Scan this article:

Our AU Market overview

What happened

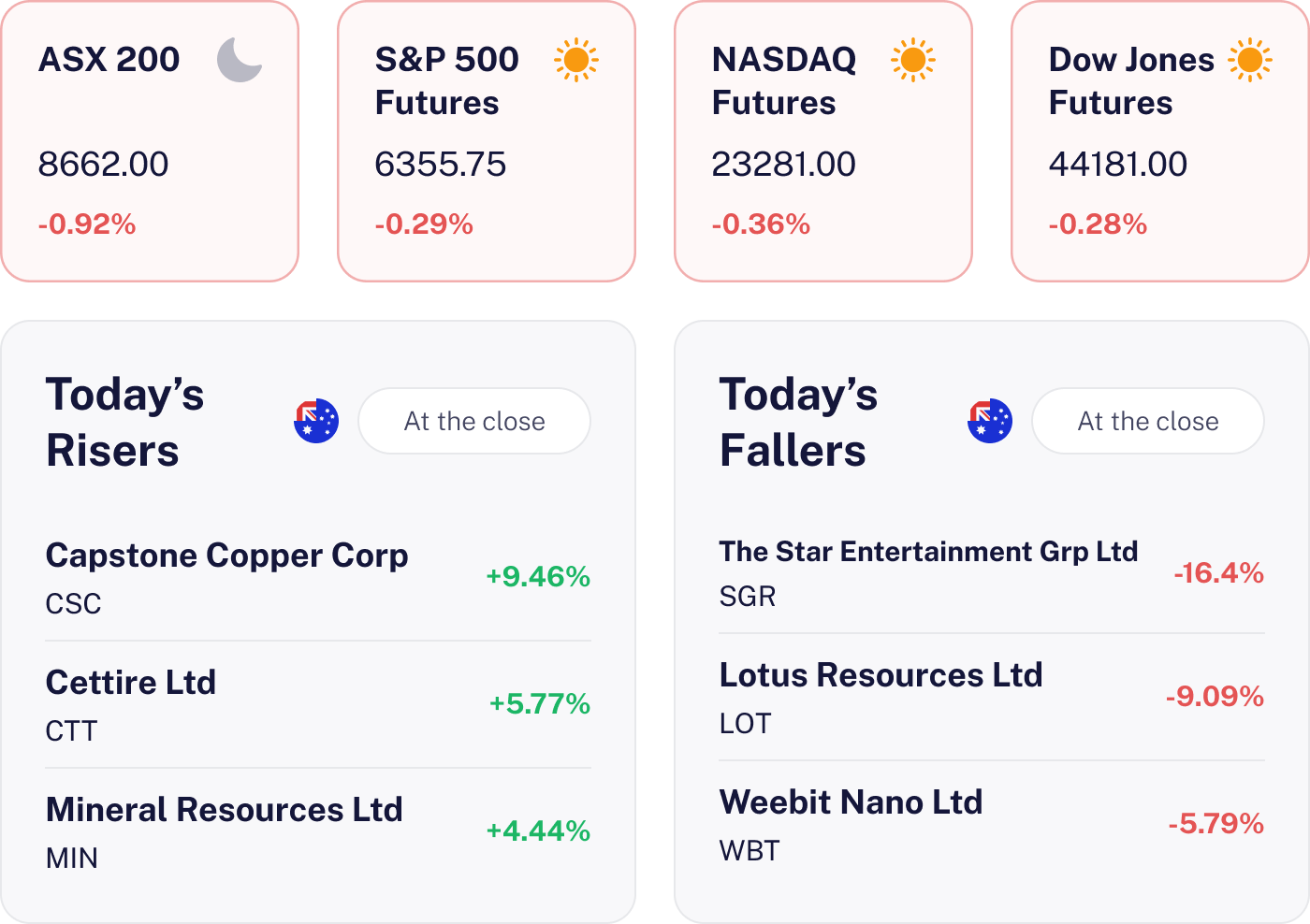

The ASX 200 fell 0.92% as investors reacted to a weak lead from U.S. markets, where major indices declined amid month end repositioning and ongoing tariff concerns. Lower oil prices, with Brent crude down nearly 1% to US$72.55 a barrel, weighed on local energy shares, while uncertainty around trade policy and subdued gold prices also dampened sentiment.

Investors remained cautious ahead of key economic and policy developments.

Why it matters for investors

This dip highlights the interconnectedness of global markets, where U.S. economic signals can ripple across the globe to impact Australian shares. Energy and resource sectors were particularly affected as commodity prices softened, prompting investors to reassess their positions.

Staying informed on global economic trends and their potential impact on local markets can empower investors to make more strategic decisions.

U.S. outlook

U.S. futures are trading lower, reflecting investor caution ahead of key U.S. economic data releases including the jobs report, manufacturing PMI and ISM manufacturing.

These reports are expected to signal a cooling economy and persistent inflation pressures.

Star Hits a New Record Low 🚨

The result:

Star Entertainment shares sank 16.4% after it missed the deadline to sell its stake in Brisbane’s Queen’s Wharf, triggering over A$41 million in payments to joint venture partners and leaving it exposed to future project costs. For the June quarter, Star reported flat revenue of A$270 million and an EBITDA loss of A$27 million, despite a recent A$300 million capital injection. It ended the quarter with A$234 million in cash. The Star is now trading at historical lows.

Why it matters:

Star is still under intense financial and regulatory pressure. The failed asset sale means it’s now on the hook for more than A$200 million in extra project costs. At the same time, it’s facing continued operating losses, new carded play rules in NSW, and a potential AUSTRAC fine that could exceed A$100 million. With a key debt facility expiring in December, Star’s funding position is looking increasingly fragile.

What’s next:

Key catalysts ahead include potential further asset sales, urgent cost cutting, refinancing of the A$1.4 billion DBC debt, and the outcome of regulatory actions. Any AUSTRAC penalty or delays in restructuring could intensify liquidity risks, making the next quarter critical for Star’s viability.

Copper Climbing: Capstone Shines 🌟

The result:

Capstone Copper shares surged over 9% today, making it the top gainer on the ASX 200, after reporting record Q2 copper production of 57,416 tonnes at cash costs of US$2.45 per pound and record adjusted EBITDA of US$215.6 million, up 42.9% year on year.

Operating cash flow before working capital doubled to US$212.4 million, and net debt fell 12.2% to US$691.9 million as of June 30, 2025.

The company reaffirmed its 2025 production guidance of 220,000 to 250,000 tonnes at cash costs of US$2.20 to US$2.50 per pound, citing strong performance at its Chilean operations and the receipt of the Mantoverde Optimized permit.

Why it matters:

This performance highlights Capstone’s operational momentum and financial strength amid a challenging broader market, underscoring copper’s strategic importance in the energy transition and infrastructure sectors. Investors are rewarding the company’s execution and improved balance sheet, especially as copper prices remain volatile.

What’s next:

Looking ahead, Capstone expects further production growth in the second half of 2025 as the Mantoverde and Mantos Blancos ramp ups continue. Key catalysts include the imminent start of the Mantoverde Optimized project and ongoing delivery against full year guidance, positioning Capstone as a leading copper producer with robust cash flow potential.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.