Scan this article:

Our AU Market overview

What happened

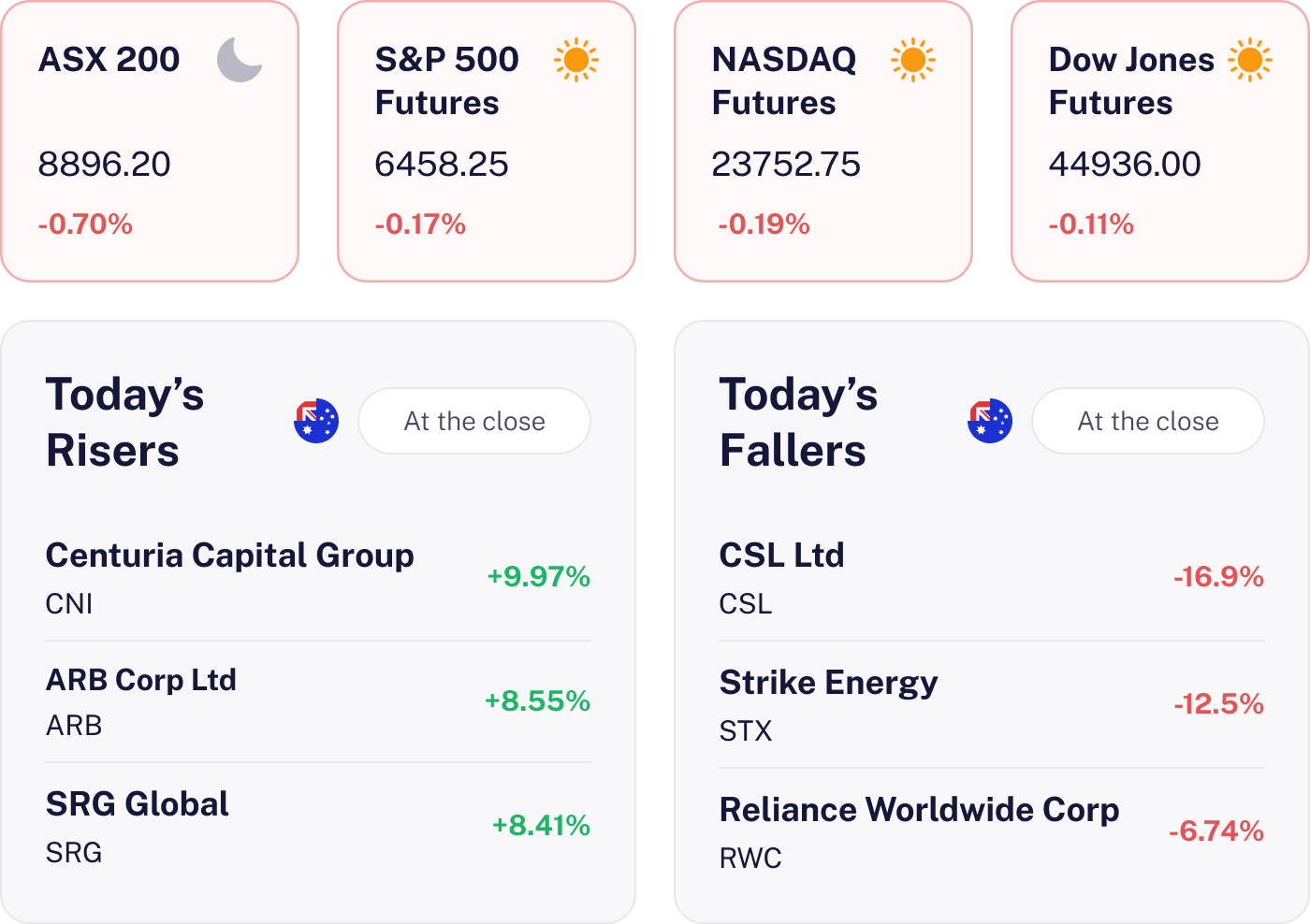

The market dipped 0.70%, weighed down by lacklustre earnings and company specific troubles. CSL led the charge south, plummeting 16.9% after announcing workforce cuts. Despite some tech and lending stocks showing resilience, they couldn’t buoy the overall market mood.

Why it matters for investors

This highlights the market’s sensitivity to earnings misses, especially from heavyweights. Investors should keep an eye on company guidance during reporting season, as even after strong gains, volatility can strike.

U.S. outlook

The U.S. market is poised for a cautious start today, with futures slightly down across the board. Mixed housing data and stable Treasury yields suggest a wait and see approach.

CSL Shares Plunge Amid Job Cuts 💼

The result

CSL plunged 16.9% today following the announcement of a major restructuring plan. This plan includes cutting nearly 3,000 jobs – approximately 15% of its workforce – in a bid to streamline operations and slash costs. The company is bracing for hefty restructuring expenses totalling A$770 million. However this move comes with the goal of achieving cost savings of A$500-550 million over the next three years.

Why it matters

As Australia’s largest pharmaceutical company, CSL’s restructuring is a big deal. It reflects the sector’s pressure to control costs amidst rising R&D and manufacturing expenses. The move signals a commitment to boosting operational efficiency and maintaining competitiveness in the global biotech arena.

What’s next

Keep an eye out for further details on how the restructuring will unfold across different regions and business units. The next earnings release will be crucial for gauging the financial impact and any updates to future guidance. Investors should also watch for progress in CSL’s R&D pipeline, particularly in immunoglobulins and vaccines, which are key to its long term growth.

Santos Shares Slide Amid Takeover Stalemate 🛝

The result

Santos dropped 2.64% to $7.75 after confirming no binding or in-principle agreement has been reached with the XRG-led consortium on its proposed $30 billion acquisition. The group, spearheaded by XRG (a subsidiary of Abu Dhabi’s state-owned Adnoc), has been in exclusive due diligence since July, with the deadline extended to 22 August to allow more time to progress talks.

Why it matters

The $30b offer valued Santos at a 28% premium to its closing market cap when the offer was made in June, and if successful would mark one of the largest foreign takeovers of an Australian energy producer. Investors had been hoping for a scheme implementation agreement by now. Instead, Santos disclosed that XRG won’t be able to sign anything binding until it secures internal and regulatory approvals – a process expected to take at least four weeks beyond the due diligence window.

What’s next

Santos has delayed its half-year results to 25 August to coincide with the conclusion of the exclusivity period, where management is expected to provide clarity on the takeover talks. Even if a framework is reached, the deal still hinges on XRG completing its internal processes and obtaining regulatory sign-off, which could push any binding agreement at least a month beyond the due diligence period.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.