This analysis of F45 is part of Equity Mates Summer Series, proudly supported by Superhero.

Listen to the podcast episode here and read more company analysis here.

The brief

Equity Mates take

Franchise businesses can be a thing of beauty. McDonalds is the best example but there are so many successful franchise businesses in Australia – Boost Juice, Dominoes, Hungry Jacks. Australia used to be called a nation of franchises because we had one of the highest franchise participation rates in the world. So it is only fitting that one of our latest success stories to list overseas is a franchise business.

Most people are probably familiar with F45. The gym chain has exploded in popularity over the past few years with their high intensity, group workouts. The company also has a famous backer in Mark Walhberg and was celebrated when it listed on the New York Stock Exchange earlier this year. However, fitness is a tough business. Famous for fads, it is one of the hardest industries to build long-term sustainable businesses. That, more than anything, is the challenge for F45.

Tell me about F45

F45 was founded in Sydney in 2013 by Rob Deutsch and Adam Gilchrist (no, not that Adam Gilchrist). The premise was simple – 45 minute high intensity, group workouts – and it became an instant hit. In the first 30 months of operations, F45 had 200 studios and in less than eight years the company has sold over 2,000 franchises across 63 countries.

The company premises itself on ‘no mirrors, no microphones, no egos’. It tries to build a culture that avoids the appearance-related pressures and trainer intimidation of so many fitness alternatives. They also claim to have a suite of proprietary technology – a fitness programming algorithm and a patented technology-enabled delivery platform (it’s 2021, it can’t just be a gym business, it needs to be GymTech).

To understand this business as an investor, you need to understand the franchise business model. Rather than raising money and employing people to open F45 gyms around the world, F45 allows everyday people to buy in and open their own F45 gyms. Generally, franchise businesses make money in three ways:

- An upfront cost for franchisees to buy in

- A recurring fee

- A percentage of sales

F45 sell their franchises for a minimum of $50,000 and an average of $315,000, with the buyer expected to spend another $100,000 on equipment. Franchisees then pay a recurring fee of ~$1,500 per month.

In this business model, F45 are responsible for expanding their gym footprint by selling new franchises to potential operators and for marketing the brand. However, they are not responsible for the day-to-day operations of the gyms, that is left to the individual franchise owners.

The challenge for F45 is to continue enticing operators to invest in an F45 franchise. The gym and fitness industry is notoriously difficult, and F45 are up against all the other options available to their potential franchisees. They must constantly ask themselves, why would a franchisee choose us over buying a McDonalds franchise?

What about the industry?

Globally, the fitness club industry is worth close to $100 billion. Within that there are competitors of every size, shape and type. There are the more traditional gym chains (Fitness First in Australia, Planet Fitness in the US), the local owner-operated gyms, and then new upstart concepts (in Australia, just some examples of new-ish chains include RBT, 12 Round, Orange Theory, Barry’s). Then there are new fitness concepts that are competing for customers – at home fitness like Peloton, Tonal and Hydrow have been a big trend of the past 18 months.

Let’s get to the numbers

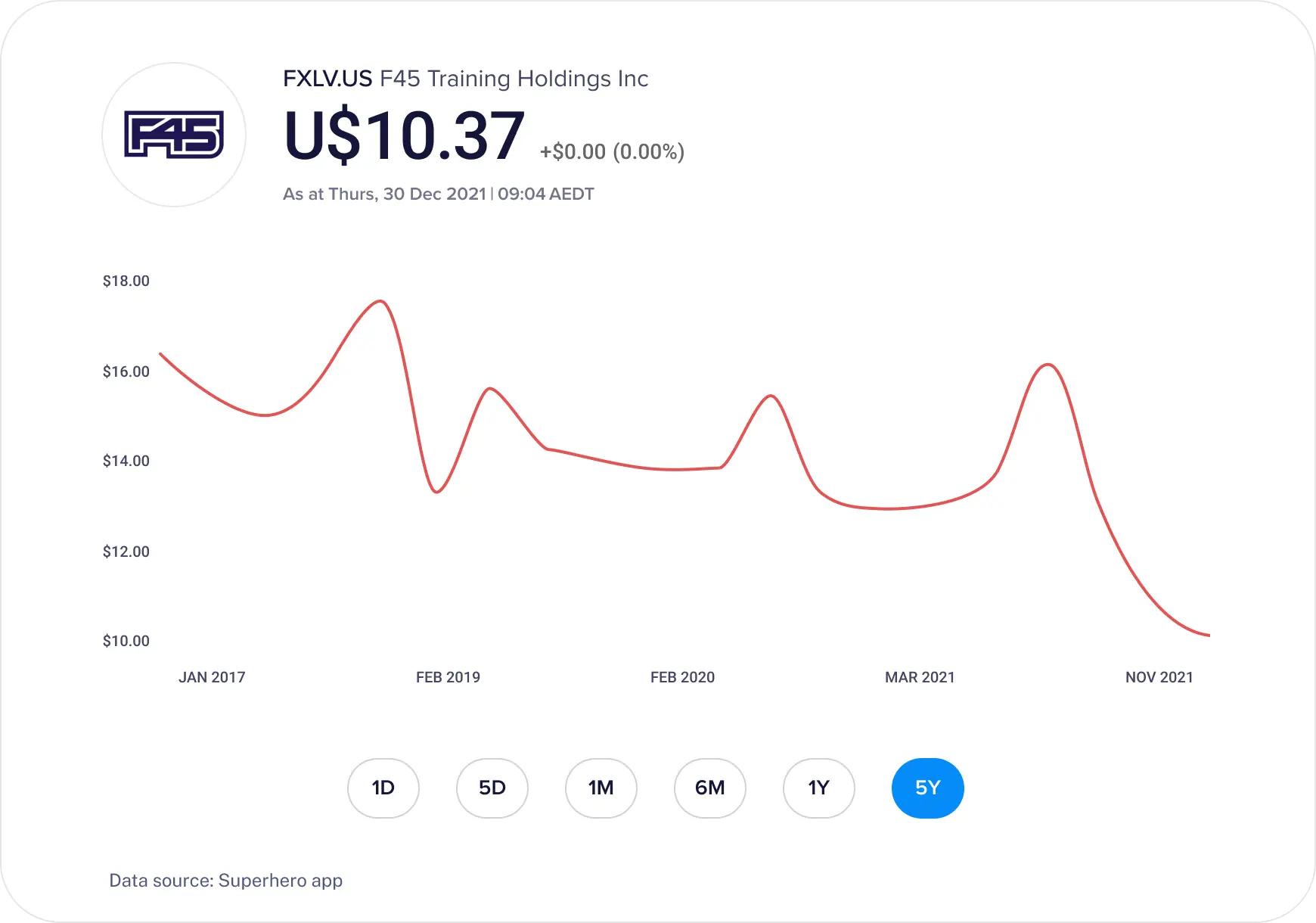

Share price

Since listing in July 2021, unprofitable high-growth companies have been punished in America. F45 are not alone in being down for the second half of the year. The share price is down 36% from where it started, giving it a market cap just shy of $1 billion.

Revenue and profit

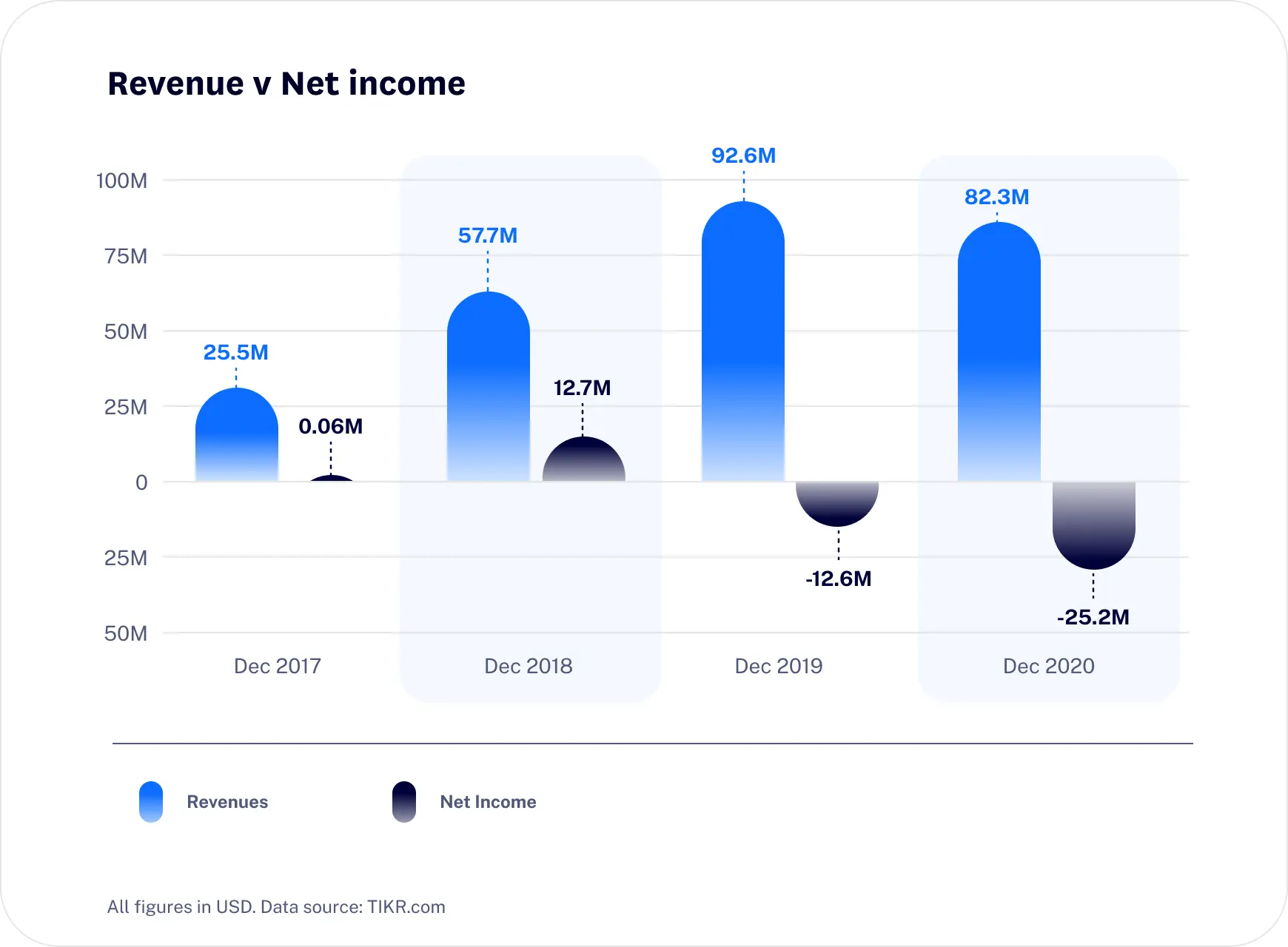

Pre-COVID, the company had an incredible few years of revenue growth. From making $25 million in 2017, it earned $93 million in 2019. However, with COVID this contracted to $82 million in 2020. Looking at F45’s quarterly numbers, the past two quarters put it back on track for a $100 million plus run rate ($26.8m and $27.2m respectively).

Even before COVID the company was unprofitable. They lost $13 million in 2019 and $25 million in 2020.

F45 has ~1,400 studios operating (and paying the company) and another ~800 that have been sold but are yet to open. As these 800 studios come online, we can expect F45’s revenue to increase.

Final thoughts on F45

F45 is on track to become one of the largest fitness chains in the world. We tried to find the largest (it wasn’t an easy Google) – Anytime Fitness has 4,500, Planet Fitness has 2,000 – so F45 will be right up there. If F45’s franchisees can build sustainable businesses then that will mean consistent revenue to F45 as the franchisor. However, if trends change and F45 loses customers then it is likely that F45’s franchisees will leave and F45 may be challenged to find replacements.

It is a truly great business story – from founding in Sydney to listing in New York in 8 years. With thousands of franchisees across 63 countries, it is likely that F45 will be around for a long time to come. The question for investors is just how much bigger can F45 become? If 2,000 locations can become 20,000 or 200,000, then F45 may be one of the biggest fitness brands globally. You could see it move into adjacencies in consumer tech, apparel and fitness equipment. However, if investors answer that question differently and think F45 may not be able to get much bigger than 2,000 gyms then we should be realistic about expectations for share price growth going forward.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.