Scan this article:

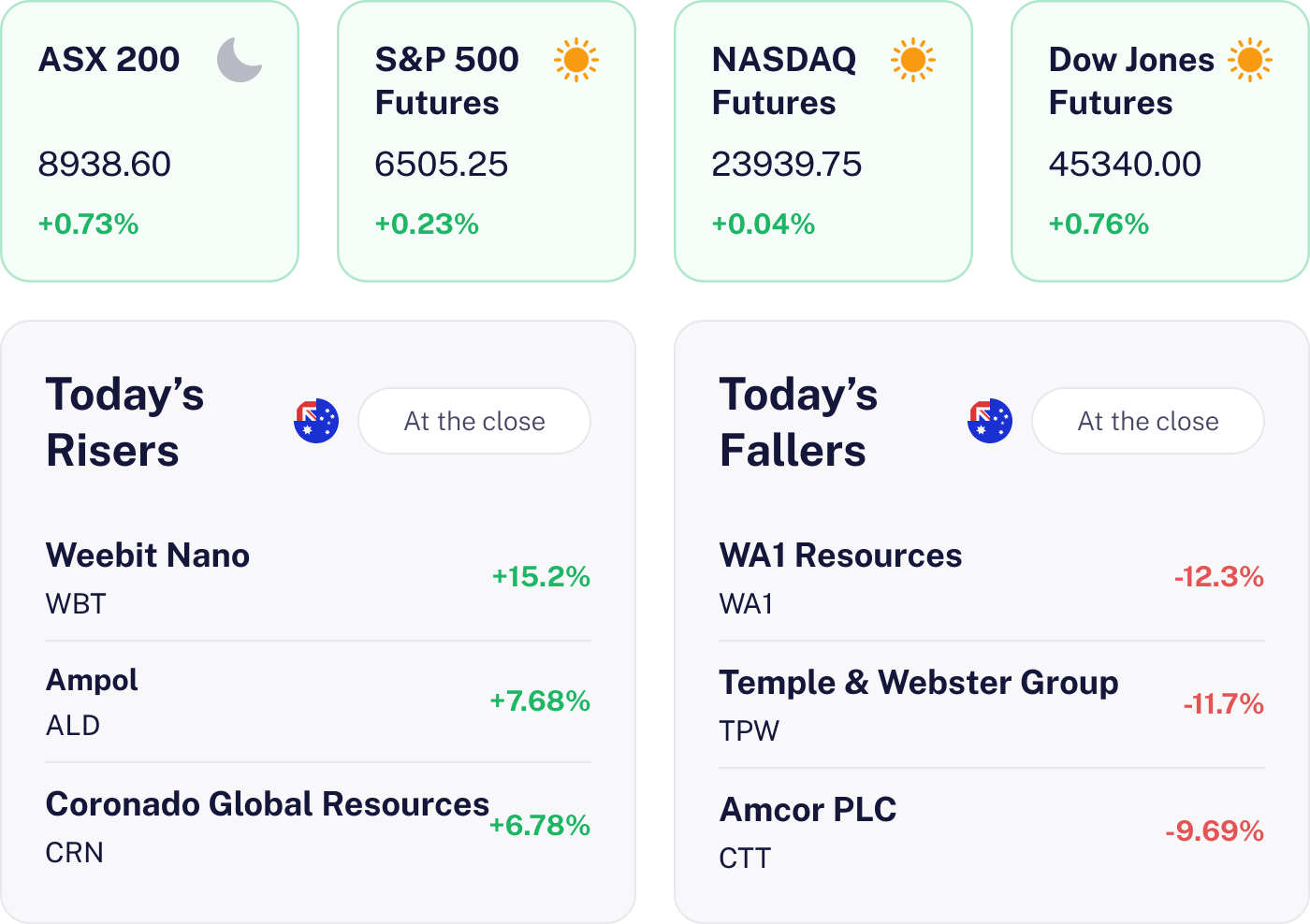

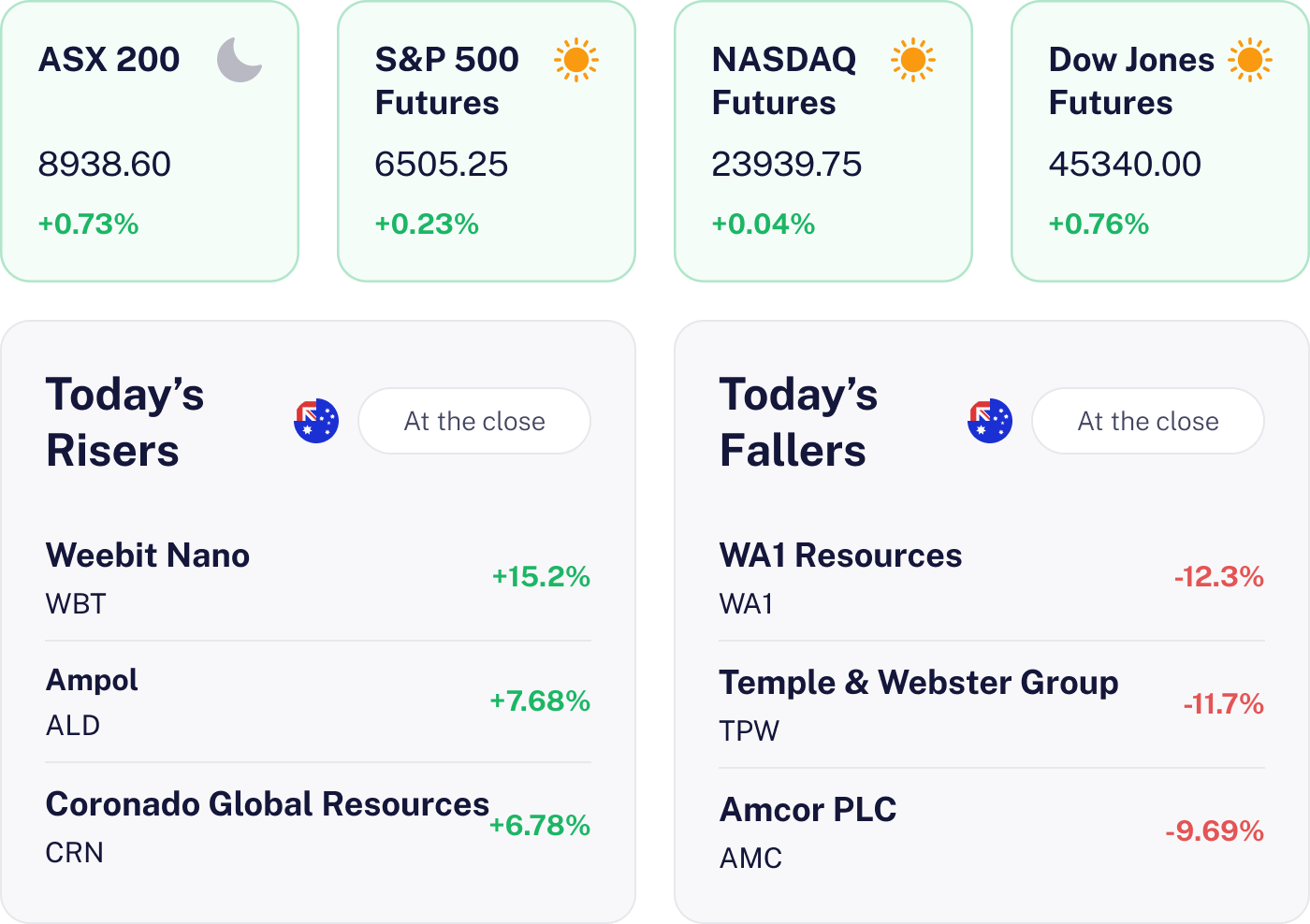

Our AU Market overview

What happened

The market reached new highs, climbing 0.73% as investors cheered a rate cut and falling unemployment. Standout earnings from healthcare and M&A activity, like Ampol’s acquisition, drove gains. However, Commonwealth Bank’s modest growth showed some sectors face high expectations.

Why it matters for investors

With supportive economic signals and strong corporate earnings, the market’s upward trend highlights opportunities in healthcare and M&A. Yet high valuations in certain sectors suggest investors should focus on stocks with real earnings momentum.

U.S. outlook

The U.S. market is poised for a positive start with futures pointing upwards, driven by anticipated retail sales and industrial production data. Investors should keep an eye on consumer sentiment and Fed commentary for potential market shifts. With a calm geopolitical backdrop, the stage is set for a supportive trading environment. Keep your eyes peeled for any surprises from earnings reports that could sway sector performance.

Ampol’s Massive Acquisition ⛽

The result

Ampol shares skyrocketed over 7% to A$29.15 following the announcement of its A$1.1 billion acquisition of EG Group Australia. This strategic move, adding around 500 service stations to Ampol’s network, has certainly got the market buzzing.

Why it matters

This acquisition is a game changer for Ampol, making it a dominant force in the Australian fuel retail sector. By integrating EG’s stations Ampol strengthens its supply chain, potentially boosting margins and operational efficiency.

What’s next

Keep an eye on Ampol’s half year FY25 results for insights into its financial trajectory. Watch for updates on the integration of EG’s network and the rollout of Ampol’s Foodary and U GO brands. These developments will be crucial for Ampol’s future growth.

Mirvac’s Residential Earnings Slide 🛝

The result

Mirvac Group dipped 0.87% to A$2.29 after FY25 results showed a decline in residential development earnings. The company reported an operating profit of A$474 million, down from A$552 million last year, but statutory profit improved to A$68 million from a previous A$805 million loss. Residential EBIT fell 15.6% to A$179 million missing forecasts.

Why it matters

The residential sector’s underperformance is a concern highlighting ongoing market challenges. Despite a strong commercial occupancy rate of 98% and improved property valuations, investors focused on the residential shortfall. Mirvac’s moderate gearing of 27.6% and A$1.2 billion liquidity offer financial stability.

What’s next

With A$1.9 billion in residential pre-sales Mirvac’s future earnings have potential. Expansion in build to rent and land lease sectors could drive growth. Investors will watch for updates on residential sales, margin recovery and capital partnerships as well as interest rate and housing demand trends.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.