Scan this article:

Our AU Market overview

What happened

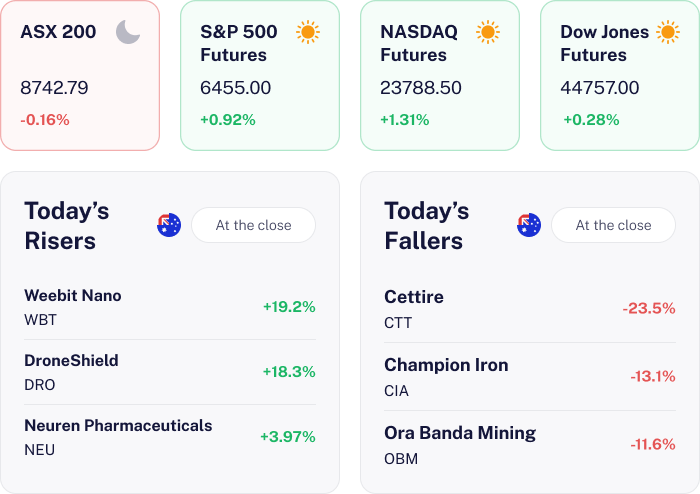

The ASX 200 rose 0.60% today as investors responded positively to softer than expected Australian inflation data. The June quarter CPI rose just 0.7% and annual inflation eased to 2.1%, boosting confidence that interest rates will be cut next month .

Gains were led by major banks such as Commonwealth Bank and Westpac. Global factors, including steady commodity prices and anticipation of key U.S. Federal Reserve decisions (due tomorrow), also supported sentiment.

Why it matters for investors

This uptick in the ASX 200 is a positive signal for investors looking for stability in the market. The softer inflation data suggests that the Reserve Bank of Australia may cut interest rates which could support further growth in equities.

With financials leading the charge, investors might see potential opportunities in banking stocks. However, keeping an eye on global economic cues remains essential as they can sway market sentiment.

US Outlook

For the upcoming U.S. market session on Wednesday, 30 July 2025, investors can anticipate a buoyant start as U.S. futures are trading higher. This optimism is supported by softer inflation data, with the Core PCE Price Index rising just 0.2% month on month, and a decline in initial jobless claims to 217,000. Easing policy uncertainty after recent legislative progress adds to the positive sentiment. Investors will be closely watching the second quarter GDP release and upcoming earnings announcements, which could influence the S&P 500, Nasdaq 100, and Dow Jones Industrial Average’s performance.

Tariff Trouble for Cettire 💼

The news

Cettire slumped ~23.5% today after the U.S. moved to suspend the de minimis exemption for imports under US$800, effective 29 August. More than 22 million shares changed hands – a sharp spike in volume pointing to a heavy-handed market response.

Why it means for investors

The luxury e-commerce retailer relies on cross-border shipping to fuel growth. The removal of duty-free status for small parcels threatens Cettire’s U.S. margins and pricing edge, putting pressure on demand in its biggest expansion market. Broader e-commerce names could also face rising scrutiny as trade barriers tighten.

What’s next

With the new tariff rule taking effect next month, markets will be watching Cettire’s next earnings and any supply chain pivots. Until there’s clarity on financial impact, investors can expect continued volatility.

Rio Tinto: Iron Ore Drags Down Earnings 🪨

The news

Rio Tinto traded lower today despite delivering a stronger-than-expected first-half result. Underlying EBITDA came in at US$11.5 billion, ahead of analyst estimates, driven by stronger output in iron ore, aluminium and copper. However EPS missed by 4% and dividends fell 5% short of consensus, impacted by US$300 million in restructuring costs tied to the Arcadium acquisition and a surprise tax hit.

Why it means for investors

Rio Tinto’s solid operating performance is significant amidst global commodity market uncertainties, particularly with Chinese demand fluctuations. The restructuring costs associated with the Arcadium deal indicate the company’s strategic focus on long term growth despite short term financial impacts.

What’s next

Investors should watch for the 2024 interim dividend payment on August 15 and updates on the Arcadium integration. Commodity price trends, especially in iron ore and copper, along with economic signals from China, will be crucial in shaping Rio Tinto’s future performance.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.