Scan this article:

In our last deep dive, we explored how Plenti evolved from a peer-to-peer disruptor into one of Australia’s most promising digital lenders. This quarter shows what that transformation looks like in action.

Plenti (ASX:PLT) has entered its FY26 year with strong momentum, delivering A$437 million in loan originations for the June quarter – up 44% on last year and 7% on Q4 FY25.

But this isn’t just a growth story. It’s a pivot point.

After years of building and testing its model across personal, renewable energy and auto lending, Plenti is demonstrating that it can grow volume significantly while managing credit risk and cost efficiency.

Auto lending shifts into high gear

Auto remained Plenti’s lead engine, with A$229 million in new loans – up 50% year-on-year. The June seasonal bump helped, but the real winner was its “Powered by Plenti” partnership with NAB, where daily originations doubled quarter on quarter.

Personal loans: sharper, faster, growing

Personal loan originations rose 48% to A$160 million, driven by ongoing improvements in the customer journey, automated credit decision making and more effective re-lend experiences for existing customers. Growth came without chasing risky volume, underscoring Plenti’s prime credit focus.

Green lending: A pause before the rebound

Green loans rose 13% to A$49 million, despite a temporary lull in June as customers waited for new government battery rebates kicking in from 1 July. That lull is expected to reverse this quarter with the company reporting extremely strong applications levels in June.

Profitability is taking shape

Loan book climbs to $2.7 billion

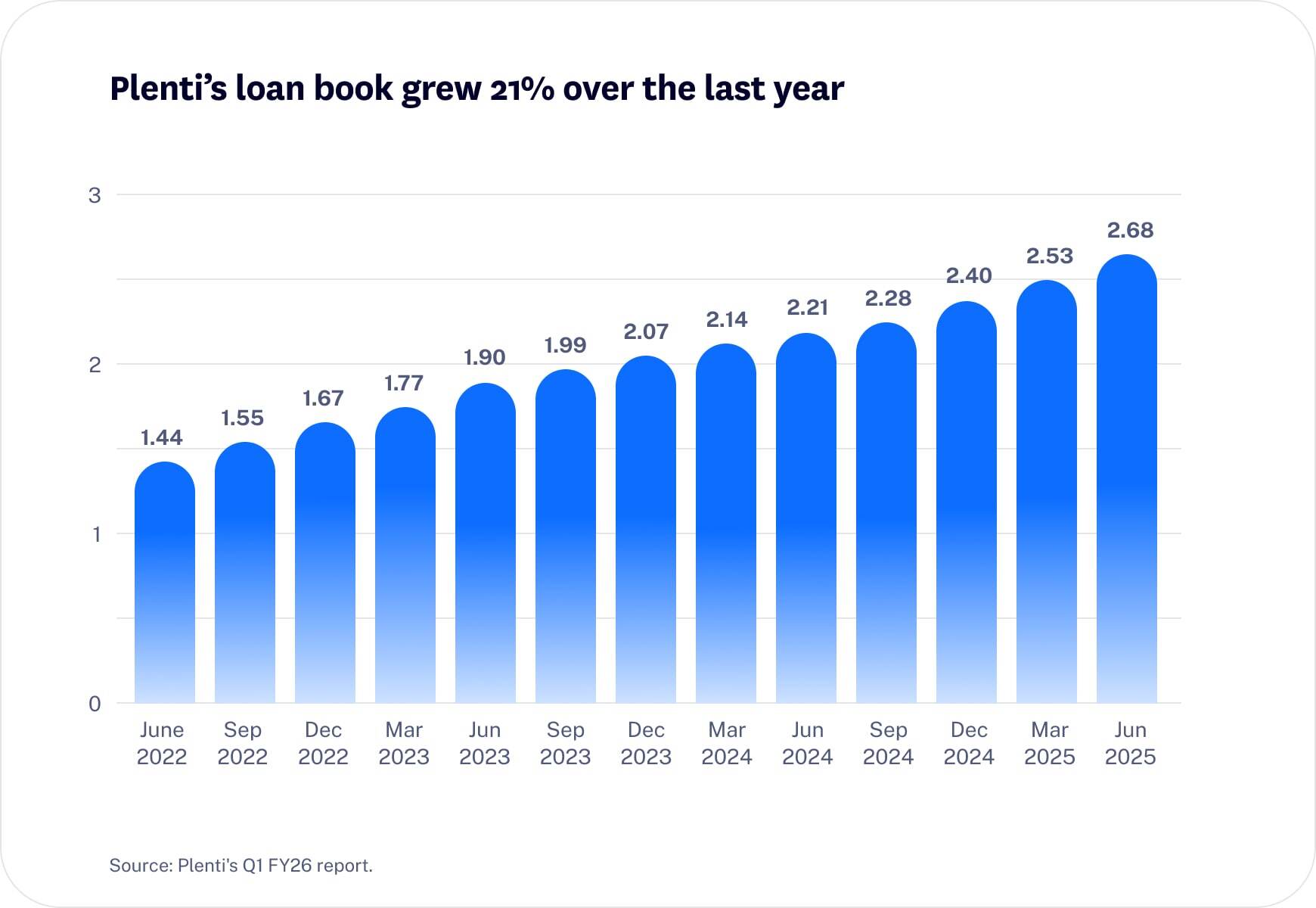

Plenti’s loan book grew 6% over the quarter and 21% year-on-year, with growth supported by more repeat borrowers, strategic partner channels and operational consistency setting the business up well as they pursue their target of a $3 billion loan book by March 2026.

Revenue hits A$73.3 million

Quarterly revenue rose 20% on the prior year. Net interest margins remained steady, with a temporary lift post-April market interest rate reductions.

Credit losses fall as book quality holds

Net credit losses dropped to 0.94% (annualised), down from 1.30% a year earlier.

Scale driving profitability

With the loan book growing rapidly and low credit losses, Plenti has flagged growing profitability momentum on top of the 126% uplift in Cash NPAT achieved in the prior financial year.

Here’s what’s powering the next phase

Plenti’s partner-led distribution and tech-first delivery model continue to be its edge and this quarter was no exception.

NAB originations more than double

The NAB co-branded auto loan channel grew its book from A$16.7 million to A$38.7 million, powered by stronger acquisition, product alignment and marketing execution.

WA battery scheme launched

In June, Plenti launched the WA Government’s new Residential Battery Scheme – building and deploying a bespoke installer and customer journeyin just six weeks. The Federal Government $2.3 billion home battery rebate scheme should also drive momentum in renewable energy lending.

ABS funding engine rolls on

May saw the completion of Plenti’s 10th ABS transaction – A$400 million in personal and green loans, priced at a 1.40% weighted average margin. Investor demand hit new highs with Plenti’s total ABS issuance now topping $3.8 billion.

What could impact performance?

While the quarter was strong, several factors could influence Plenti’s performance over the coming periods:

- Funding market conditions: As a non-bank lender, Plenti’s cost of capital depends on access to securitisation and wholesale markets. Any tightening in credit markets could impact margins or origination volumes.

- Economic environment: Consumer sentiment, employment trends and interest rate movements could influence demand for loans and repayment behaviour.

- Competitive pressure: Banks and fintechs continue to compete aggressively in the consumer lending space, which could affect pricing and customer acquisition.

Plenti remains focused on maintaining credit quality and scaling with cost discipline.

From playbook to performance

If the deep dive told the story of where Plenti could go, this update marks another step forward as that foundation translates into record volumes and rising revenue.

With nearly A$2.7 billion in loans, falling credit losses, deepening partner traction and a pathway to recurring profitability, Plenti is starting to look less like a challenger and more like a future leader in Australian lending. But as always, future performance will depend on both execution and external conditions.

A specialist in consumer loans, Plenti has built a massive loan book, expanded into high-growth sectors like EV finance and renewable energy loans and even landed partnerships with big names like NAB, Tesla and Cadillac.

Superhero Markets Pty Ltd has a commercial arrangement with Plenti (ABN 11 643 435 492) and investors should be aware this arrangement may influence the objectivity of the information presented. Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. Plenti’s products are offered independently and nothing included in the information presented should be considered an endorsement or guarantee of their products and services by Superhero.

As always, it is essential to conduct your own research and due diligence before making any investment decisions. All investments carry risk so please consider carefully before investing. Remember that past performance is not indicative of future performance. Graphics, charts and graphs provided for illustrative purposes only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.