Scan this article:

Our AU Market overview

What happened

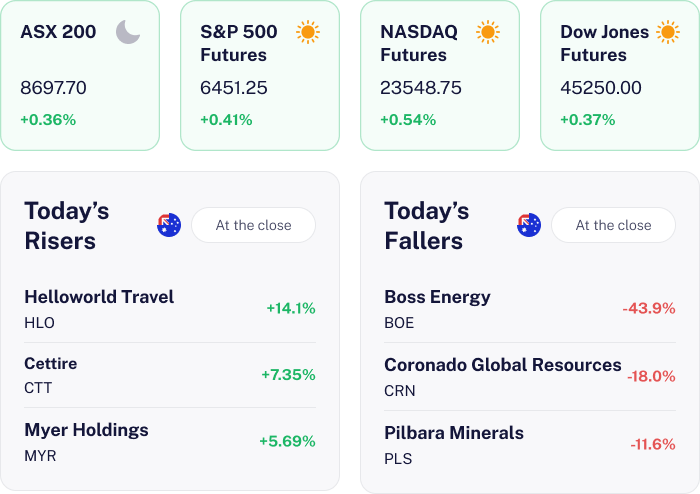

The ASX 200 rose 0.36% today as optimism from a new U.S. EU trade agreement and expectations of an extended U.S. China tariff truce boosted investor confidence, offsetting recent weakness in local banks and falling oil prices. Gains in large caps like Newmont Corporation, Commonwealth Bank of Australia and Block Inc. helped lift the index, while investors looked ahead to upcoming Australian inflation data for further direction.

Why it matters for investors

This uptick is a positive signal for Investors, suggesting that global trade developments are having a reassuring effect on market sentiment. While local banks faced some headwinds, the strength in large cap stocks indicates a balanced market with opportunities for diversified portfolios. Keeping an eye on inflation data will be crucial as it could influence future market movements.

US Outlook

U.S. futures are trading higher, reflecting optimism ahead of the session as investors digest the latest trade updates between the U.S. and both the EU and China. Positive momentum from the previous session and stable Federal Reserve policy expectations are supporting risk appetite, suggesting a constructive tone for Investors trading U.S. equities.

No Longer a Honeymoon 💔

The news

Boss Energy shares plunged over 43% today after management warned of potential production difficulties at its Honeymoon uranium project. The company revealed that recent wellfield design and drilling results indicate less continuity of mineralisation and leachability, which could impact future output targets.

Additionally, Boss Energy finished the fiscal year with production of 349,188 pounds of triuranium octoxide (aka ‘yellowcake’), exceeding guidance, and maintained costs at US$36 per pound. The company holds over US$224 million in cash and inventory, with sales of just 100,000 pounds for the quarter. Output from ion exchange rose 60%, and the U.S. Alta Mesa project also delivered improved volumes.

Despite the solid financials it is that forward guidance risk that the market has reacted very strongly to.

Why it means for investors

This result is significant as it highlights operational risk in uranium development, a sector already marked by supply uncertainty and volatile pricing. The sharp decline in Boss Energy’s share price weighed on the broader ASX 200, underscoring investor sensitivity to execution risk in critical resource projects.

What’s next

Investors will closely watch for further technical updates from Honeymoon, clarity on revised production guidance, and any updates at Alta Mesa. The market will also monitor uranium price trends and sector sentiment, as well as Boss Energy’s ability to address wellfield challenges and restore confidence in its growth outlook.

Helloworld’s Travel Triumph 🚀

The news

Helloworld Travel raised its full year EBITDA guidance to between A$58 million and A$62 million, up from the previously downgraded A$52 million to A$56 million range, against a backdrop of a decline in total transaction value and booking volumes. The company attributed this to stronger margins, robust cruise demand, a revaluation gain on its Webjet stake, and a 110% increase in Ready Rooms hotel business compared to last year.

Network agent retention remained high at 96%, and forward bookings are strong into next year. Full year results will be released on August 26

Why it means for investors

This matters as it highlights resilience in the travel sector, with consumers shifting from long haul to more affordable mid haul destinations like Japan, Bali, Thailand, and Fiji. The ability to maintain profitability despite lower volumes and airfares reflects effective cost control and business diversification. Cruise demand and hotel growth are notable sector trends as well.

What’s next

Investors will watch for the August 26 results and further updates on margin sustainability, booking trends, and the performance of the Webjet investment. Continued shifts in travel patterns and macroeconomic factors could influence future guidance and sector sentiment.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.