Scan this article:

Our AU Market overview

What happened

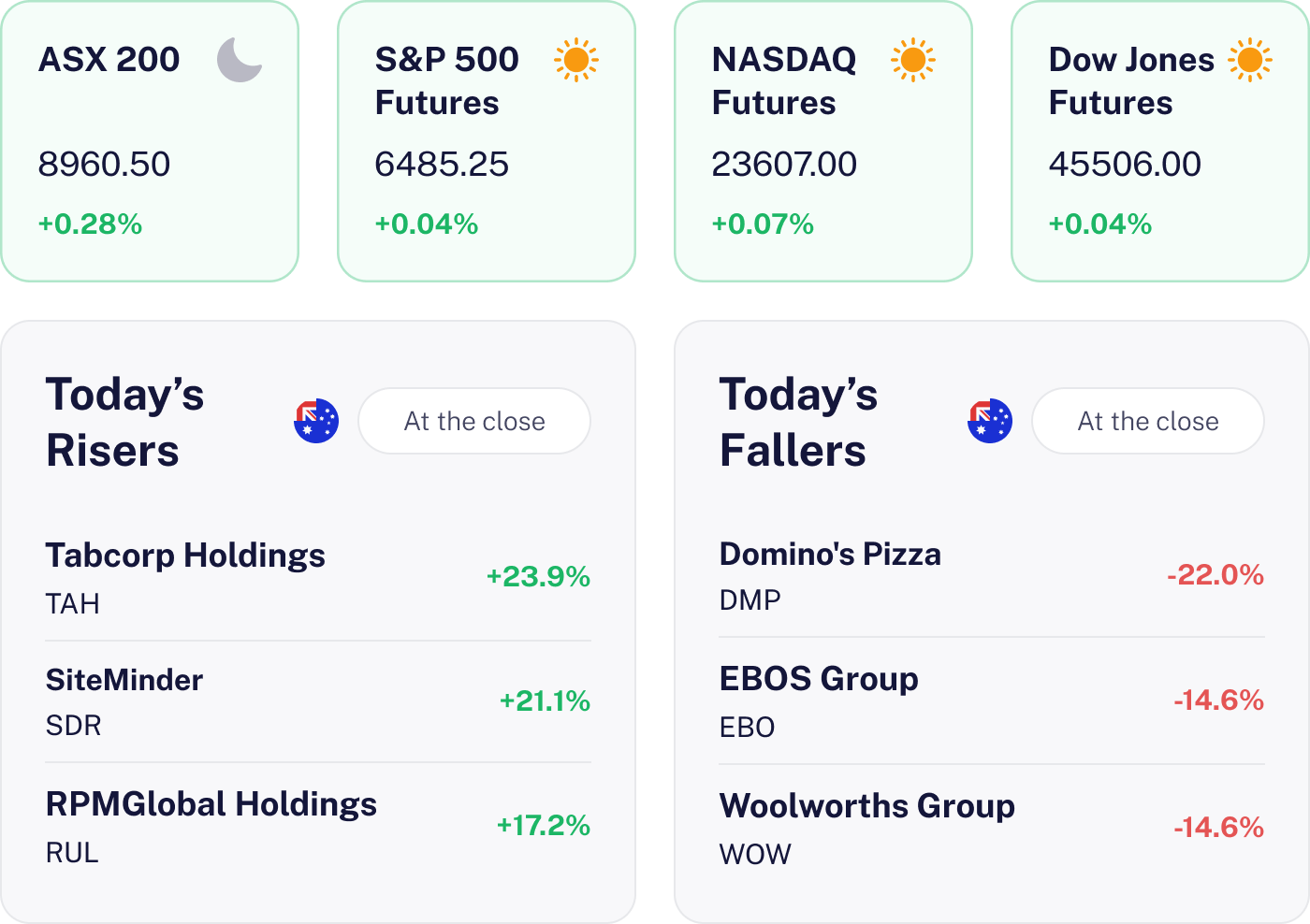

The market ticked up 0.28%, buoyed by financials and industrials. Commonwealth Bank and Westpac shone, thanks to their defensive allure. Industrials like Brambles added sparkle, but earnings season kept things spicy with some misses. Despite global jitters, local factors held sway.

Why it matters for investors

With financials and industrials leading, the market’s showing its resilient side. But with valuations stretched, it’s a reminder to keep your portfolio balanced. Keep an eye on interest rates and housing for potential opportunities. Diversification remains your trusty sidekick in navigating these choppy waters.

U.S. outlook

The U.S. market is poised for a major decision point as Nvidia Corporation reports their second quarter earnings tonight to close out the Big Tech earnings season.

Domino’s Shares Plunge Amid Losses

The result

Domino’s Pizza Enterprises Ltd took a nosedive today, leading the ASX 200 losses. The stock plummeted by 22% to approximately A$15.10 after revealing a statutory loss for FY25. Adding to investors’ woes, the company reported a 0.9% decline in group same store sales for the first seven weeks of FY26.

Why it matters

This downturn underscores the challenges facing the Consumer Cyclical sector, particularly in the fast food industry. With cost inflation and competitive pressures mounting, Domino’s struggles reflect broader market anxieties. The unexpected CEO resignation further clouds the company’s outlook, shaking investor confidence.

What’s next

Investors will keenly watch the execution of Domino’s cost efficiency program and any news on leadership succession. The upcoming interim trading update will be pivotal in assessing if sales trends and margins are stabilising. Keep an eye on consumer sentiment shifts for potential recovery signs.

SiteMinder Soars on Cash Flow Triumph

The result

SiteMinder Ltd (ASX:SDR) was the star of the ASX 200, rocketing 26.2% to A$6.88 after unveiling FY25 results. The icing on the cake was the unlevered free cash flow of A$4.7 million, smashing Jarden analysts’ forecast of A$2.7 million. This unexpected cash flow feat was the main driver behind the stock’s impressive leap, showcasing SiteMinder’s operational prowess.

Why it matters

In a world where cash is king, SiteMinder’s performance is a beacon for SaaS firms. Investors are increasingly valuing profitable growth, and SiteMinder’s results could spark a sector wide re-rating. With a strong global presence, SiteMinder is well positioned to lead the hotel commerce technology space.

What’s next

Keep an eye out for potential analyst upgrades on the back of this result. Watch for sector trends like travel demand and tech adoption, which could shape SiteMinder’s path forward. Also what will competitors in this space will do in response.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.