Scan this article:

For thousands of years, humans have been mining and burning coal as a form of energy and heat. But it was only during the Industrial Revolution that fossil fuel became truly ubiquitous.

In the three centuries since, coal has been king as the cheap energy source powered global growth around the world as nations went through a period of rapid expansion. In more recent decades, coal has been the bedrock of large, rapidly emerging economies like China.

This enormous demand sent the coal price soaring for much of the early noughties, fattening profit margins and giving a new generation of miners a leg up. At the turn of the century you could buy a (literal) tonne of coal for around $40. Eight years later, the coal price was nearly five times higher.

In recent years however, environmental concerns and a green energy boom have battered coal’s public image. But demand for the commodity hasn’t dissipated even if the pandemic pushed some suppliers to the brink.

In fact, in the last 12 months the fortunes of coal have reversed as geopolitical tensions created an energy crisis in Europe. The resounding demand for Australian coal has seen exporters shipping 9 times as much product to buyers and created the best coal market in living memory.

Soaring commodity prices have turned around miners like Whitehaven which used the windfall to completely pay off its COVID-19 debts, swinging from net losses to announcing record profits within a single year. As earnings season approaches its conclusion, coal miners and energy stocks have been among the best performers on the ASX, beating analyst expectations and paying out big dividends to patient shareholders.

Did you know? Coal overtook iron ore as Australia’s largest export in 2022 as miners cashed in on soaring prices.

The opportunity for coal

A bumpy energy transition has helped create a second wind for coal at a time when many would have guessed the sector would be winding down.

There are a handful of reasons why coal has remained so resilient. For one, its natural successors have had to wrestle with their own setbacks, including inconsistent public policy and powerful vested interests.

Throw in the technological obstacles which inhibit the storage of renewable power and the transportation of hydrogen for example. and it has been more difficult to replace coal than to simply retain it.

At the same time, population growth and increasing industrialisation continue to underwrite demand for power. Coking coal meanwhile is still in hot demand as an essential ingredient in steelmaking.

Russia threw fuel on the fire when it invaded Ukraine in early 2022, reshaping the geopolitical landscape in Europe. The ensuing sanctions on Russian gas and coal exports spelled a sudden energy shortfall and shrank the export market by 20%. Friendly nations were required to step in, triggering price pressures that have created serious cash flow for Aussie miners.

While the ‘perfect storm’ won’t last forever, it has again proven why coal isn’t dead. And why some producers will continue to make hay while the sun shines.

Did you know? In 2021, Russia ranked as the world’s third largest coal producer, exporting about 20% of the world’s supply. The European Union officially stopped buying it on 10 August.

The challenge

Miners of all stripes are naturally beholden to commodity prices – and it’s rarely straightforward.

A high coal price can bake in fat profit margins for producers. Conversely a low one can squeeze its bottom line and make it uneconomic to dig up.

But sustained high prices present their own risk. Historically, coal’s outsized role in energy production stems from the fact it’s relatively easy and cheap to dig up, transport and burn. Make it too expensive however and energy alternatives begin to look more and more attractive.

The more expensive coal stays, the more investment flows elsewhere. Falling demand for coal helps bring prices back down and the cycle continues. The free market at work, folks. But when it comes to energy, there’s a bit more at play.

The issue with coal relates to its longer-term prospects. We know for example that countries including Australia are introducing zero-emission targets and that environmental and political pressures prevent us (rightly) from burning it indefinitely.

Growing public pressure on banks and financiers and fears of being left with stranded assets meanwhile could make it increasingly difficult for coal miners to expand or find capital should they require it. New coal projects are repeatedly failing to get off the ground.

It’s a reasonable assumption that one day we won’t use coal at all. But whether that day comes in five, twenty or fifty years, is unclear. In the meantime, there will be opportunities for investors that can see past the potential ethical issues presented by the industry.

The future of coal

Take the Vales Point coal power plant for example, which the NSW government sold for $1 million in 2015. Four years later, the buyer had slashed costs and was pocketing nearly $135 million in annual profit, to the disbelief of sceptics.

We’re seeing a similar dynamic amongst miners that just a few years ago were being written off. Right now they’re the most profitable companies on the ASX.

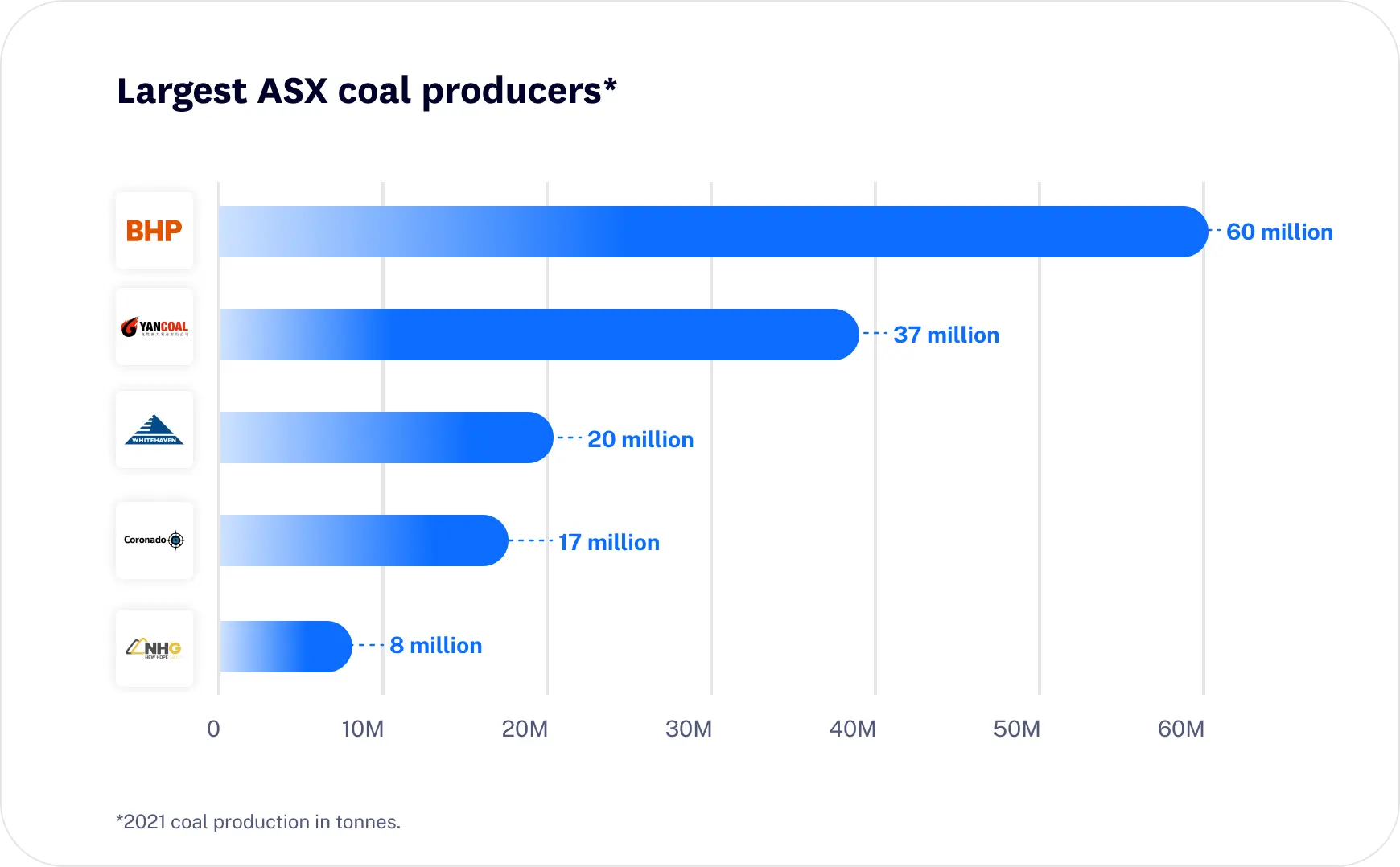

New Hope (ASX: NHC) has doubled its share price in the last six months. First half profits at Yancoal (ASX: YAL) are up 13x on last year. The fortunes of Coronado (ASX: CRN) have completed a $1 billion turnaround. Stanmore (ASX: SMR) has completed a $585 million expansion as it buys up BHP’s coal assets.

Two years ago, Whitehaven (ASX: WHC) was asking for debt relief. Today it’s sitting on $1 billion cash. Tomorrow it’s expected to unveil full-year earnings of $3 billion.

Read more Deep Dives here.

Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. Any advice provided is intended to be of a general nature only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.