Scan this article:

Our AU Market overview

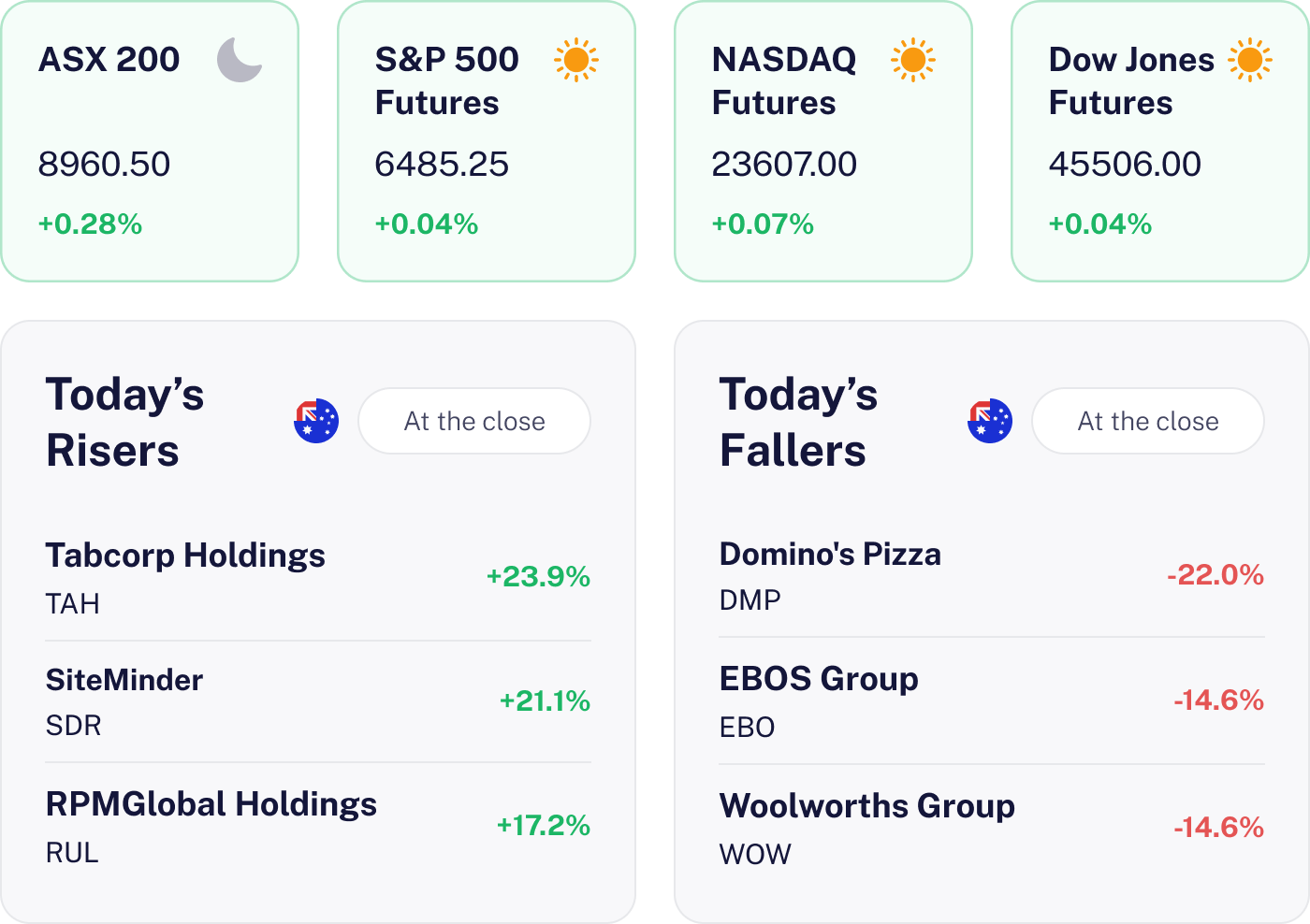

What happened

The market nudged up by 0.22% to 8,980, driven by gains in the financial sector. Major banks like Commonwealth Bank and National Australia Bank led the charge, buoyed by strong domestic economic performance and earnings momentum. However mixed reactions to earnings reports added a dash of caution.

Why it matters for investors

While bank strength offers a buffer, the mixed earnings reactions and global economic uncertainties mean investors should stay sharp. The steady climb hints at underlying confidence, but staying informed is key to navigating the market’s twists and turns.

U.S. outlook

Based on futures, the U.S. market looks set for a mixed session. Investors should watch for GDP revisions and Fed commentary, which could sway sentiment. With inflation hints and stable job data in the mix, it’s a day to watch out for any surprises.

Qantas Shares Skyrocket on Recovery Hopes

The result

Qantas shares soared today, fuelled by management’s upbeat announcement that the airline anticipates reaching pre-Covid capacity by FY26. The stock jumped as much as 13.6%, peaking at A$12.62 before settling around A$12.12 compared to the previous close of A$11.11. This surge reflects strong investor confidence in Qantas’s recovery trajectory.

Why it matters

This development signals a robust recovery for Qantas outpacing many global peers and boosting the Australian aviation sector’s outlook. The impressive share price rise underscores confidence in Qantas’s strategic direction and operational recovery, which is crucial for profitability and market share.

What’s next

Investors will watch FY26’s first-half results for signs that revenue growth in domestic (3–5%), international (2–3%) and loyalty (10–12% EBIT growth) can hold up against higher capex and fleet expansion. Delivery of 20 A321XLRs, including new lie-flat business cabins, will also be closely tracked.

South32 Slides Despite Profit Rebound

The result

South32 returned to the black with a full-year net profit of US$210m, compared to a US$205m loss last year, as copper output climbed 20% and aluminium rose 6%. Revenue lifted 17% to US$5.78b but earnings fell well short of consensus estimates of US$483m. The miner declared a final dividend of 2.6 US cents per share, down from 3.1c last year and below forecasts.

Why it matters

Despite the profit turnaround, investors punished the stock, with shares down 7.22% to $2.70. The weaker-than-expected result and trimmed dividend raised questions about cashflow resilience, especially with fellow metals producers IGO and Mineral Resources also trading lower on the day.

What’s next

Investors will focus on whether South32 can sustain production gains in copper and aluminium into FY26 while managing the closure of Mozal. Dividend capacity and further guidance updates will be key markers for confidence in the miner’s recovery path.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.