Scan this article:

Our AU Market overview

What happened

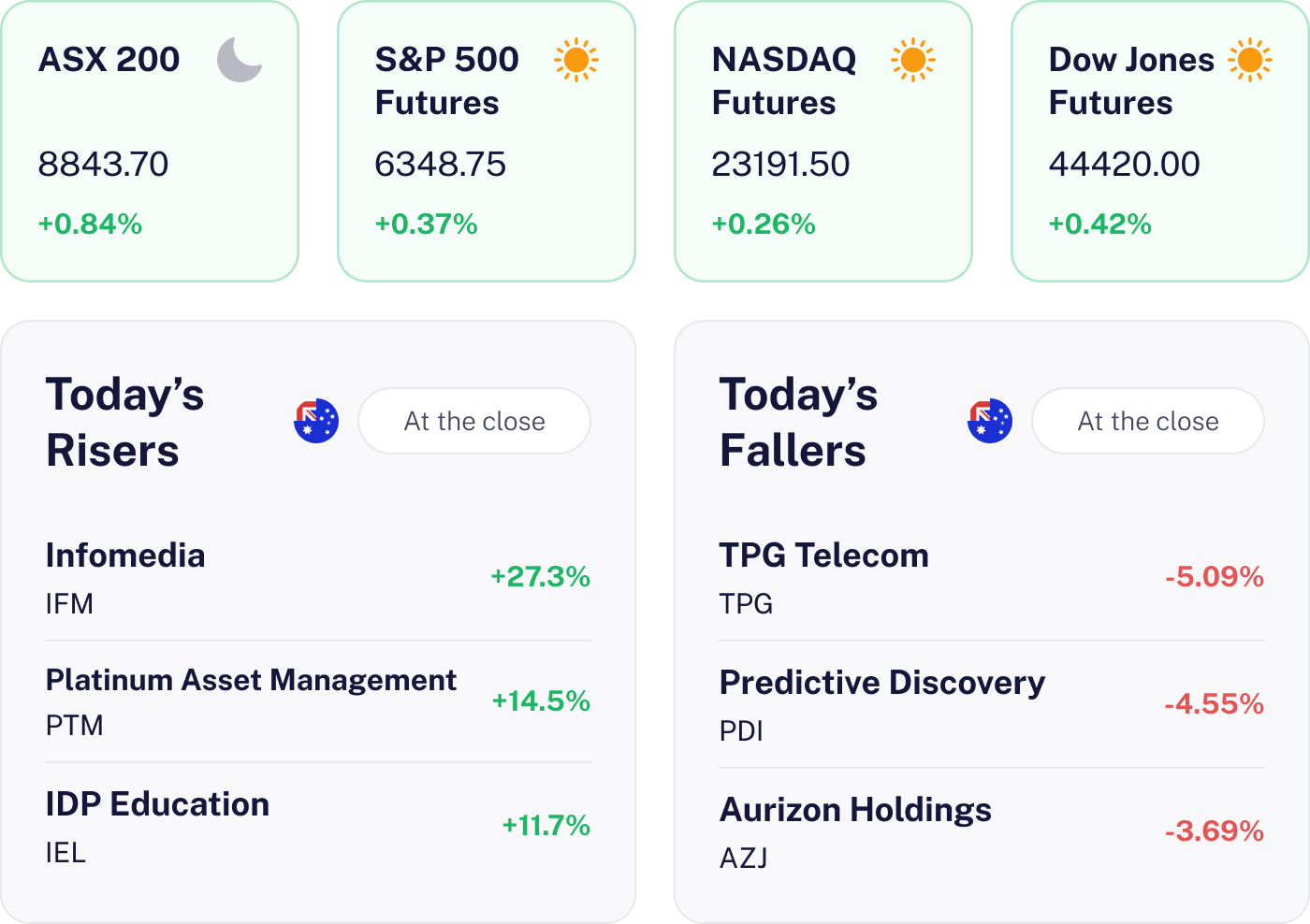

The ASX 200 climbed 0.84% to a new record high today driven by strong gains in banks like CBA and Westpac, as well as mining giant BHP and healthcare leader CSL, all of which posted solid advances. Investor optimism was further boosted by growing expectations of interest rate cuts both in Australia and the U.S., which lifted financial and real estate stocks.

Gold miners also surged on higher bullion prices, helping offset lingering caution from a weak Wall Street lead and falling oil prices.

Why it matters for investors

Today’s rally in the ASX 200 demonstrates the market’s resilience and adaptability, with key sectors like banking and healthcare leading the charge. This could signal a favourable environment for growth, especially with potential interest rate cuts on the horizon.

The surge in gold miners is a reminder of the sector’s role as a hedge against market volatility, providing a cushion amidst global economic uncertainties.

U.S. outlook

U.S. futures are positive, supported by strong second quarter GDP growth of 3.0% and a sharply narrower trade deficit. This upbeat backdrop sets the stage for potential gains in the S&P 500, Nasdaq and Dow Jones Industrial Average during the upcoming session.

ASX Rings the Wrong TPG Bell 🔔

The result

TPG Telecom dropped 4.9% to $5.23 at the open after an ASX error wrongly linked the telco to a takeover announcement involving private equity firm TPG Capital and Infomedia. The mix-up triggered a sharp sell-off, wiping more than $437 million in market value before trading was halted at 10:15am.

The ASX has since confirmed that all trades in TPG Telecom before the halt will be cancelled.

Why it matters

This is a major misstep for the ASX. Administrative errors like this shake confidence in market integrity especially when they hit large-cap names like TPG. For investors, the volatility was entirely disconnected from fundamentals, highlighting how sensitive pricing can be to misinformation, even in a highly regulated market.

What’s next

TPG reports interim results on 29 August. While today’s events aren’t expected to impact business operations, management may address the fallout. In the short term, the share price could remain choppy as the market digests the ASX’s clean-up process.

Those are some REA-lly Good Results 🏠

The result

REA Group (ASX: REA) announced a record breaking FY25, propelling its stock up 6.94% to A$254.50. The company reported revenue of A$1.673 billion, a 15% increase, with EBITDA up 18% to A$969 million and net profit after tax rising 23% to A$564 million. Australian revenue grew 14%, Indian revenue surged 25% and financial services revenue increased 10%.

Why it matters

REA’s robust performance highlights its dominance in the Australian real estate technology sector, significantly outpacing competitors like Domain. The results reflect resilience in digital real estate advertising amid fluctuating property markets.

This success not only boosts REA’s standing but also positively impacts its parent company, News Corp. For investors, the strong financials and increased dividends signal confidence in continued growth.

What’s next

Investors should watch for growth in REA’s Indian operations and its expanding financial services. The upcoming dividend payment will be closely monitored, alongside trends in the Australian and Indian property markets. Strategic moves by competitors could also influence REA’s trajectory.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.