Scan this article:

Our AU Market overview

What happened

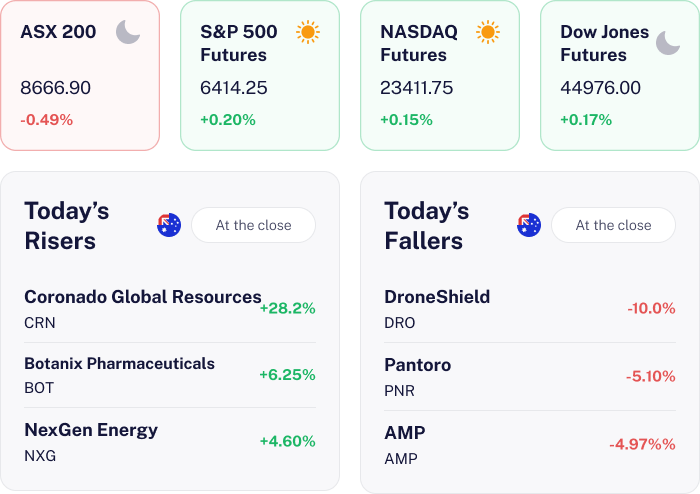

The ASX 200 fell 0.49% today as cautious comments from the Reserve Bank of Australia’s governor led investors to pare back expectations for interest rate cuts this year, weighing on major banks and financials.

Weakness in heavyweight mining stocks like BHP also dragged the index lower, while mixed U.S. tech earnings and a subdued Wall Street session further dampened sentiment. Gains in energy shares from higher oil prices provided only partial support.

Why it matters for investors

The RBA’s stance has set a more cautious tone, affecting investor sentiment, especially in the financial sector.

For investors, this means keeping an eye on central bank communications is crucial, as these can influence market expectations and sector performance. The mixed signals from the U.S. tech sector also highlight the interconnectedness of global markets.

US Outlook

Investors should gear up for a constructive session in the upcoming U.S. market, as futures are pointing higher. This optimism is fuelled by recent gains in retail sales and ongoing stock market momentum, despite slower GDP growth projections.

✨ Newmont’s Golden Quarter Shines

The news

Newmont posted strong Q2 results, producing 1.5 million ounces of gold and 36,000 tonnes of copper. Net income reached US$2.1 billion, with adjusted EPS of US$1.43 — beating estimates by over 25%. Revenue came in at US$5.32 billion, nearly 10% ahead of expectations. Free cash flow hit a record US$1.7 billion.

The company also launched a US$3.0 billion share buyback and declared a US$0.25 dividend. However, operations at the Red Chris mine in Canada were temporarily suspended after a safety incident involving three workers.

Why it means for investors

Newmont’s performance reinforces its position as a global mining heavyweight, with strong cash generation and shareholder returns. The share buyback and dividend highlight management’s confidence in the outlook. Still, the Red Chris shutdown is a reminder of the sector’s ongoing safety and operational risks.

What’s next

Newmont says it remains on track to meet 2025 targets. Investors will be watching for updates on Red Chris, as well as gold and copper price movements, and how quickly the company deploys its US$3b capital return program.

🚧 Maas Faces Governance Hurdle

The news

Maas Group shares fell 1.71% after confirming its subsidiary, Capital Asphalt, is being investigated by the NSW ICAC for alleged bribery and inflated invoices worth over A$343 million.

Maas clarified the alleged misconduct occurred before it acquired its 75% stake in December and stated that the individuals involved are no longer with the business. The company reaffirmed its zero tolerance for unethical behaviour.

Why it means for investors

This development is significant as it raises governance and reputational concerns at a time when Maas is delivering strong financial results, including a record FY24 underlying EBITDA of A$207.3 million, up 27% year on year, and a 12% increase in net profit after tax to A$73 million.

The broader construction sector remains sensitive to regulatory scrutiny and compliance risks, which can impact investor sentiment

What’s next

Investors will be watching for further updates from the investigation and any potential operational or financial impacts. The company’s reaffirmed guidance and ongoing integration of recent acquisitions will also be key catalysts, while the current share price offers a potential 14% upside to fair value if fundamentals remain intact.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.