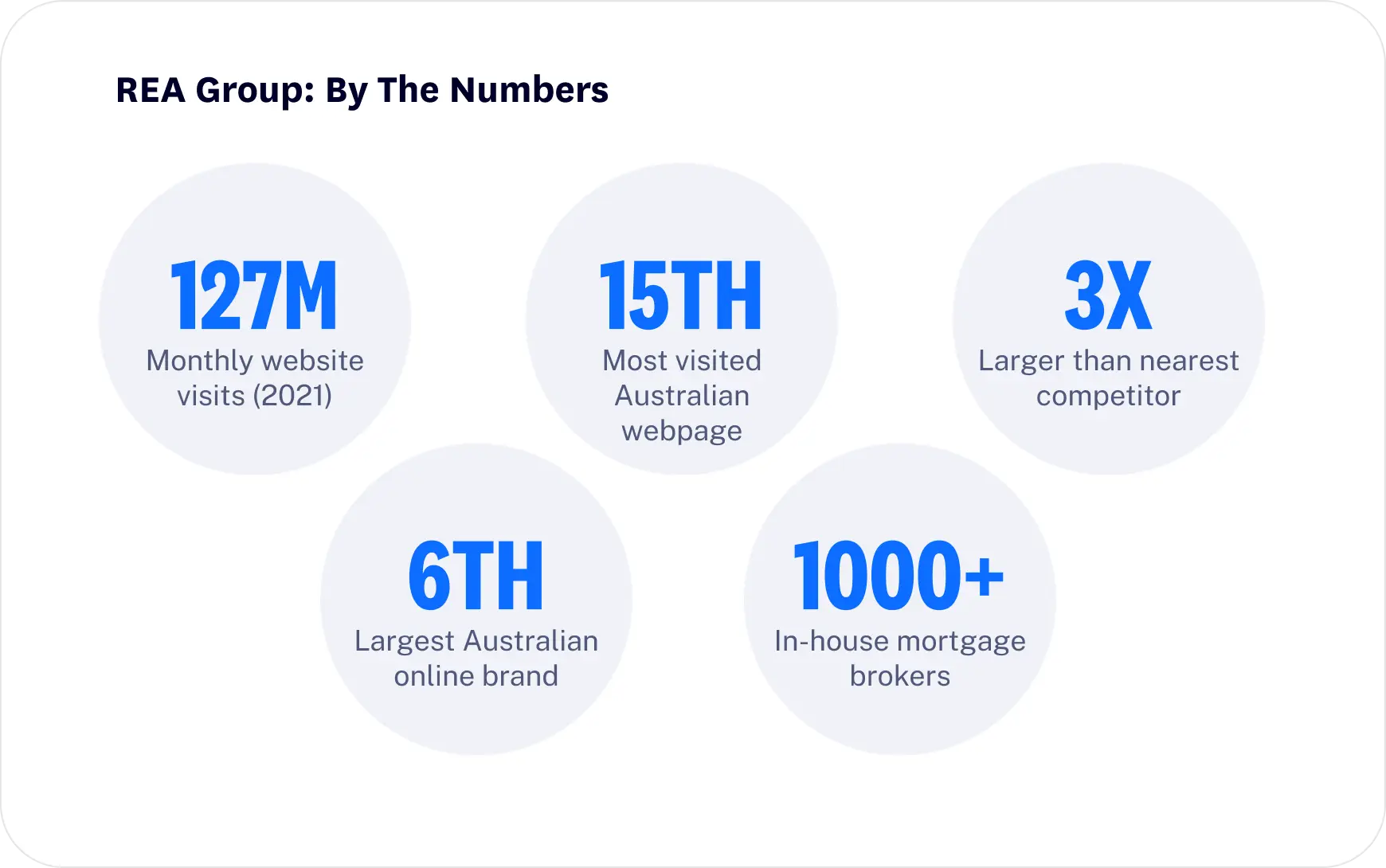

The numbers

Did you know? Had you bought Amazon at the bottom of the dot-com bust, you would have made roughly $430 for every dollar you invested. Impressive right? But had you bought REA Group you would have made $1,040. (Dividends excluded.)

The opportunity

Such is REA’s dominant position in Australia that today it attracts 12.8 million sets of eyeballs every month, or around 65% of the nation’s adult population. So obsessed are Australians with property that REA.com.au ranks as the 15th most-visited website in the country, beating out myGov, The Guardian, and LinkedIn.

Over the years, REA has spread throughout Asia including Hong Kong, India, Malaysia, Thailand and Indonesia, as well as the United States via a string of prudent acquisitions.

It operates Realtor.com, the second largest real estate in the U.S. (38.1 million monthly views) as well as India’s largest (housing.com).

But REA is a lot more than Facebook Marketplace for real estate and significantly more sophisticated. It has expanded into commercial property, mortgages (Mortgage Choice and Smartline), the share house market (flatmates.com.au), and even short term work spaces (Spacely).

The company has found success in aggressive vertical integration, investing heavily in property tech to corner every step of the property process. Customers can inspect a property in VR, fill out rental paperwork with 1Form, submit a mortgage application with Simpology, value a property with Hometrack, transact with Realtair, and even ‘buy now, pay later’ fees with Campaign Agent.

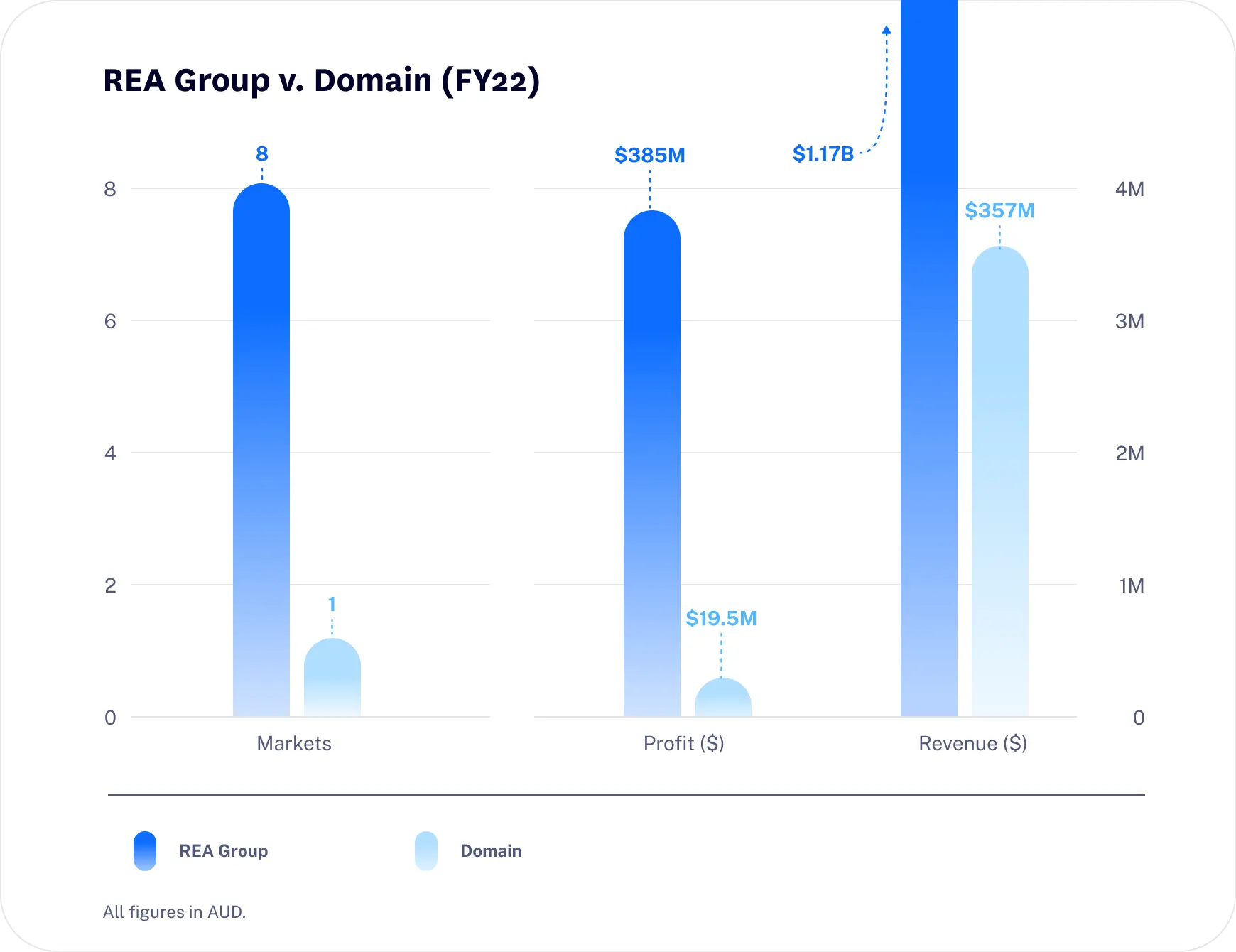

REA has grown as Australia’s property values have exploded, magnifying the fees generated from sales, the number of transactions, the size of its market and, crucially, REA’s oversized slice of it. For the first time ever, REA cracked $1 billion in revenue this year.

There’s still room for REA to grow as well. Today the Australian housing market is worth in the realm of $10 trillion. That’s roughly four times the size of every ASX-listed company combined.

The competition

Did you know? There are over 80 platforms to list your property for sale in Australia but REA has the most listings and most website visits while also being the most expensive for agents to use.

The challenge

As much as the real estate sector loves to trade on the ‘as safe as houses’ sentiment, property and the companies that deal in it do carry their own risks.

For one, interest rates are going up for the first time in more than a decade – and they’re going up quickly. The extra repayments are unsurprisingly placing a handbrake on property price growth – higher repayments lower your borrowing power – with economists forecasting values could drop sharply this year.

These kinds of market constraints could begin to hit REA’s bottom line, which is heavily dependent on market activity and property demand. However it’s complicated. REA argues lower prices are actually in its interest, to bring buyers back into the market and force agents to advertise more on its platform.

Whether or not that comes to pass is another matter, but it does emphasise the fact that REA is buffeted by market conditions as readily as the next business.

Nor is REA as diversified as its smaller rival Domain, which has moved into insurance and comparison businesses as well. While these ventures are initially expensive and slow down Domain’s path to profitability, it also lessens the company’s reliance on listings.

REA as a whole is both fast-growing and profitable but some of its overseas ventures like Housing.com in India are still loss-making. Those acquisitions and ongoing investment combined with salary inflation are blamed by REA for rising costs in its business.

The future of REA

While property incumbents could again be disrupted by a new wave of technologies, REA has gone to great lengths to cover itself. Major investments coupled with a dominant market position means it could be well placed to see off competitive threats.

It has done so in a market that is entirely unique in this country: property. Perhaps nothing else is so ingrained in the Australian psyche. The fact the most iconic film produced domestically was The Castle only confirms the point.

For share investors looking to get some exposure to the property sector, there are few names bigger on the ASX. Certainly, there’s no other business that looks and feels like REA, guiding buyers, sellers and renters every step of the way.

Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. Any advice provided is intended to be of a general nature only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.