Scan this article:

Hey Superheroes,

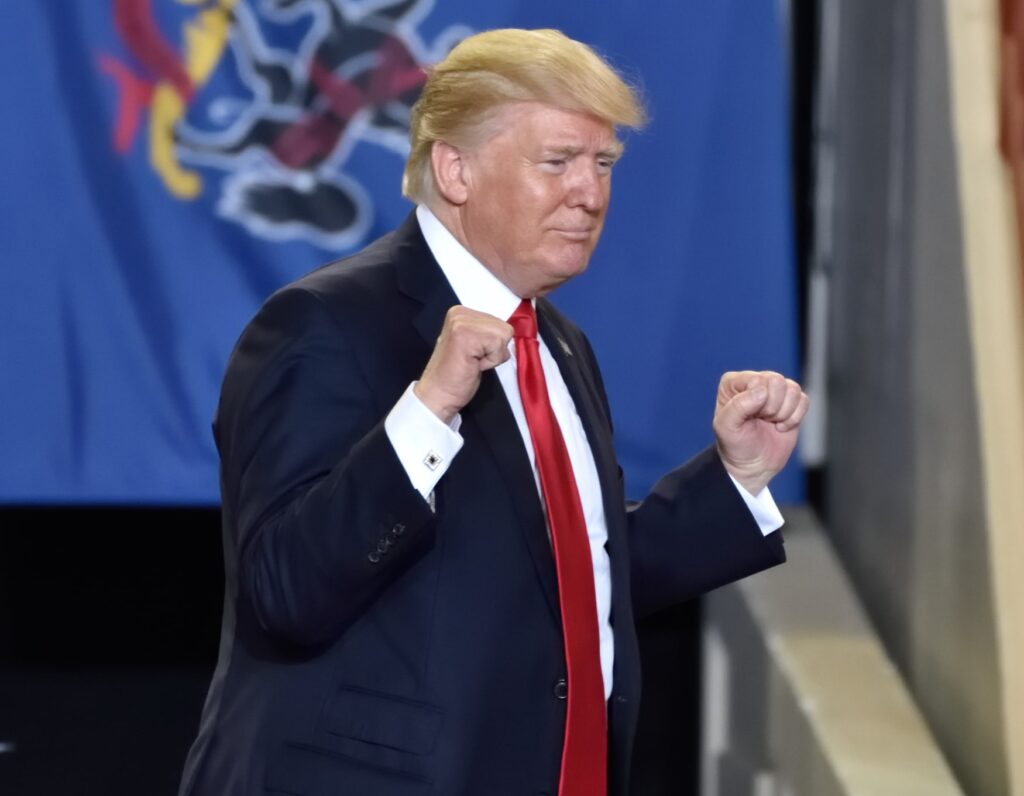

Elon Musk is aiming to uncover the mysteries of the universe by following in Donald Trump’s footsteps (sigh), and U.S. inflation is cooling off (phew). Get ready for a hefty dose of financial news updates delivered in a flash.

1. Microsoft clears regulatory hurdles in $69b Activision Blizzard buy

Game on.

In an epic conclusion, a U.S. federal judge granted Microsoft the ultimate power-up: the green light for its planned $69 billion acquisition of video game maker Activision Blizzard.

The Federal Trade Commission (FTC) tried hard to block the deal, fearing that the power move to acquire Activision and its highly popular games could result in unfair gaming industry domination. But Microsoft expertly maneuvered them.

Activision Blizzard’s and Microsoft’s shares rallied this week, levelling up the excitement and indicating investors are placing their coins on a victorious takeover.

🧐 Why does this matter to investors? The deal would become Microsoft’s biggest-ever acquisition — and the biggest transaction in the video game industry’s history.

In case you’re not familiar, Activision Blizzard is the result of a merger between Activision and Vivendi Games, bringing together the creators of legendary franchises like Call of Duty, Guitar Hero, World of Warcraft, Diablo and Overwatch.

Should Microsoft seal the deal, it would gain a formidable arsenal of games in every format.

🎮 Stay in the game: The FTC is appealing the court’s decision, so keep your health potions ready for further updates.

Did you know?: Gaming accounts for just 8% of Microsoft’s colossal annual revenue. The real money-maker lies in its B2B dominance. Read more about how Microsoft became the world’s 2nd largest company.

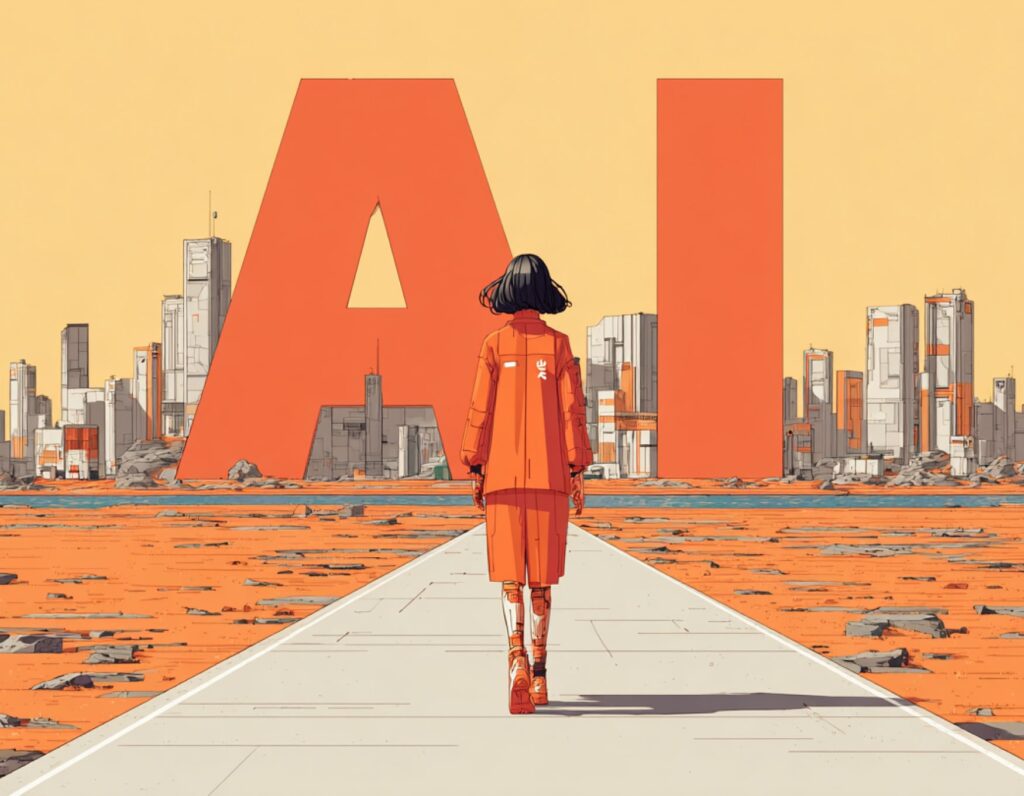

2. Elon Musk goes full Donald Trump with his “TruthGPT” rival

Twitter owner and Tesla CEO Elon Musk is back at it, launching a new company and OpenAI rival called xAI.

In true Musk fashion, the website for the company didn’t specify what it plans to research or what AI products it might create but said its goal is to “understand the true nature of the universe.” Cue the cosmic soundtrack.

Musk has been dropping hints about his desire to build an alternative AI firm for months. He told Fox News in April that he’s working on “TruthGPT,” which he called “a maximum truth-seeking AI that tries to understand the nature of the universe.”

Experts see the effort as Musk’s attempt to rival OpenAI, the company behind ChatGPT. (Yep, the one that Musk initially invested in but walked away from after a failed attempt to take it over.)

🤖 Battle of the bytes and “biases”: He’s since taken jabs at the company as it becomes more successful, calling it “woke” and “biased”.

OpenAI, being well aware of the abundance of data points from across the vast internet (duh), openly acknowledges the potential for biases to emerge. But ChatGPT denies ever engaging in favouritism during the training process.

🔦 Some other things we’re shining the Spotlight on:

- ROARING RALLY: Investors are piling into bets on Rivian Automotive, leading to a record nine-day winning streak for the electric vehicle (EV) maker’s stock. After reporting better-than-expected quarterly vehicle deliveries, RIVN shares surged 83% over the last eight trading sessions.

- INFLATION’S VACATION: U.S. inflation hit a 2-year low this week, offering hope for the Federal Reserve to conclude its aggressive interest-rate hikes soon.

- HISTORIC MOMENT: Get ready for an RBA shake-up. Deputy Reserve Bank governor Michele Bullock is replacing Philip Lowe to become Australia’s first female central bank governor

- IN JULY 2023, WE WEAR PINK: Aussies are eagerly anticipating the new ‘Barbie’ flick, reflected in record-breaking share purchases of Mattel on Superhero. MAT’s share price is up 13% from the previous month.

That wraps up this edition of Spotlight. Stay sharp, stay motivated and remember, knowledge is power when it comes to navigating financial markets.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.