Scan this article:

Our AU Market overview

What happened

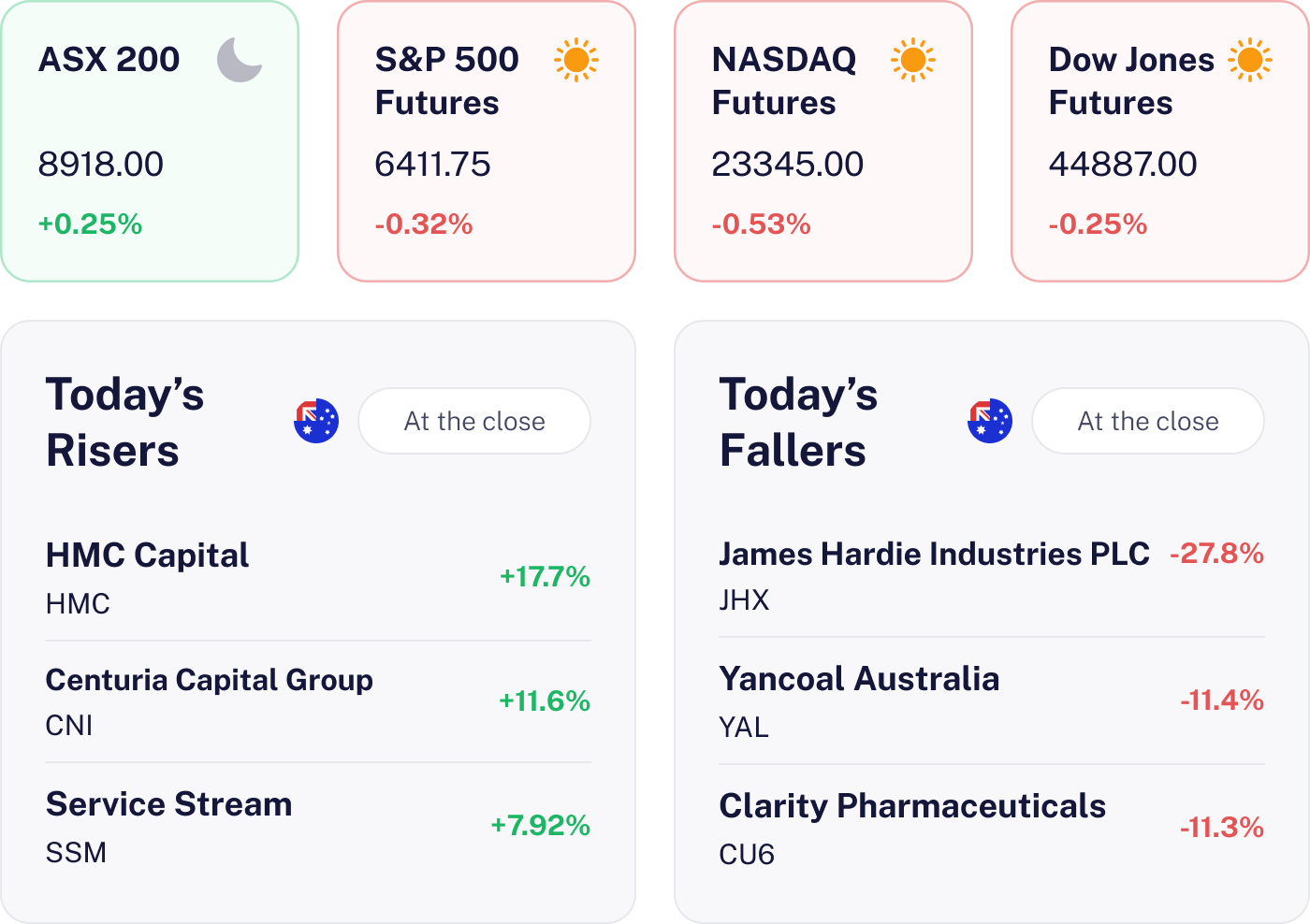

The market ticked up by 0.25%, showing resilience amid mixed earnings reports and global influences. Financials rebounded, counteracting a sharp drop in energy stocks, notably Yancoal’s 11.4% plunge. Consumer sentiment rose boosting discretionary stocks while expectations of future rate cuts added a positive twist.

Why it matters for investors

This modest gain underscores the importance of sector rotation and company specific news during earnings season. Investors should watch global trends and central bank policies, which continue to shape market dynamics. Keep an eye on consumer confidence and financials for potential opportunities.

U.S. outlook

The U.S. market is set for a bumpy ride with futures pointing lower, reflecting jitters over a slowing economy and sticky inflation. With GDP contracting and consumer spending cooling, there may be concerns of stagflation. Keep an eye for the FOMC minutes to be released later today.

Stockland Soars on Strong FY25 Results 📊

The result

Stockland jumped 6.99% to A$6.12 following its FY25 results, which surpassed expectations. The company also provided FY26 guidance aligning with analyst forecasts. A notable change is the adjustment of the dividend payout ratio to 60-80%, down from 75-85%.

Why it matters

This performance highlights Stockland’s resilience in a challenging property market, marked by higher interest rates. The strategic shift in payout ratio suggests a focus on capital retention for growth, resonating well with investors. With a 34% gain over the past year, Stockland is outperforming many peers in the Australian real estate sector.

What’s next

Analysts will watch how Stockland implements its new payout policy and any updates on capital allocation. Key areas to monitor include interest rate trends and regulatory changes that could impact property valuations.

Lottery Corp Shares Soar on Profit Beat 🎟️

The result

The Lottery Corporation dazzled the market today with a full-year net profit of A$365.5 million, surpassing analyst expectations despite a 11.7% dip from last year. Investors cheered the stronger than expected dividend, sending shares up 6.99% to A$5.66.

Why it matters

TLC stands out with its robust dividend and solid business model. As Australia’s top lottery and Keno operator, TLC’s resilience boosts confidence in the consumer cyclical and gambling sectors.

What’s next

Eyes are on TLC’s AGM for FY26 guidance and strategic updates. With a potential 3.5% price rise, TLC is poised for continued interest if defensive themes remain in vogue.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.