Scan this article:

Our AU Market overview

What happened

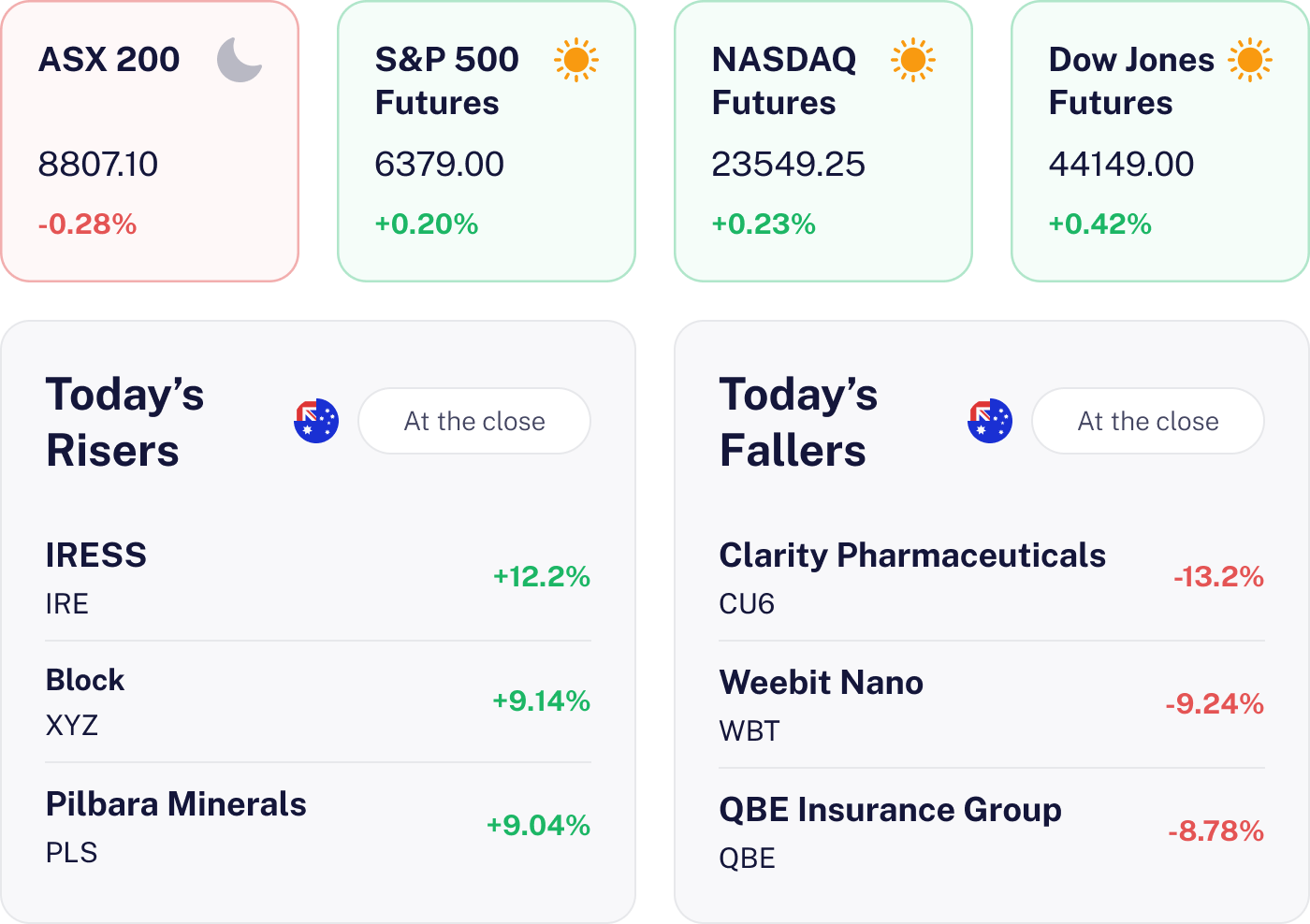

The market slipped 0.28%, with tech and financial stocks weighing heavily. Despite this, the materials sector shone, climbing 1.36% thanks to mining stocks riding high on strong commodity prices. Consumer discretionary names like Wesfarmers and JB Hi Fi hit multi year highs, showcasing resilience amid the broader dip.

Why it matters for investors

This session highlights the ongoing sector rotation and the importance of earnings quality. While tech and banking stocks faced profit taking, resource linked stocks found favour. The market’s slight retreat suggests consolidation, not a trend shift, offering savvy investors opportunities to spot strength amid the pullback.

U.S. outlook

U.S. markets are poised for a modestly positive session, with futures indicating slight gains. Economic data is light, with no major surprises expected from Treasury auctions or consumer credit updates. The absence of significant earnings reports or Federal Reserve commentary keeps the focus on steady momentum from the previous session. With no geopolitical tensions or commodity shocks on the horizon, Australian investors can expect a stable trading environment, offering a supportive backdrop for those eyeing U.S. equities.

Block Soars on AI and Afterpay Boost 🚀

The result

Block (ASX:XYZ) dazzled the market with its latest AI powered features for Square payment terminals, boosting merchant efficiency. This innovation, coupled with a 17% surge in Afterpay spending to over US $9 billion (A$13.8 billion), sent the stock soaring by 9.14% to A$127.09. Investors are clearly impressed as today’s gain helps Block lift to a 20.5% increase over the last month.

Why it matters

Block’s AI integration sets a new benchmark in the fintech sector, potentially pressuring competitors to catch up. The robust Afterpay performance highlights the enduring consumer appetite for flexible payment solutions, reinforcing Block’s strategic positioning and investor confidence.

What’s next

Keep an eye on Block’s upcoming annual reports in February and April 2026 for deeper insights. Further AI enhancements and Afterpay’s trajectory will be key indicators of Block’s continued growth and innovation. Investors should watch for these developments to gauge future potential.

QBE Shines with Stellar Profit Leap ✨

The result

QBE Insurance Group (QBE.AX) reported a solid interim profit of US$1.02 billion (A$1.56 billion), a leap from US$802 million the previous period. This beat market expectations, powered by higher premiums and fewer natural disaster claims. The stock traded between A$21.34 and A$23.24, closing at A$21.39 with over 8 million shares exchanged. A 31 cent interim dividend was announced, payable on September 26, 2025.

Why it matters

QBE’s impressive results reflect its strategic prowess in premium pricing and risk management, crucial in today’s economic climate. The lower catastrophe claims have bolstered margins, a boon for the insurance sector. With a strong North American foothold, QBE is well positioned to ride the wave of rising commercial insurance demand.

What’s next

Investors should keep an eye on the upcoming dividend and QBE’s next earnings report in early 2026. Watch for changes in catastrophe claims, premium rates, and the firm’s North American strategy, as these will steer future earnings and stock performance.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.