Scan this article:

Hey Superheroes,

Happy October! Can you believe that we’re in the last quarter of 2023?

The month began with both the ASX 200 and AUD/USD exchange rate hitting an 11-month low.

But it looks like our Superheroes are standing their ground (or soaring through the skies 🦸). There’s been some heavy buying activity for VAS and A200 this week.

Here’s our top story.

Airbnb is expanding beyond short-term rentals

Airbnb has had a tough few years.

There was the pandemic, tighter regulations around short-term rentals, and then most recently, the highly-trending “Airbnbust.”

It’s no wonder why Airbnb CEO Brian Chesky has gone back to the drawing board to explore new opportunities for the company.

🌎 The grand plan

Currently, only 18% of Airbnb’s bookings come from stays longer than a month.

In a post-pandemic world where “remote working” and “extended holiday” have sort of become synonymous, Chesky thinks that there’s room (and houses) for Airbnb to expand into being a platform offering stays up to a year.

There’s an extra bonus here too, with longer stays also meaning Chesky gets to take his own holiday from the headache around short-term rental regulations. Just like Victoria’s new 7.5% Airbnb levy. 😮💨

🚗 Airbnb car rentals

Chesky also wants Airbnb to become more than just a “website you visit once or twice a year.”

The company also has ideas around becoming a platform for car rentals and even dining pop-ups. Hmmmm.

🩹 No more band-aids

Despite finally becoming profitable last year, there’s no denying that Airbnb lost quite a bit of cash (equivalent to 23% of its net income) on customer refunds.

Acknowledging that, Chesky plans to use AI’s powers to begin stricter quality control for both listings and customers.

Similarly, Airbnb will soon introduce a tool for “pricing insights” that aims to make listing prices more transparent and competitive. Does this mean the end of $500 cleaning fees?

TL;DR: Airbnb is fixing its issues and working to become an all-inclusive one-stop shop for all things fun and adventure. Do you think it’ll happen?

🔦 Some other things we’re shining the Spotlight on:

CHOPPING BLOCK: Block Inc has begun staff layoffs, believed to be affecting 1% of its 12,000 workforce… as its market cap now (US$26b) trends below the price it paid for ASX-darling Afterpay (US$29b) in 2021.

BIG BANK MORTGAGE WARS: CBA just saw its home loan book drop for the second month in a row. With both Macquarie and Westpac growing aggressively in this space thanks to faster service and lower rates, expectations are for CBA to ramp up its focus on its mortgage book in the coming months.

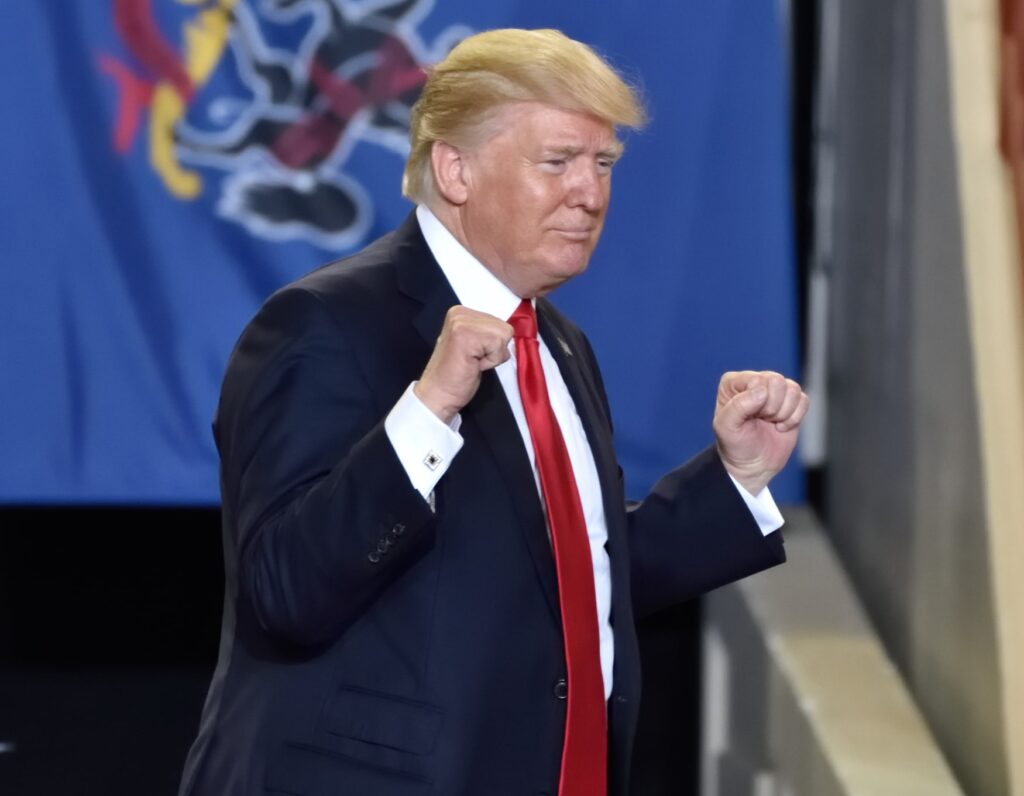

WARREN’S LOW HP: Noticed HP’s shares underperforming recently? It’s because Uncle Warren has been selling out. Berkshire Hathaway has cashed in over US$500m worth of the HP shares (17% of its holdings) since September 11.

CHEEKY BEVVY: Coca-Cola and PepsiCo have just hit 52-week lows despite sparkling revenues and bubbly net income. Would you consider this a fizzy opportunity?

And that’s it for this week’s Spotlight!

U.S. Quarterly Earnings Season is once again just around the corner, with big banks JPMorgan and Wells Fargo kicking it off next week.

If you’d like to keep up to date with the reporting calendar and key company results, chuck us a follow on our Instagram page, @superheroau!

Thanks to all of you for being here and reading!

If you haven’t yet, check out last week’s Spotlight, where we talked about Amazon getting sued for allegedly being a monopoly.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.