Scan this article:

Our AU Market overview

What happened

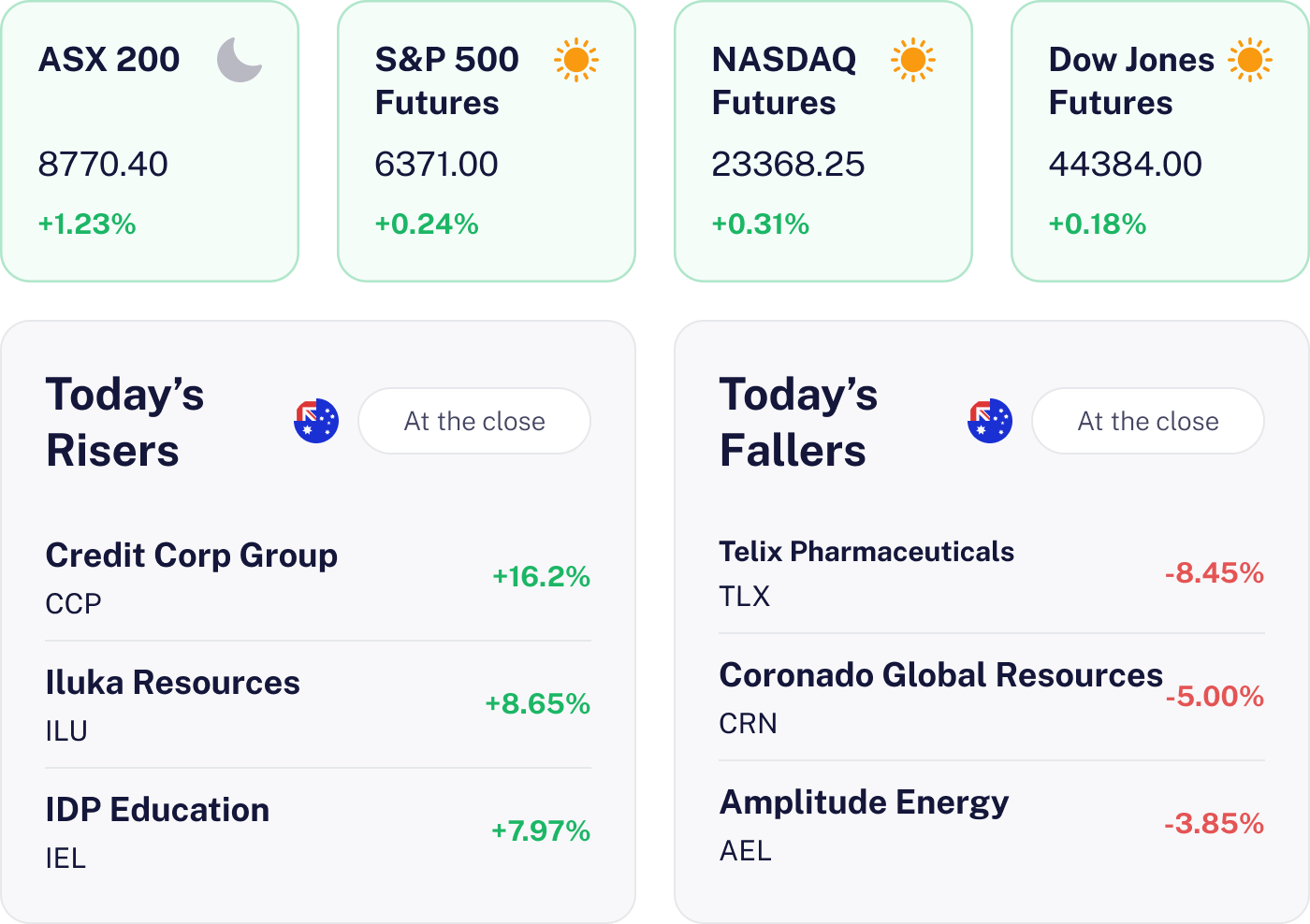

The ASX 200 ended flat (+0.02%) as investors digested global trade tensions and a weaker-than-expected US jobs report. Defensive names like Woolworths and Wesfarmers held the line, while miners slipped on softening commodity prices. Locally, earnings season kicked off with traders looking to corporate results for insight into cost pressures, consumer demand and FY26 outlooks.

Why it matters for investors

With earnings season underway, company results will set the tone for August. Forward guidance will be critical as investors assess how listed companies are navigating cost inflation, wage growth and shifting consumer demand. Expect increased volatility in the coming days as the market reacts to surprises, upgrades and downgrades.

U.S. outlook

U.S. equity futures are positive, reflecting optimism ahead of today’s session as investors anticipate key U.S. Upbeat sentiment is supported by recent momentum in tech stocks and stable Federal Reserve policy expectations.

Telix’s Costly Expansion 💸

The result

Telix Pharmaceuticals fell over 19% to A$16 at the open, hitting a 52-week low after the company disclosed that operating expenses, excluding R&D, are expected to reach ~36% of revenue in the first half of 2025. The jump in costs comes from expanding U.S. operations and recent acquisitions, including RLS Radiopharmacies.

That overshadowed a strong Q2 result, with unaudited revenue up 63% year-on-year to US$204 million. Full-year revenue guidance of US$770 to 800 million was reaffirmed.

Why it matters

The sell-off shows growing investor concern around rising costs and shrinking margins, even as Telix grows sales and global reach. The company’s aggressive reinvestment strategy is under scrutiny, especially in a market that’s now rewarding operational discipline over expansion-at-any-cost.

What’s next

The sell-off shows growing investor concern around rising costs and shrinking margins, even as Telix grows sales and global reach. The company’s aggressive reinvestment strategy is under scrutiny, especially in a market that’s now rewarding operational discipline over expansion-at-any-cost.

Austal gets the Aussie Government’s vote 🇦🇺

The result

Austal shares surged 7.94% to $6.93 after locking in a major strategic shipbuilding deal with the Federal Government. Under the agreement, its new subsidiary, Austal Defence Australia, will lead the build and delivery of 26 surface combatant vessels from Henderson, WA.

The company also upgraded its unaudited FY25 earnings guidance from “at least $80 million” to “at least $100 million”, thanks in part to the finalisation of a U.S. contract with General Dynamics Electric Boat.

Why it matters

This is a big win for Australia’s defence supply chain and for Austal’s long-term revenue outlook. The new government contract will run across multiple years and provide recurring income, while the earnings upgrade signals strong project execution and improving margins. The federal government will retain a “sovereign share” in the new entity, giving it veto and oversight powers.

What’s next

Investors will be watching for more detail on the revenue split between the Landing Craft-Medium and Landing Craft-Heavy programs, as well as future contract wins under Austal’s expanding defence portfolio.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.