Scan this article:

Our AU Market overview

What happened

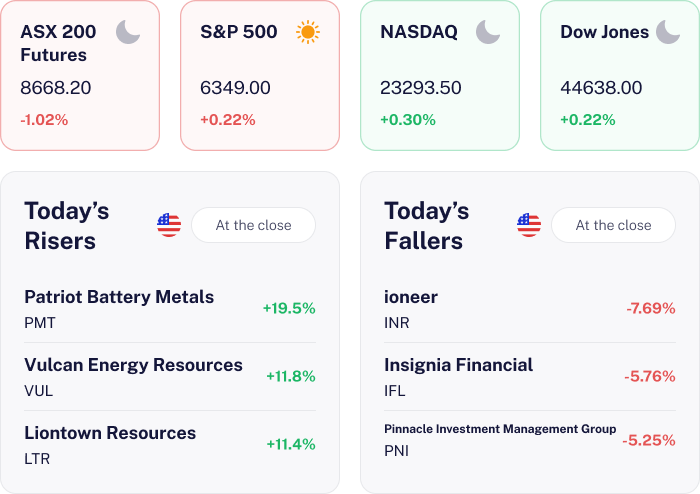

The ASX 200 fell 1.02% today as weakness in major bank stocks weighed heavily on the market, with CBA, NAB and Westpac all posting losses of more than 2%. Broader negative sentiment was driven by disappointing earnings updates and concerns over global growth, while investors also reacted to softer commodity prices.

Most sectors finished in the red, making it the index’s worst session since early April.

Why it matters for investors

Today’s downturn in the ASX 200 highlights the sensitivity of the market to banking sector performance and global economic signals. For Investors, this serves as a reminder of the interconnectedness of financial markets and the potential ripple effects of sector specific challenges.

Keeping an eye on earnings reports and global economic indicators will be crucial as these factors can significantly influence market sentiment and investment decisions.

With the increase in unemployment rate, analysts now have stronger expectations for a rate cut at the RBA’s next meeting.

US Outlook

U.S. futures are pointing higher as upbeat retail sales and stable macro conditions lift investor sentiment. No major data is due today, but all eyes are on earnings this week.

Verizon and Domino’s Pizza kicks things off today, with Coke, Philip Morris and RTX set to report Tuesday.

Wednesday heats up with Alphabet, Tesla and IBM all due post-market. Blackstone, Honeywell and Union Pacific drop results Thursday morning, before Intel takes the spotlight that evening. With the S&P 500 near record highs, this week’s earnings could drive the next move.

👀 The Disruptor Gets Disrupted

The news

SEEK shares traded flat today following a contrasting mix of stronger guidance and unfortunate news.

SEEK now expects revenue between A$1.06 billion and A$1.10 billion, EBITDA of A$440 million to A$470 million, and adjusted profit between A$135 million and A$160 million. Spending is now expected to come in lower than originally planned, helping to boost free cash flow.

However, Employment Hero, once backed by SEEK’s own venture fund, is now suing SEEK for alleged anti competitive conduct after being blocked from SEEK’s platform.

Why it means for investors

SEEK’s upgraded guidance is a positive signal – lower costs and stronger cash flow are clear tailwinds. But the lawsuit from Employment Hero adds a layer of uncertainty. Not only does it raise potential legal risk, it also reflects growing competitive pressure in the online recruitment space.

What’s next

Investors are watching for the outcome of the Employment Hero litigation and SEEK’s ability to maintain relevance as new rivals emerge. The company’s focus on platform unification and operating leverage will be key, but the sector’s rapid innovation cycle means SEEK must continue evolving to avoid losing ground to more agile competitors.

🧱 Block’s S&P 500 Debut

The news

Block surged over 11% today reaching a near five-month high after news it will be added to the S&P 500 Index, replacing Hess Corp following Chevron’s acquisition of Hess.

Block’s last reported quarterly revenue was US$5.77 billion, with net income of US$189.87 million, and its next earnings report is scheduled for 7 August 2025.

Why it means for investors

Inclusion in the S&P 500 is significant as it typically drives increased demand from index funds and institutional investors, often resulting in higher liquidity and valuation. The move also signals Block’s growing stature in the fintech sector, highlighting its resilience despite recent earnings volatility and ongoing competition in digital payments and commerce platforms.

What’s next

Investors will be watching for Block’s upcoming earnings, as well as potential impacts from its S&P 500 inclusion on trading volumes and share price. Broader sector trends, such as evolving digital finance ecosystems and regulatory developments, will also be key catalysts for the stock in the coming months.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.