Scan this article:

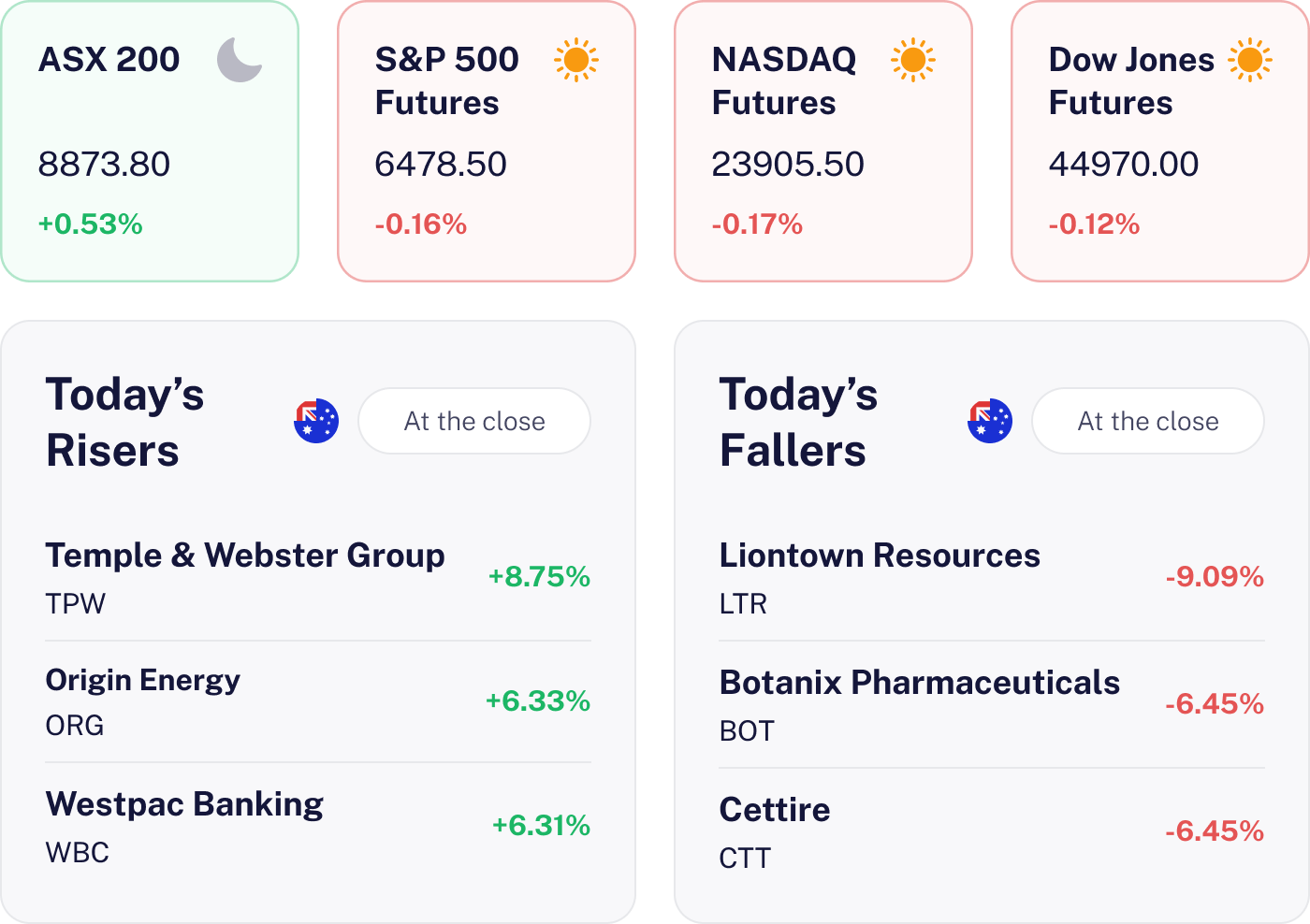

Our AU Market overview

What happened

The market climbed to fresh highs, advancing over 0.5% as robust domestic data and strong corporate earnings bolstered confidence. The unemployment rate fell to 4.2%, with record high female participation and solid job growth while Pro Medicus surged over 6% on a 39% profit jump.

Why it matters for investors

This upbeat market vibe signals ongoing strength, driven by resilient jobs growth and positive earnings. With supportive policy outlooks, investors can expect opportunities in growth and financial sectors, though central bank actions remain crucial to watch.

U.S. outlook

U.S. market futures are slightly in the red hinting at a cautious start as investors digest steady inflation data and resilient jobless claims. With no major earnings reports to stir the pot, all eyes are on Federal Reserve commentary for clues on rate cuts. Meanwhile, unexpected crude oil inventory increases could dampen energy sector spirits. Australian investors should brace for a session marked by caution.

Westpac Shares Surge on Strong Q3 🏦

The result

Westpac soared by 6.31% to A$36.04 thanks to a robust Q3 2025 performance. The bank reported a statutory net profit of A$1.9 billion. Revenue climbed 4% with expenses up 3% due to wage inflation and strategic investments. Net interest margin expanded to 1.99%, benefiting from a high rate environment.

Why it matters

Westpac’s impressive results have outpaced expectations setting it apart in the competitive banking sector. Strong net interest margin and profit growth highlight its resilience. With potential rate cuts on the horizon, Westpac’s disciplined cost management and tech investments, like AI fraud detection, are strategic assets.

What’s next

To maintain investor confidence Westpac aims for a Q4 profit of A$1.4 billion. The next earnings release on August 18, 2025 and the Annual General Meeting on December 11, 2025 are key dates. Investors are keenly watching RBA policy signals as rate cuts could impact future profitability.

Suncorp Soars on Profit Spike ☀️

The result

Suncorp Group dazzled with a 52% spike in net profit after tax, reaching A$1.823 billion. This windfall, bolstered by A$351 million from asset sales and robust investment income, outshone analyst forecasts of A$1.750 billion. Shares are trading around A$20.65 with a promising short term trend.

Why it matters

Suncorp’s stellar performance underscores its dominance in the insurance sector, buoyed by asset sales and investment returns. With a P/E ratio above its historical average, investors seem to be optimistic, though the high payout ratio merits a watchful eye.

What’s next

Eyes are on Suncorp’s next moves post asset sales. Investors will eagerly await management’s FY26 guidance and potential capital initiatives. The upcoming dividend payment on September 25, 2024, and sector trends like claims inflation will also be key focal points.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.