Scan this article:

Our AU Market overview

What happened

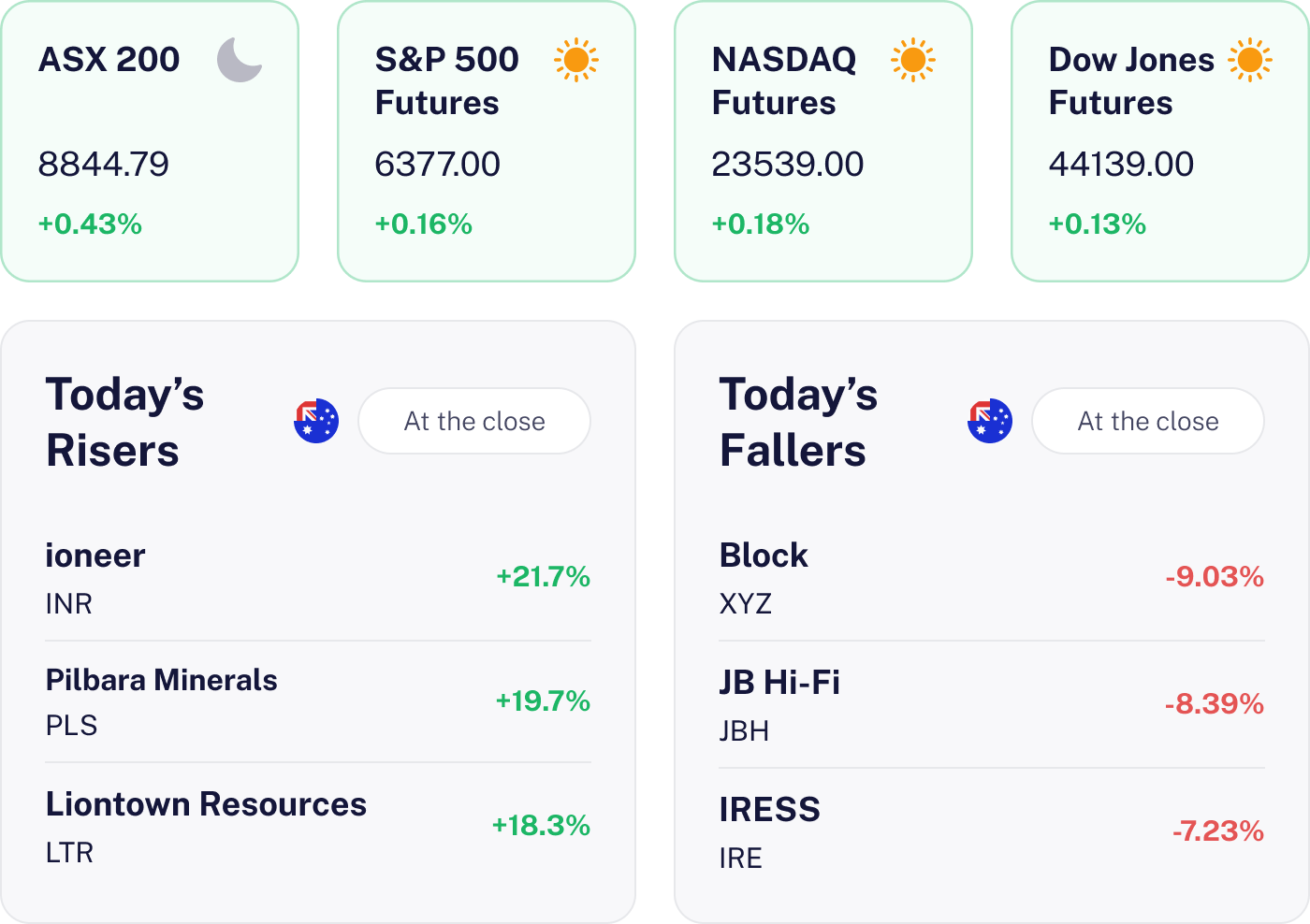

The ASX 200 climbed 0.43%, reaching new heights as optimism around an expected RBA rate cut tomorrow boosted sentiment. Gains were driven by resource giants and a surge in lithium stocks, while tech lagged due to weaker earnings reports.

Why it matters for investors

With the RBA expected to ease rates, financial conditions are becoming more favourable particularly for cyclicals and defensives. Resource stocks remain crucial while tech’s earnings volatility underscores the need for careful stock selection.

U.S. outlook

The U.S. market is poised for a positive start with futures showing modest gains. A light economic calendar today allows earnings and Federal Reserve commentary to take the spotlight while the absence of geopolitical tensions supports a risk on sentiment. Investors should keep an eye on rates and the dollar, as their stability could maintain the market’s upbeat tone.

JB Hi-Fi Shines Despite Leadership Shift 📺

The result

JB Hi-Fi (ASX:JBH) soared to a record high before sliding 8.39% to A$107.83 after unveiling FY25 results. The tech retailer posted stellar numbers – sales jumped 10% to A$10.6bn, underlying EBIT climbed 9.4% to A$707.8m and shareholders scored a special dividend of A$1.00 per share. But the upbeat earnings were tempered by news that CEO Terry Smart will step down in October, with current COO Nick Wells set to take the reins.

Why it matters

Strong earnings and dividends reflect JB Hi-Fi’s robust cash flow and market resilience, even amid leadership changes. The increased payout ratio signals confidence but raises questions about future strategic investments. The share dip highlights investor concerns over governance continuity.

What’s next

Investors should watch Nick Wells’ strategic priorities and any FY26 trading updates. Key areas include margin sustainability, capital allocation, and integration of The Good Guys. These factors will shape JB Hi-Fi’s performance in the coming months.

Mineral Resources Gains on Lithium JV 🪨

The result

Mineral Resources (ASX:MIN) announced a 50-50 joint venture with Livium to commercialise the LieNA lithium processing technology. This JV aims to license the technology, targeting an 8% gross product royalty rate. Shares closed at A$38.12, driven by investor interest in the JV.

Why it matters

The LieNA technology offers strategic optionality by recovering lithium from low grade ores, potentially enhancing yields and reducing costs. This could diversify MIN’s cash flow beyond mining cycles, providing an asset light earnings stream less exposed to commodity price volatility.

What’s next

Investors should watch for JV execution milestones, including pilot validation and licensing agreements. Any improvements in lithium prices could further boost MIN’s earnings. Keep an eye on company updates regarding production guidance and capital allocation strategies.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.