Scan this article:

Hey Superheroes,

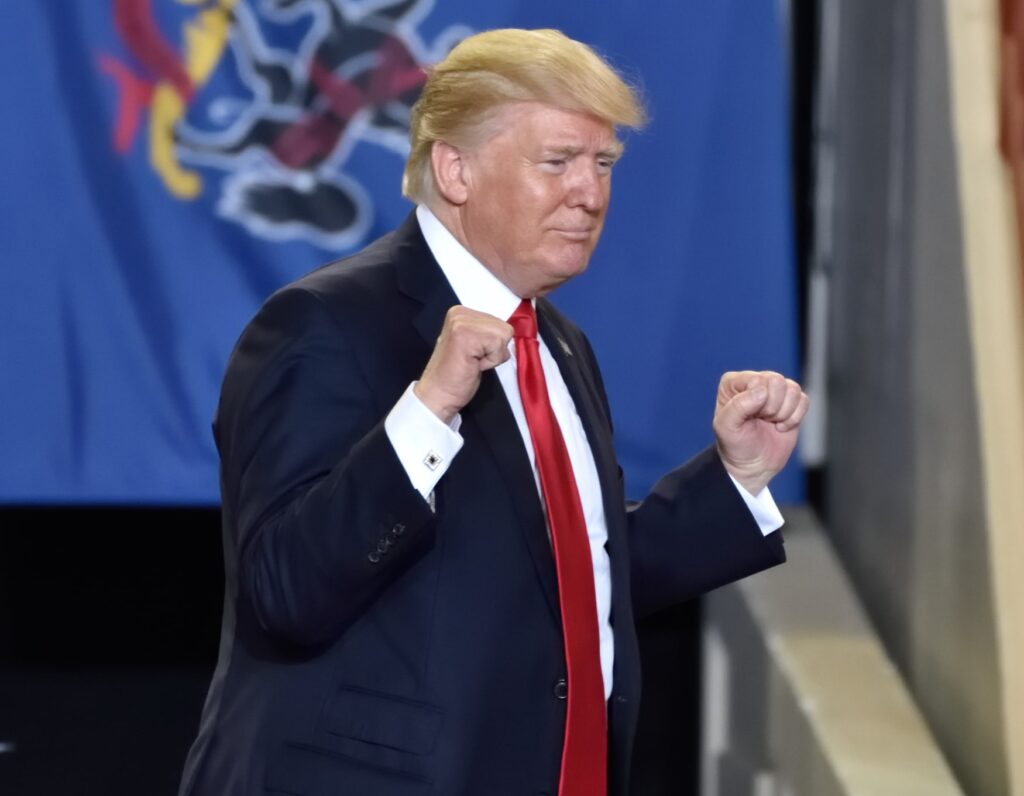

The U.S. indexes fell on Wednesday, dragged down by tech heavyweights Apple, Tesla and Nvidia, leaving our local index down 1.8% for the week.

Oh, and the Aussie consumer watchdog ASIC is firing on all cylinders this week. It seems to be on a suing roll with Westpac, AustralianSuper and PayPal all caught in the crosshairs.

Let’s catch you up on all the headline acts.

This megabyte-sized IPO is giving Nvidia the jitters

Word on the street is that Arm is aiming to raise almost US$5 billion before it hits the Nasdaq, which would value it at around $50 billion.

It’s the biggest IPO since EV-maker Rivian’s in 2021.

📖 A bit of background

Owned by the world’s largest tech-focused VC fund, SoftBank, Arm designs the IP behind computer processing chips, including AI use cases.

SoftBank said it would still maintain its majority stake by a mile—90% of its shares.

Unlike the giant of the microchip world, Nvidia, Arm is not a manufacturer of chips. Instead, it licences its IP for others to make them instead.

🤔 What does this mean for investors?

Well, the timing of the IPO comes as no surprise.

The hope is that investors will stay bullish on AI stocks after a significant rally throughout 2023.

But this week, there were mixed feelings creeping into the market after prominent Wall Street analyst Robert Arnott suggested Nvidia’s 232% stock price was entering bubble territory.

For context, Arnott also predicted that Tesla would drag down the S&P 500 back in 2020.

He called the chipmaker “a great company priced beyond perfection”. Ouch!

So, can AI sustain the hype or will the near-term fundamentals of inflated AI stocks catch up with them?

Albermarle finally captures Liontown’s heart

U.S. chemicals giant Albermarle just made Aussie lithium explorer Liontown Resources a better takeover offer (at $6.6 billion).

And this time, the board of Liontown is backing it.

🦁 The cat-and-mouse history

Albermarle’s been courting Liontown for over a year now, so it seems the fourth time’s a charm.

But it’s not just persistence that’s won over the lithium company’s board.

The first offer came in at $2.20 a share in October 2022. So, the latest offer of $3 a share is 36% higher.

When the news of the improved offer hit the market in late trading yesterday, LTR shares jumped almost 9%.

🔦 Some other things we’re shining the Spotlight on:

LATERS, LOWE: Outgoing RBA governor Phillip Lowe said his final goodbyes this week to make room for a new era with Michele Bullock at the helm. He made a parting shot at critics for what he called “vitriol”, “personal attacks” and “clickbait”, despite admitting that some of his comments on rate rises may have “missed the mark”.

CHINA BITES BACK: Apple is facing a ban on iPhones used by Chinese government employees, which saw its share price drop over 5% this week. The news triggered the company to shed a massive US$300 billion in market value in just 2 days. Could this be payback for the U.S.’ attacks on TikTok and Huawei?

EXITING THE COCKPIT: Another controversial leader made an early exit this week. After a string of scandals, like the mysterious “ghost flights” (advertising already cancelled flights), Qantas’ CEO Alan Joyce decided it was time to pass on the captain’s hat to new leader (and former CFO) Vanessa Hudson early. While Qantas’ financial performance is strong, its reputation desperately requires some serious re-calibrating.

EVERYTHING MUST GO (AGAIN): Tesla’s drive for sales over profitability has brought another unpopular price drop across its EV range. Its share price fell almost 5% at the end of last week.

That wraps up another weekly Spotlight.

Thanks to all of you for being here and reading!

P.S. How’s everyone doing out there lately? We really want to hear your genuine thoughts on investing with Superhero. It only takes 3 minutes to leave a review, and you’ll be helping shape the future of our product and empowering others on their investing journey.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.