Scan this article:

Our AU Market overview

What happened

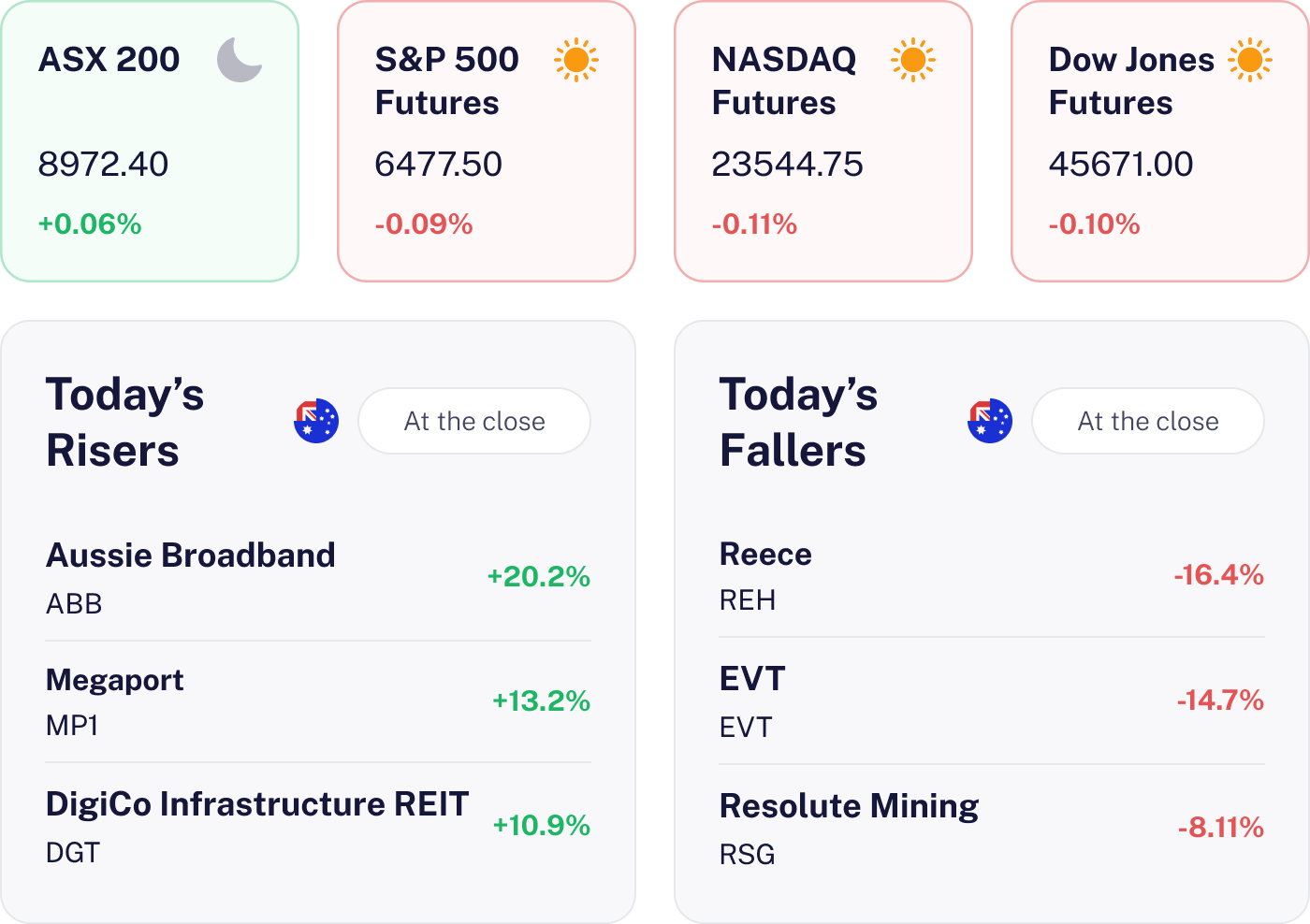

Local shares were flat, up just 0.06% as investors grappled with valuation concerns and mixed earnings. The market’s recent rally hit a speed bump, with resource stocks losing their shine amid softer commodity prices and global growth jitters. Select companies like Aussie Broadband and NIB Holdings bucked the trend with strong results, but overall sentiment was cautious.

Why it matters for investors

Today’s flatline underscores the importance of focusing on companies with robust earnings and effective cost management. With the market’s elevated price to earnings ratio, investors should keep an eye on global economic signals that might sway central bank policies and influence market risk appetite.

U.S. outlook

Investors brace for a cautious start to the U.S. market today, as futures hint at a slight dip. Economic data, including new home sales and manufacturing indices, will be in focus, with potential softness in construction and manufacturing weighing on sentiment. We got a little taste of that today with the Reece Holdings results. Investors are still also digesting the latest speech from the Reserve Bank Chair Jerome Powell after he boosted expectations of a rate cut in September.

Santos Climbs as Energy Sector Shines

The result

Santos reported a first half net profit of U.S.$439 million, despite a U.S.$119 million impairment from its PNG LNG project. The underlying EBITDAX of U.S.$1.8 billion surpassed expectations, showcasing resilience. Shares closed at A$7.78, rising 1.04% with increased trading volume. Also at play is the announcement that it would allow potential buyers of the company more time to decide on a proposed $36 billion acquistion.

Why it matters

This performance highlights Santos’ operational strength amidst challenges. The impairment underscores risks, yet the earnings beat boosts investor confidence. With a 4.57% dividend yield, Santos remains attractively valued, aligning with sector averages.

What’s next

Investors should monitor updates on PNG project repairs and global LNG pricing. Future earnings reports and any strategic changes in capital allocation will be pivotal for Santos’ outlook. Also keep one eye on that proposed acquisition later this year.

Reece Earnings Miss Stirs Concern

The result

Reece faced a sharp 24% drop in full year profit, deemed “disappointing” by CEO Peter Wilson. This news sent shares plummeting 17.7% to A$11.58, marking a 55.9% loss over the past year. The stock’s volatility is high, with a 27.79% rate and a beta of 2.00, signalling a bumpy ride ahead.

Why it matters

Operating in the plumbing supplies sector, Reece is heavily impacted by construction cycles. Today’s results reflect broader industry woes, with the ASX 200 feeling the pinch. Investors are now questioning the company’s ability to bounce back amid economic headwinds.

What’s next

Investors should tune into the earnings call for insights on demand trends across regions and management’s cost control strategies. Keep an eye on broader construction data, as it could further influence Reece’s stock trajectory. Surprises in today’s release might just shake things up!

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.