Scan this article:

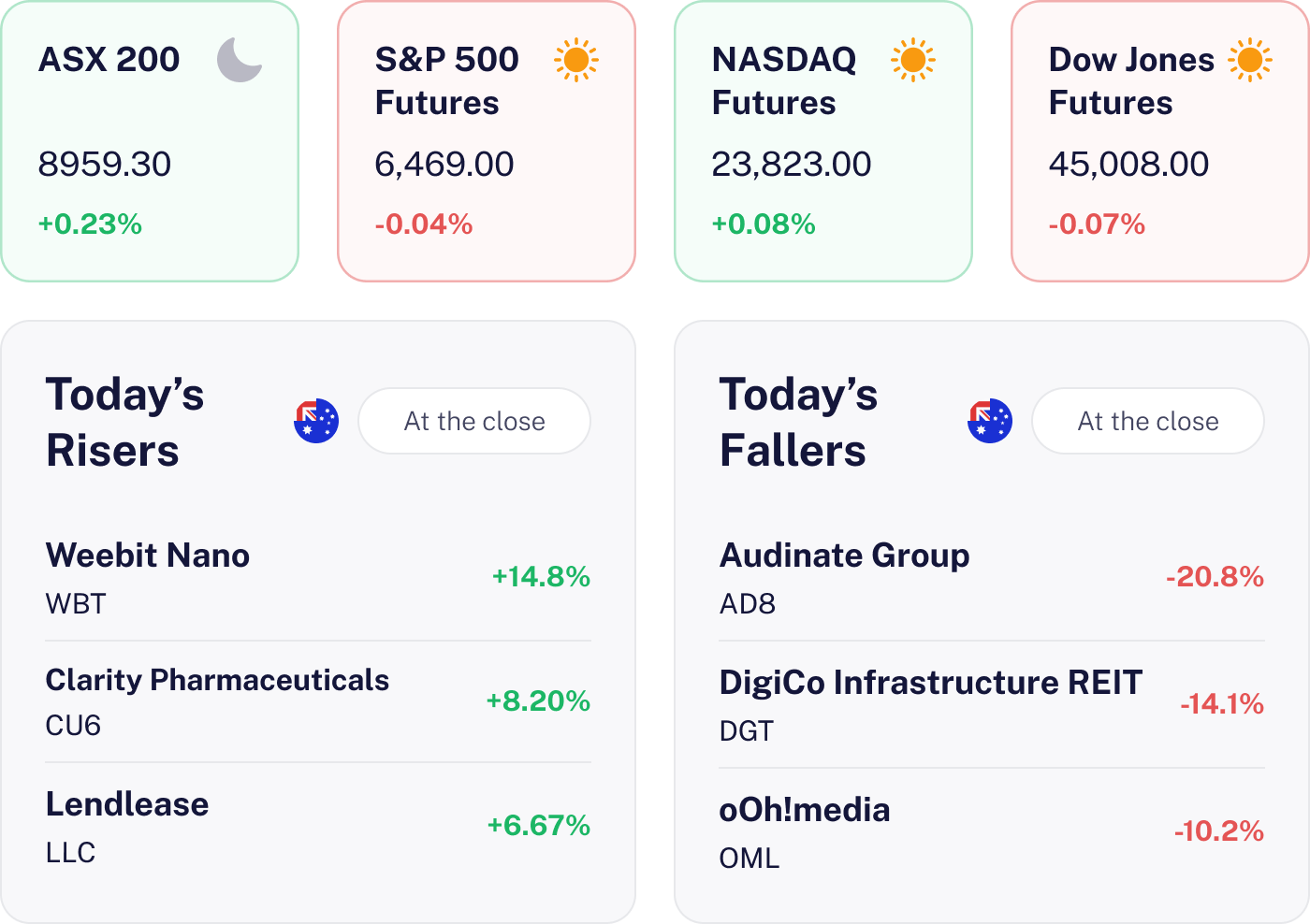

Our AU Market overview

What happened

The market nudged higher, climbing 0.23% as investors cheered strong corporate earnings and positive economic signals. Lendlease, GPT Group and Aurizon Holdings led the charge, buoyed by upbeat financial results and strategic moves. Ampol’s surprising half year performance added to the optimism.

Why it matters for investors

This uptick reflects confidence in Australia’s economic resilience amid global uncertainties. Banking and mining stocks shone while energy shares felt the heat from falling oil prices. This underscores the power of solid fundamentals and central bank support in propelling market momentum.

U.S. outlook

The U.S. market is poised for a positive start, buoyed by resilient sentiment and a lack of major economic or geopolitical disruptions. The recent easing of inflation concerns supports a dovish Federal Reserve outlook, adding to the constructive tone.

NAB Jumps Despite Payroll Error 🏦

The result

NAB has uncovered fresh payroll errors under its 2024 Enterprise Agreement, forcing the bank to set aside at least $130 million for remediation. Third-quarter cash profit came in at $1.77b, down 1% on last year, as expenses climbed 3% on the back of higher payroll and tech spending. On the upside, business lending rose 4% to a record $4.6b while home lending grew 2% in line with the broader market.

Why it matters

The payroll bungle has thrown a spanner in NAB’s cost-cutting push, lifting full-year expense growth guidance to 4.5% and above analyst forecasts of 3.9%. The extra $130m spend – coupled with a $254m credit impairment charge – has raised questions about operational oversight. Still, strong revenue and lending growth helped steady market confidence with NAB shares rising 2.65% as analysts highlighted resilient business demand.

What’s next

Analysts will keenly watch NAB’s full year results on 6 November and its AGM on 12 December. Key focus areas include further payroll remediation updates, cost management and sustaining loan growth amid evolving economic conditions.

BlueScope Plummets on Profit Slump 🔨

The result

BlueScope Steel faced a rough day as shares tumbled 3.14% to A$23.48 after revealing a 90% drop in full-year net profit after tax, missing FY25 estimates. The second half EBIT was 6% below consensus, excluding New Zealand, where results aligned with expectations. This sharp decline reversed part of the 24% gain achieved earlier this year.

Why it matters

This result highlights the cyclical and regionally sensitive nature of the steel sector, with BlueScope’s New Zealand challenges mirroring broader industry issues like input cost pressures and demand volatility. Investors are now questioning sector stability and regional performance’s impact on future earnings.

What’s next

Investors will focus on the upcoming earnings report, scrutinising management’s guidance on cost controls and demand outlook. Key metrics include the next half year earnings estimate of A$0.65 per share and a revenue forecast of A$8.19 billion. Watch for strategic responses to New Zealand’s underperformance and updates on dividend policy.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.