Scan this article:

Hey Superheroes,

The ASX closed at a four-week high midway through the week thanks to mining and energy stocks, and Blackstone became the first private equity firm to hit the US$1 trillion mark.

Meanwhile, ChatGPT-4 has gone from genius to…huh?

Let’s get you your weekly markets fix.

Carvana drives itself out of the ditch with a 10x bounce-back

Sorry, short sellers. It’s time to eat some dust.

Carvana (CVNA) has been burning rubber on the market track in 2023, and the result was acceleration-inducing. Its shares were up 1000% for the year to date on Wednesday, before pulling back slightly overnight.

This week, they announced they’d refinanced their debt funding to save bootloads on interest payments and extend their cash runway.

📖 A bit of background: Carvana is an online used-car dealer in the U.S. The company burst onto the scene 11 years ago with its novel and iconic multi-story car vending machines.

After booming big time when Covid hit and new car supply chains hit the brakes, Carvana ran into trouble a year later as the pandemic eased and the used-car price bubble burst.

Its share price was a shadow of its former self for a couple of years and amid concerns of bankruptcy, short-selling vultures started circling what they thought was a lemon of a business.

But as Carvana’s results and liquidity have stabilised, those pessimistic opportunists have been left holding the bag…a $2 billion one.

Could it be why it’s been gracing the list of Superhero’s top traded U.S. stocks for the past year?

A telecom showdown of astronomical proportions

ICYMI: Telstra, the pioneer of communication in the land down under, recently struck a deal with Elon Musk’s Starlink: blazing fast home internet services to regional areas.

But its biggest competitor, Optus, is determined not to get left behind.

It’s sealed a deal of its own with a plan to use Starlink’s network for conventional mobile phone coverage to eliminate regional blackspots.

📱Why phone coverage? Well, Optus aspires to compete with Telstra’s legendary regional and remote mobile coverage it has built from its days as a public service.

But instead of spending ridiculous sums on new phone towers, it’s disrupting Telstra’s long-standing competitive advantage with new technology.

Hold onto your space helmets, Superheroes. The deal requires Starlink to launch thousands of new satellites to build its capability, so don’t expect much from the Optus deal until at least 2025.

🔦 Some other things we’re shining the Spotlight on:

CHATGPT’s IQ MYSTERY: It’s not just you. A paper from Stanford and UC Berkeley scientists found GPT-4’s performance has been suffering from brain fog lately. It’s struggling with tasks it used to ace, from maths problems to visual reasoning.

NETFLIX’S EX FILES: Looks like you won’t have to boot your ex off after all. The plan to tackle password sharing is paying off, with Netflix adding nearly 6 million new subscribers in the last quarter. But the stock still fell this week after the streamer missed on revenue.

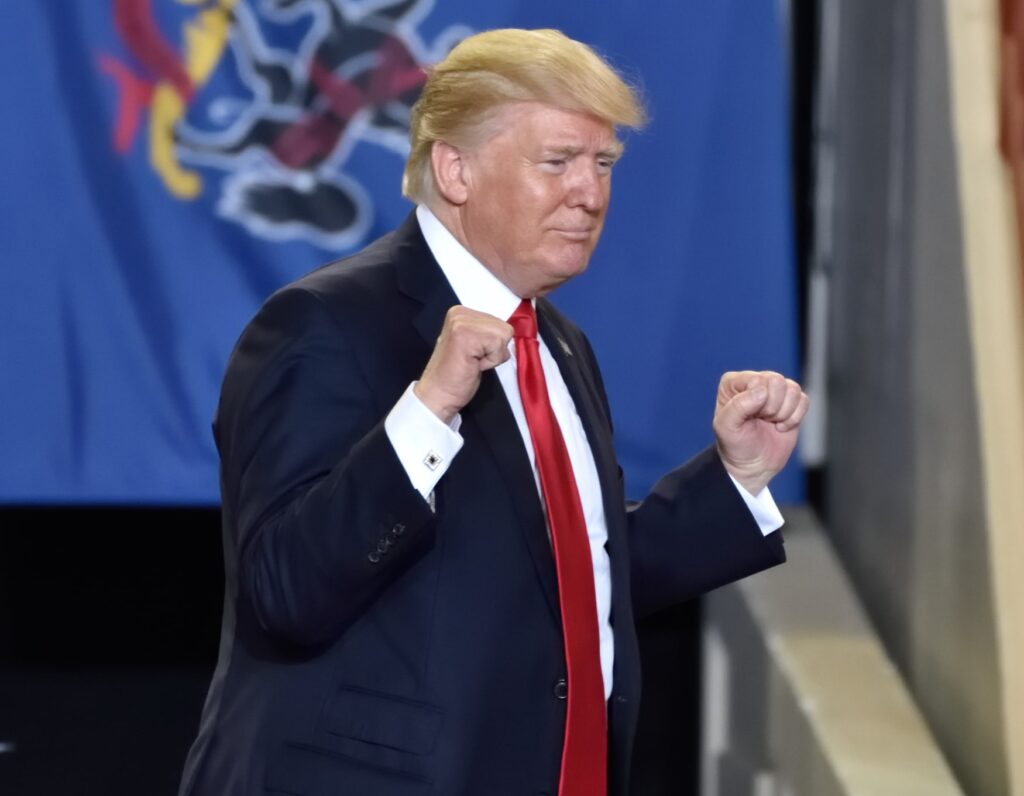

NUCLEAR-POWERED IPO: Oklo, the nuclear fusion developer backed by OpenAI’s Sam Altman, announced plans to take the company public earlier this week.

TESLA’S ELECTRIFYING QUARTER: Despite slashing prices on its models, Tesla reported its best-ever quarterly sales after delivering a record 466k EVs. But their margins got a bit squeezed.

That wraps up another weekly Spotlight.

Thanks to all of you for being here and reading!

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.