Scan this article:

Our AU Market overview

What happened

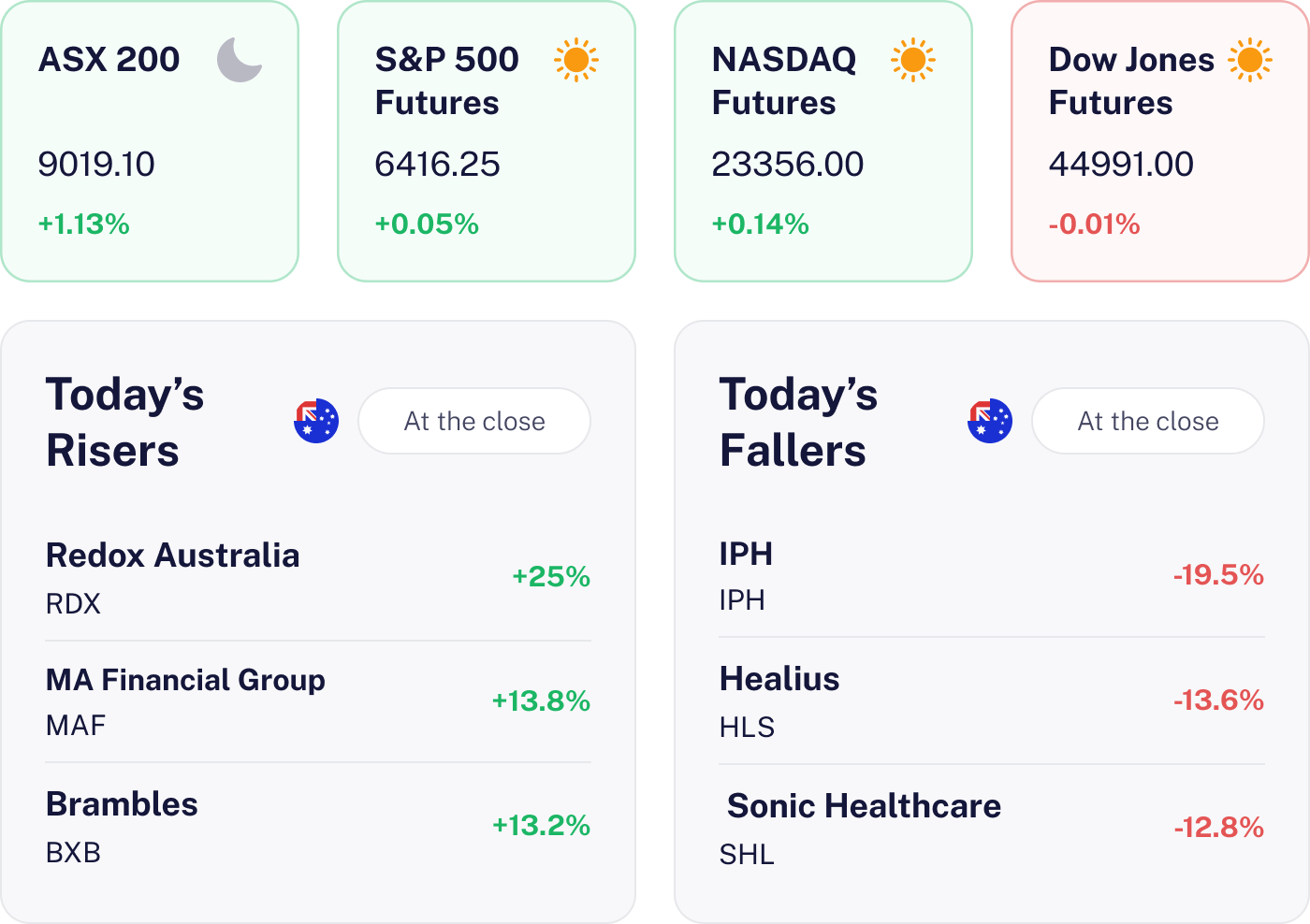

The market ticked up by 1.13%, buoyed by robust earnings from industrials like Downer EDI, which hit a 52-week high. However IPH took a tumble dropping nearly 20% despite solid results as investors questioned growth sustainability. Global gains and stable commodities added a positive vibe.

Why it matters for investors

While the market rose individual stock performance varied underscoring the need for careful analysis. Keep an eye on company fundamentals and sector trends for better investment decisions.

U.S. outlook

U.S. markets are poised for a cautious start with futures indicating a dip amid mixed economic signals and geopolitical jitters. Investors should brace for potential volatility as jobless claims and home sales data could sway sentiment. Earnings from major retailers and tech firms may highlight consumer spending pressures while Fed commentary keeps rate cut hopes in check.

Bega Cheese Soars on Strong Earnings 🧀

The result

Bega Cheese made a splash today with a 7.68% leap to A$5.61. The FY25 results were the talk of the town, boasting a 23% year on year group EBITDA growth. The bulk business outperformed expectations and the FY26 guidance hit the sweet spot with consensus forecasts.

Why it matters

In a sector grappling with margin pressures, Bega’s impressive results and “clean” cash backed performance are a breath of fresh air. This could spark a sector re-rating, drawing eyes back to the defensive consumer staples stocks. For investors, it’s a sign of Bega’s operational resilience and quality earnings.

What’s next

Eyes will be on Bega’s management for more insights into FY26, especially regarding margins and strategic plans. The AGM or any interim updates could unveil more about their game plan, particularly in high margin areas.

IPH Plummets on U.S. Patent Woes 📚

The result

IPH took a nosedive on the ASX 200, dropping 19.5% to A$4.50 after CEO Andrew Blattman flagged a decline in U.S. patent filings. Despite a strong statutory net profit of A$68.8 million (up 13.2%) and revenue of A$710.3 million (up 16.5%) the market’s focus was firmly on future prospects.

Why it matters

This sharp decline signals broader concerns for the intellectual property sector, particularly those with U.S. exposure. The drop in U.S. filings could be a harbinger of macroeconomic pressures or shifts in innovation cycles, affecting IPH’s growth and investor confidence.

What’s next

Investors will be keenly watching for further guidance from IPH on the U.S. situation. Key upcoming catalysts include management’s strategic responses, such as diversification or cost cutting and sector wide patent activity data, which could either corroborate or alleviate current concerns.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.