Scan this article:

Our AU Market overview

What happened

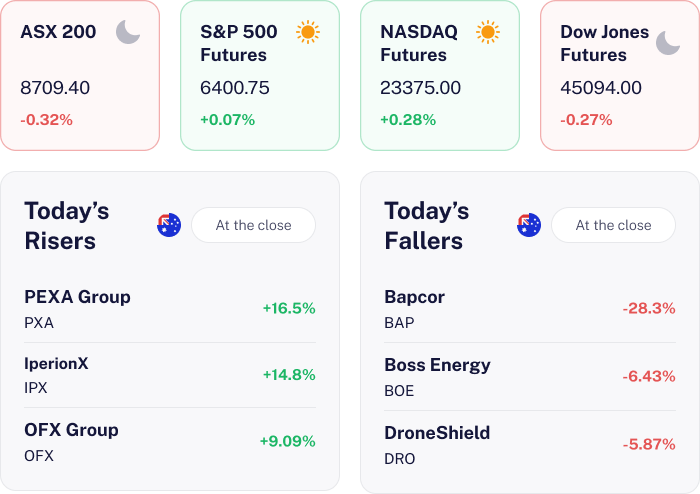

The ASX 200 slipped 0.32% today as early gains faded, with investors responding to a more cautious tone from the Reserve Bank. Governor Michele Bullock noted that trimmed mean inflation is declining, but not as quickly as expected, signalling that any rate cuts are likely to be gradual.

Financials dragged the market lower, led by a 4% slide in Macquarie after announcing its CFO’s exit ahead of an AGM. Lithium stocks rallied on China supply shocks, while gold miners retreated as easing global trade tensions dented safe-haven demand.

Why it matters for investors

The RBA’s wait-and-see stance contrasts with more aggressive easing expected overseas, which could weigh on risk sentiment locally.

Earnings downgrades and corporate instability, like Bapcor’s 28% plunge, have added to investor caution. However, strength in lithium and iron ore points to pockets of resilience. Markets may stay rangebound until macro data or company outlooks offer clearer direction.

US Outlook

U.S. equity futures traded mixed ahead of the open, with Nasdaq and S&P 500 futures edging higher while Dow futures slipped, as investors looked ahead to key macro signals. After the bell, Alphabet beat earnings expectations and announced a $10bn capex lift, while Tesla missed on revenue and warned of further demand softness. Investors are now bracing for the US Fed’s interest rate decision and press conference. Slower growth and sticky inflation have left markets on edge, with volatility likely as rate and earnings guidance unfolds.

🥇 Fortescue’s Iron Ore Triumph

The news

Fortescue jumped over 4% after reporting record annual iron ore shipments of 198.4 million tonnes – up 4% year on year. The June quarter also impressed, with 55.2 million tonnes shipped. Costs improved, with hematite C1 costs down to US$16.19 per tonne for the quarter and US$17.99 for the full year — the first annual decline since FY20.

Fortescue ended FY25 with US$4.3 billion in cash and US$1.1 billion in net debt. It also scrapped its Arizona hydrogen and Gladstone electrolyser projects.

Why it means for investors

The numbers highlight Fortescue’s strong operational performance and tighter cost control, even in a challenging iron ore market. Exiting major green energy projects marks a clear pivot back to core mining – a move likely to reassure investors wary of overreach.

Despite today’s rally, Fortescue still trades on a low P/E ratio, suggesting the market remains cautious on its growth outlook.

What’s next

Looking ahead, Fortescue forecasts a further 3% increase in iron ore volumes for FY26, though persistent issues at the Iron Bridge project and broader sector headwinds could weigh on sentiment.

Analysts will watch for updates on project execution, iron ore pricing, and any further strategic shifts as the company navigates a volatile commodities landscape.

💥 Bapcor’s Bumpy Ride

The news

Bapcor plunged nearly 30% to A$3.66, marking their lowest level since March 2020. The sharp decline followed an announcement that trading was weaker than expected in May and June, coupled with over A$50 million in post tax writedowns and the exit of three directors.

For the six months to December 2024, the company’s revenue was flat at $987.8 million, rising just 0.3%. Profit fell, with underlying net profit down 15% to $45.5 million. On a statutory basis (after all adjustments), profit dropped 13% to $40.8 million even after cutting costs and improving cash flow.

Why it means for investors

This matters because Bapcor is a major player in the automotive aftermarket sector, owning brands like Autobarn and Burson. The combination of weak retail trading, significant writedowns and board instability signals deeper operational and governance challenges. The stock’s sharp fall also reflects broader investor concerns about consumer demand and margin pressures in the sector.

What’s next

Looking ahead, investors will focus on whether Bapcor can stabilise trading, deliver on its cost savings target of over A$20 million for FY25, and restore board confidence. Any signs of further retail weakness or additional leadership changes could weigh further on the stock. The next earnings update and progress on strategic initiatives will be key catalysts.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.