Scan this article:

Our AU Market overview

What happened

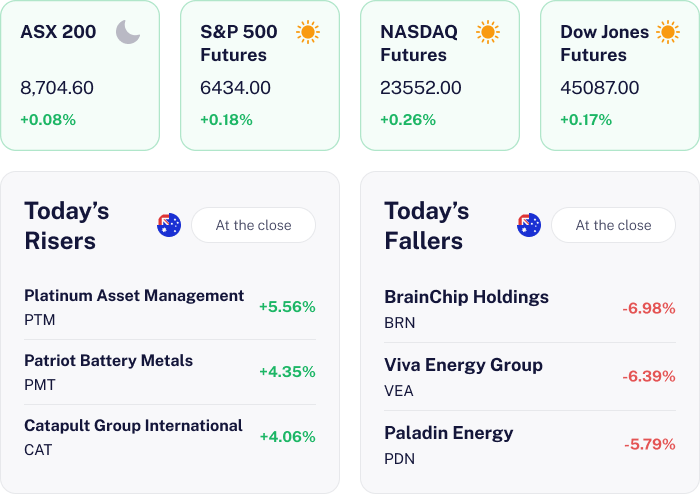

The ASX 200 edged up 0.08% as investors balanced early losses with cautious optimism ahead of tomorrow’s key Australian inflation data, which could influence future Reserve Bank policy. Gains in select resource and technology stocks helped offset weakness in financials and real estate.

Global sentiment remained mixed after modest moves on Wall Street and uncertainty around recent U.S. EU trade developments. Investors remained watchful for earnings updates and sector specific news as well as keeping one eye on the U.S. Federal Reserve’s latest Interest Rate decision later this week.

Why it matters for investors

The slight uptick in the ASX 200 suggests a cautious yet hopeful market stance, as investors anticipate how the forthcoming inflation data might sway Reserve Bank decisions. This balancing act between sectors indicates diverse opportunities and risks.

Keeping an eye on global cues and sector specific news can help investors navigate potential volatility and spot opportunities in resource and technology stocks, which have shown resilience amidst broader market fluctuations.

US Outlook

As we look to the upcoming U.S. market session on Tuesday, 29 July 2025, U.S. futures are trading higher. This buoyancy is bolstered by expectations of key U.S. GDP and inflation data releases that could reinforce a soft landing narrative, along with recent stable jobless claims. Continued optimism around tech sector earnings is also afoot. Investors should anticipate a positive session, with attention on US$ and commodity price movements for further cues.

Viva Energy’s Rocky Road 🚧

The news

Viva Energy shares fell over 6% after the company reported unaudited group earnings (EBITDA) of about A$300 million for the first half, well below the A$452 million reported a year ago as convenience sales dropped 10% due to a 27% plunge in tobacco sales following new packaging laws implemented in April and ongoing illicit trade.

Convenience sales excluding tobacco were down 2%, though flat in the June quarter. Gross margins improved to 39.2%, but refining earnings were hit by an unplanned outage, turnaround activity, and higher energy costs. Geelong’s refining margin averaged US$8.20 per barrel, down from US$10.80 a year ago. Integration of the OTR Group continued, with nine new stores opened and eleven more in progress.

Why it means for investors

The result highlights sector wide challenges in retail fuel and convenience, especially from regulatory changes impacting tobacco packaging, as well as operational risks in refining. The sharp drop in tobacco sales and weaker refining margins reflect broader headwinds for downstream energy and retail, while cost controls and margin improvements offer some resilience.

The stock’s steep decline signals investor concern over earnings quality and future growth, particularly given negative EPS and declining return on equity.

What’s next

Investors will watch for further updates on OTR integration, progress on new store openings, and potential stabilisation in convenience sales excluding tobacco. Refining margin recovery and operational reliability at Geelong remain key.

Any regulatory shifts or further illicit trade pressures on tobacco could however weigh on results. The next catalyst will be the formal release of audited half year results and management’s outlook for the second half.

Woodside’s Strategic Power Move ⚡

The news

Woodside Energy shares rose 1.57% after announcing it will take operational control of the Bass Strait gas assets, a key east coast energy source, through an agreement with ExxonMobil Australia. This transition is expected to unlock over US$60 million in synergies and could enable the development of four new wells, potentially delivering up to 200 petajoules of gas to the domestic market.

In its latest quarterly update, Woodside reported a 2% increase in production to 50.1 million barrels of oil equivalent, with quarterly revenue of US$3.28 billion and a strong realised LNG price of US$62 per BOE.

Why it means for investors

This move strengthens Woodside’s position as a leading gas supplier, supporting around 40% of Australia’s east coast demand and comes just weeks after the Australian government said it was considering a gas reservation policy to help avert supply shortfalls. The operational shift highlights sector trends toward consolidation and efficiency, while the company’s cost reductions and updated production guidance reinforce its competitive standing.

The robust dividend yield of 7.74% also remains attractive for income focused investors.

What’s next

Looking ahead, completion of the Bass Strait transition is expected in 2026, pending regulatory approvals. Key catalysts include further technical assessments for new well development, ongoing cost management, and potential updates to production guidance.

Investors should also monitor upcoming dividend announcements and broader energy market dynamics.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.