Scan this article:

Our AU Market overview

What happened

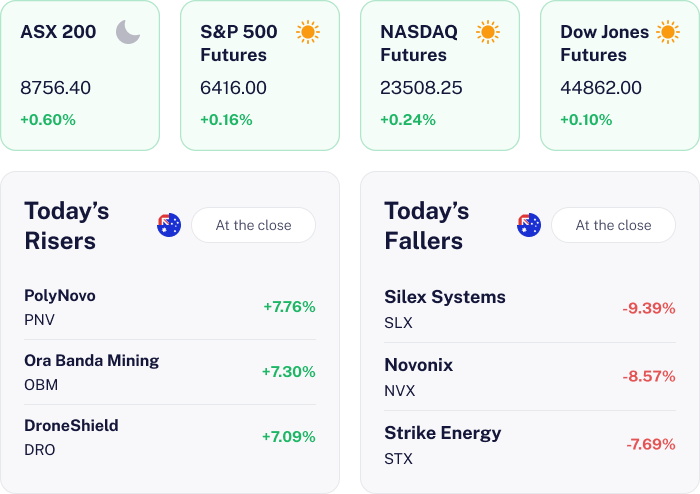

The ASX 200 rose 0.60% today as investors responded positively to softer than expected Australian inflation data. The June quarter CPI rose just 0.7% and annual inflation eased to 2.1%, boosting confidence that interest rates will be cut next month .

Gains were led by major banks such as Commonwealth Bank and Westpac. Global factors, including steady commodity prices and anticipation of key U.S. Federal Reserve decisions (due tomorrow), also supported sentiment.

Why it matters for investors

This uptick in the ASX 200 is a positive signal for investors looking for stability in the market. The softer inflation data suggests that the Reserve Bank of Australia may cut interest rates which could support further growth in equities.

With financials leading the charge, investors might see potential opportunities in banking stocks. However, keeping an eye on global economic cues remains essential as they can sway market sentiment.

US Outlook

For the upcoming U.S. market session on Wednesday, 30 July 2025, investors can anticipate a buoyant start as U.S. futures are trading higher. This optimism is supported by softer inflation data, with the Core PCE Price Index rising just 0.2% month on month, and a decline in initial jobless claims to 217,000. Easing policy uncertainty after recent legislative progress adds to the positive sentiment. Investors will be closely watching the second quarter GDP release and upcoming earnings announcements, which could influence the S&P 500, Nasdaq 100, and Dow Jones Industrial Average’s performance.

DroneShield Sets New Record 🚀

The news

DroneShield surged over 7% after announcing record June quarter revenue of A$38.8 million, a 480% year on year increase and the highest in its history. Year to date revenue under contract for 2025 stands at A$176.3 million, already triple the 2024 full year total.

Cash receipts for the quarter reached A$43.9 million, with a cash balance of A$192 million as of July 24. Software as a service revenue rose to A$1.9 million for the quarter, with management projecting further acceleration in 2026 as next generation AI enabled platforms are launched.

Why it means for investors

This performance underscores surging global demand for counter drone systems amid heightened geopolitical tensions and increased defence spending. The company’s rapid shift toward recurring SaaS revenue and expansion into major defence markets, especially the U.S., positions it at the forefront of a sector experiencing structural growth.

What’s next

Key upcoming catalysts include manufacturing expansion in Sydney, planned capacity additions in Europe and the U.S., and potential contract wins under new U.S. government funding for border surveillance and drone defence. Management targets annual output of A$2.4 billion by end 2026, with SaaS revenue expected to scale sharply as AI enabled offerings are rolled out.

Investors should watch for updates on large contract conversions and further U.S. policy developments.

MinRes Hits Guidance, Shares Rise 📈

The news

Mineral Resources shares gained 2.26% after the company confirmed it met full year FY25 production and cost guidance across mining services, iron ore and lithium. The Onslow Iron joint venture turned cash flow positive, reaching a run rate of 32.4 million tonnes per annum in June, with average production costs at A$63 per wet metric tonne, which was the lowest expected figure in the guidance.

At Wodgina, spodumene concentrate costs fell to a record low of A$641 per dry metric tonne. Mining services quarterly volumes hit a record 83 million tonnes and full year volumes reached 280 million tonnes. The company ended the quarter with over A$1.1 billion in liquidity, including A$400 million in cash and reported an improved net debt to earnings position.

Why it means for investors

These results underscore MinRes’ operational resilience and cost discipline amid ongoing volatility in iron ore and lithium markets. The company’s ability to deliver on guidance, lower costs and maintain strong liquidity has reassured investors, especially after a challenging year for commodity prices and sector sentiment.

The stock’s gain today reflects renewed confidence in management’s execution and the company’s diversified business model.

What’s next

Looking ahead, MinRes expects to ship 17.1 to 18.8 million tonnes of iron ore from Onslow in FY26, with a key haul road upgrade due in the first quarter. Additional plant upgrades at Wodgina are targeted to lift lithium recovery rates above 65% in FY26.

Investors will watch for further cost improvements, commodity price trends and the upcoming full year results in August, which could serve as the next catalyst.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.