Scan this article:

Our AU Market overview

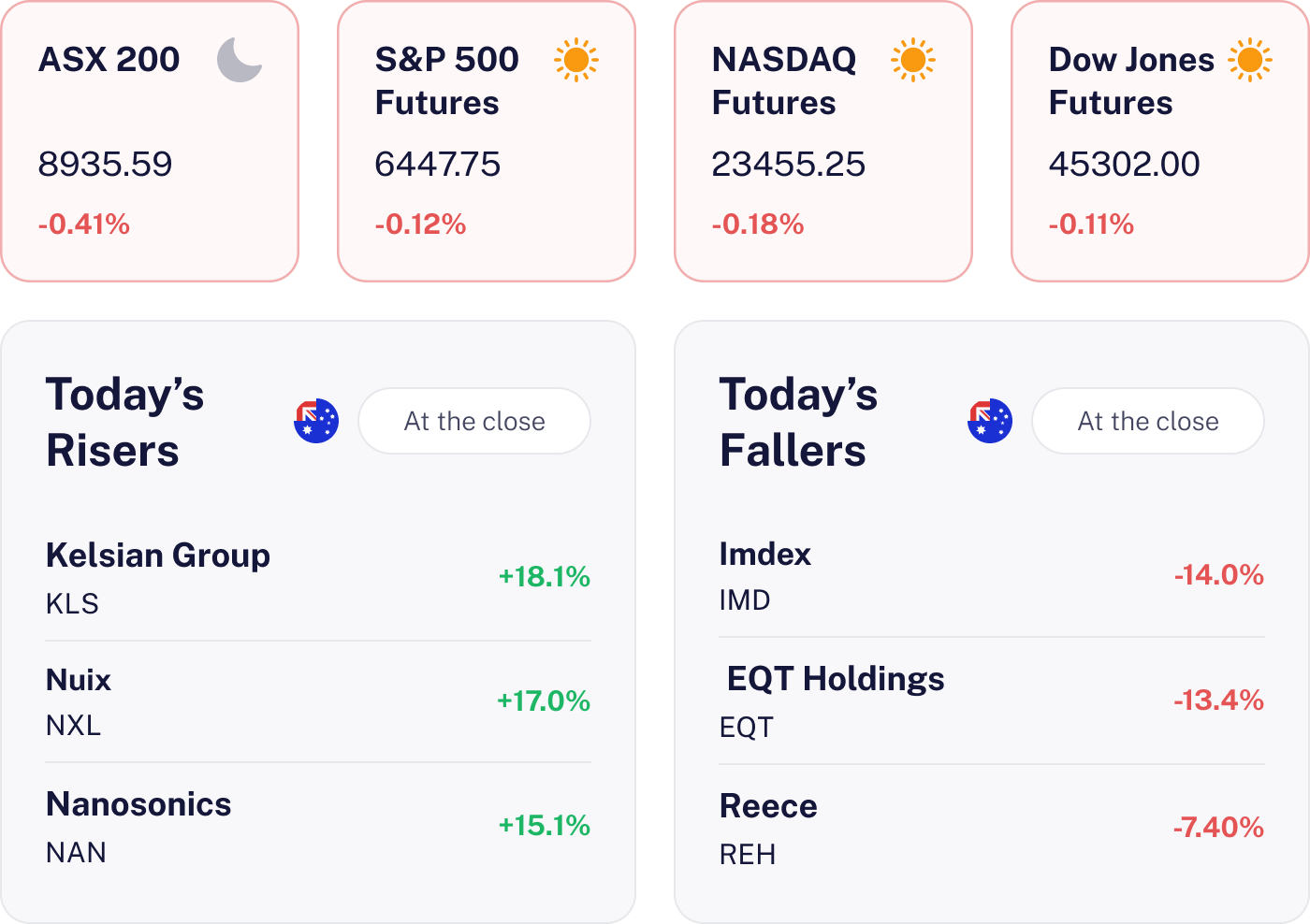

What happened

The market took a hit, slipping 0.41% as investors grappled with weaker global sentiment and mixed corporate results. A broad sell off in major U.S. indices overnight added to the pressure while resource stocks like Rio Tinto underperformed due to softer commodity prices and weaker Chinese demand.

Why it matters for investors

This downturn highlights the importance of keeping an eye on global trends and commodity cycles. Despite some sector resilience, the market’s pullback suggests a period of consolidation offering investors a chance to reassess risks and growth prospects.

U.S. outlook

U.S. market futures are slightly down hinting at a cautious start as inflation concerns linger and no major earnings or economic data are on the docket. With geopolitical uncertainties simmering in the background expect a subdued session with potential for choppy trading. Investors might want to keep their eyes peeled for Thursday’s data releases for clearer market direction.

CTD Halts Trading Amid Audit Woes

The result

Corporate Travel Management has hit pause on its trading as it grapples with audit issues, delaying its FY25 financial statements release to 25 September. Shares were last seen at A$16.05 before the halt. Deloitte’s audit uncovered potential revenue and cost recognition hiccups, necessitating a “material correction” to past financials.

Why it matters

This hiccup isn’t just a trip up for CTD; it’s a wake up call for the corporate travel sector. With CTD being a major player, investor anxiety is on the rise especially after the recent auditor switch from PwC to Deloitte. This could cast a shadow over the sector until the dust settles.

What’s next

All eyes are set on the 25 September release of CTM’s FY25 results. Investors will be keen to understand the financial corrections, audit findings and management’s next steps. Keep an ear to the ground for any further announcements from CTD or the ASX.

Tyro Shares Dip Amid Profit Slide

The result

Tyro Payments reported a 31% drop in statutory net profit for FY25, slipping to A$17.8 million from A$25.7 million in FY24. Flat transaction volumes and revenue growth that missed analyst expectations contributed to this decline. Consequently, Tyro fell 2.5% to A$1.17.

Why it matters

In a competitive payments technology sector, Tyro’s flat transaction values and revenue shortfall signal potential challenges in capturing growth. With the industry riding a wave of digitisation, Tyro’s performance raises concerns about its ability to leverage these tailwinds especially as competition intensifies.

What’s next

Investors will closely watch Tyro’s upcoming Annual Report and any developments in takeover discussions. Insights into management’s strategies for growth and cost control will be crucial in assessing Tyro’s future trajectory.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.