Hey Superheroes,

It’s a short week for Wall Street with markets closed for the full day of Thursday and half of Friday for Thanksgiving. Closer to home, the ASX has trended relatively flat despite companies hosting annual general meetings.

Here’s all the news you’d want to read.

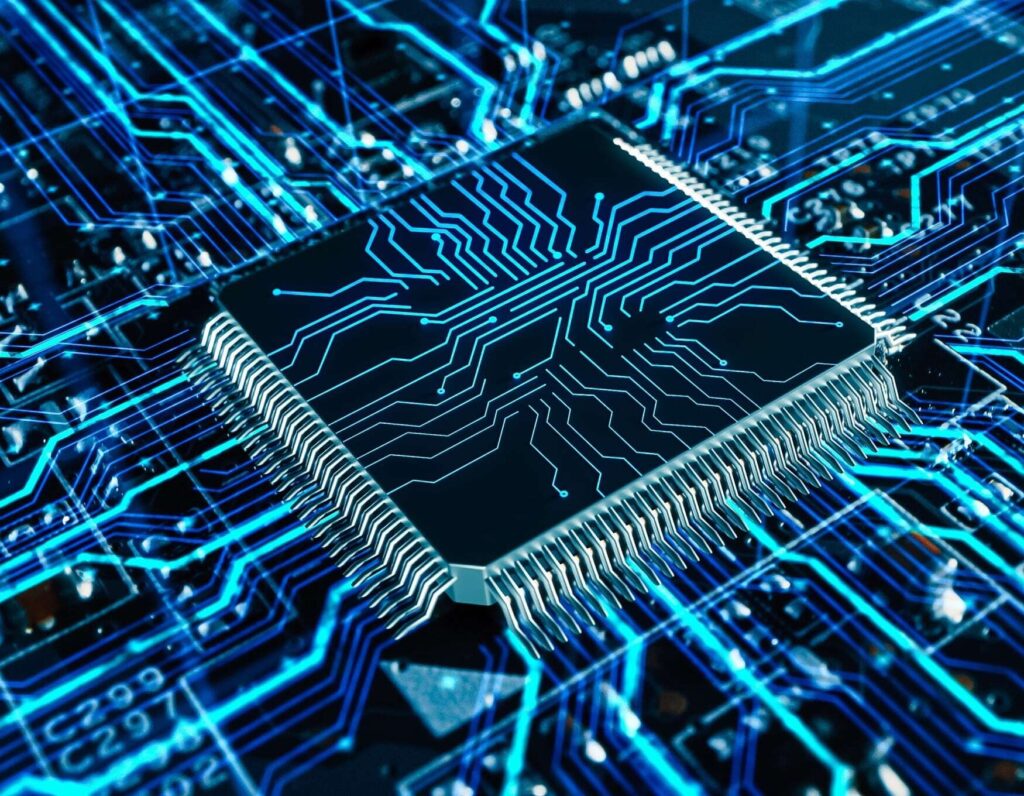

NVIDIA’s hot chips get even hotter

Calling 2023 the year of NVIDIA wouldn’t be an exaggeration.

The chip maker’s share price has soared 240% so far this year, it beat its Q2 revenue expectations by US$2 billion and then went on to beat its Q3 revenue expectations by… wait for it… US$2 billion!

(Well US$1.92 billion to be exact, but close enough?

NVIDIA’s shift to AI pays off

NVIDIA’s shift to AI pays off

Avid gamers would agree – the first thing you’d think of when hearing the name “NVIDIA” was its GeForce graphics cards that cost an arm and a leg.

But these days, NVIDIA rhymes with AI and rightly so.

NVIDIA’s Data Centre segment, which houses its AI-related products, recorded revenue growth of 279% year-on-year, now contributing 80% of the company’s total Q3 revenue.

It overtook the revenues of NVIDIA’s graphics segment last year.

Road bumps ahead for NVIDIA

Road bumps ahead for NVIDIA

Despite stellar growth and higher guidance for Q4 revenues (now expected to be US$20b from US$17.9b), NVIDIA’s share price slumped 3.4% after its earnings release.

This may be attributed to its CFO’s statement that future sales will be impacted by increasing trade restrictions with China.

Important considering that an estimated 20-25% of NVIDIA’s Data Centre’s revenue comes from the country.

To give you some context…

To give you some context…

The U.S. government last month announced further restrictions on NVIDIA’s chip sales to China in an effort to slow down the country’s tech advancement.

NVIDIA is now banned from exporting seven types of chips to China.

To combat this, NVIDIA has created cut-down versions of the banned chips to comply with restrictions. The company’s CFO also expects sales growth from other regions to make up for the decline in China.

Timeline of the OpenAI saga

You’ve likely seen the words “OpenAI,” “CEO” and “Microsoft” plastered on several headlines this week.

Long story short, OpenAI (the creator of ChatGPT) saw its CEO get fired, its CTO become interim CEO, its president and three senior researchers resign and its interim CEO replaced with another interim CEO…all within a couple of days.

These major people changes saw Microsoft step in – unsurprising considering Microsoft is one of OpenAI’s biggest investors.

The OpenAI timeline we all need

The OpenAI timeline we all need

So what and why things happened is still in discussion, but here’s some key facts

- Friday last week:

OpenAI CEO Sam Altman is told by the company’s board that he is getting fired. CTO Mira Murati is announced as interim CEO. Straight after that, co-founder and president Greg Brockman is called and told he has been removed from the board but would remain at the company. Later that day, Brockman announces that he has quit the company entirely with three senior AI researchers also resigning that evening. - Saturday: News spreads to OpenAI’s investors (including Microsoft), who go on to try and convince the board to bring Altman back. An agreement is apparently reached where Altman and Brockman would be brought back and the board would resign. However this didn’t end up happening…

- Sunday: Microsoft CEO Satya Nadella gets involved with the discussions and a new interim CEO is announced after Murati publicly announced her support of Altman’s return.

- Monday: Satya Nadella announces that Microsoft would be hiring both Altman and Brockman. On the same day, 95% of OpenAI employees threaten to quit the company with a petition for the board to step down circulated.

- Tuesday: OpenAI’s X account announces that Altman is back as CEO and that the majority of the board has been replaced.

So what in AI happened?

So what in AI happened?

While OpenAI’s board announced that the decision to remove Altman as CEO came due a lack of transparency – some speculate that it was to do with OpenAI’s mission.

OpenAI was founded as an open-source nonprofit. However, as years passed and Altman’s focus began to shift towards profitability and product development, the board apparently became concerned that its CEO was losing sight of the company’s original purpose.

Perhaps the next few weeks will shed some more light.

Some other things we’re shining the Spotlight on:

Some other things we’re shining the Spotlight on:

- ORE-SOME PRICE SURGE: Iron ore prices hit a 9-month high following a new round of stimulus from the Chinese government. BHP and RIO closed at 8-month highs this week while FMG hit a 52-week high.

- BEZOS’ BILLION DOLLAR SALE: Amazon ex-CEO Jeff Bezos has been slowly selling off his shares in the e-commerce giant, cashing in on shares worth approximately US$240 million last week. Estimates are for Bezos to sell off as much as US$1 billion worth of stock.

- IT’S TIME TO SETTLE: AMP shares jumped up 6.7% following news of a lower-than-expected class action settlement of A$100 million. Analysts had initially predicted a pay out quadruple the amount of the final settlement. Would you call this a win for AMP?

That’s all for this week’s Spotlight!

U.S. markets will be back in full swing next week.

Thanks for reading!

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

CBA throws cash at shareholders

CBA throws cash at shareholders