Scan this article:

Our AU Market overview

What happened

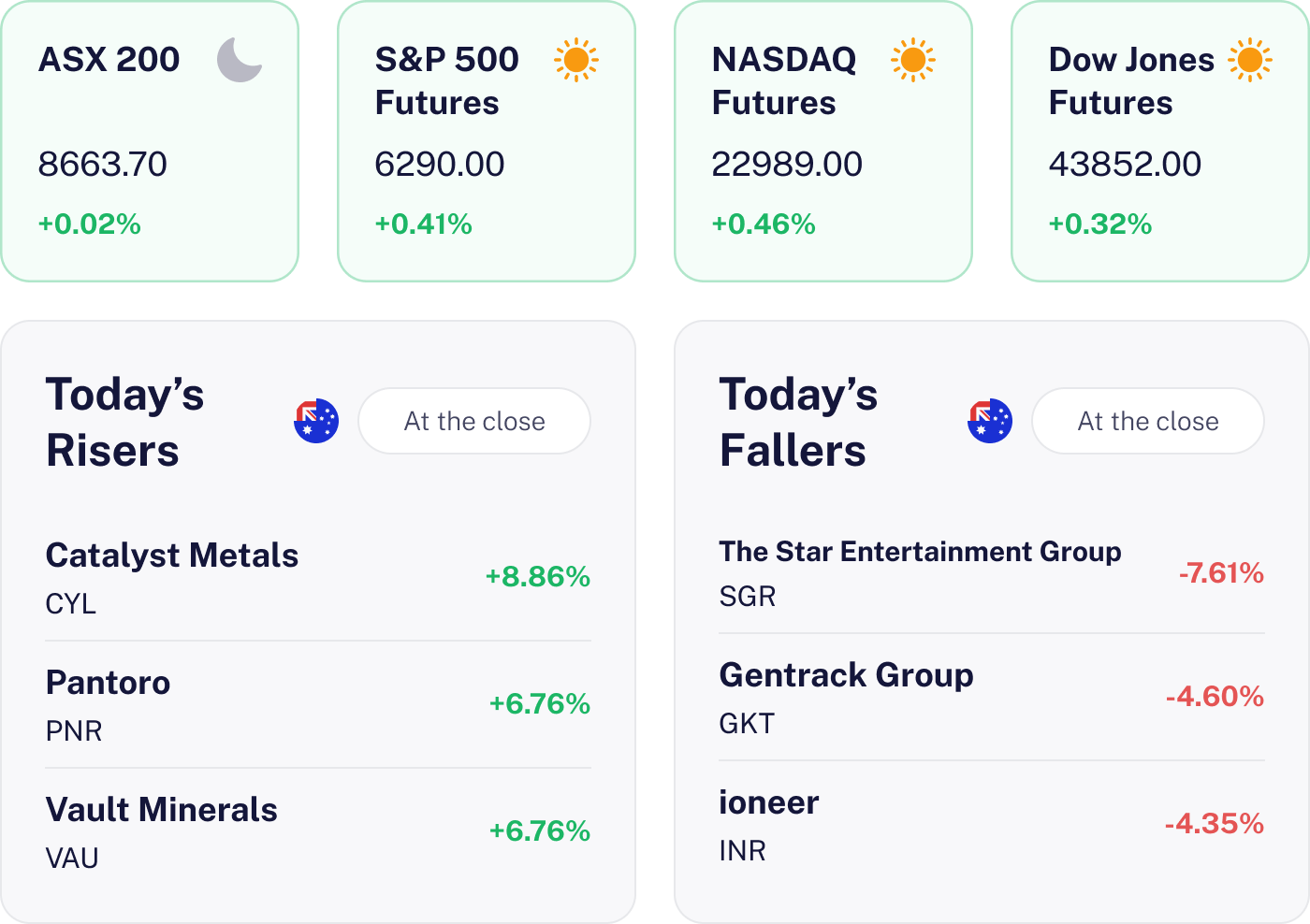

The ASX 200 ended flat (+0.02%) as investors digested global trade tensions and a weaker-than-expected US jobs report. Defensive names like Woolworths and Wesfarmers held the line, while miners slipped on softening commodity prices. Locally, earnings season kicked off with traders looking to corporate results for insight into cost pressures, consumer demand and FY26 outlooks.

Why it matters for investors

With earnings season underway, company results will set the tone for August. Forward guidance will be critical as investors assess how listed companies are navigating cost inflation, wage growth and shifting consumer demand. Expect increased volatility in the coming days as the market reacts to surprises, upgrades and downgrades.

U.S. outlook

U.S. equity futures are positive, reflecting optimism ahead of today’s session as investors anticipate key U.S. Upbeat sentiment is supported by recent momentum in tech stocks and stable Federal Reserve policy expectations.

Domain’s Big Move 🚀

The result:

Domain shareholders have overwhelmingly backed its $2.8 billion sale to U.S.-based CoStar Group at $4.43 per share. A massive 99.98% of votes were cast in favour, with 91.22% of shareholders supporting the deal.

Next stop: court approval on August 6. Trading will be suspended from 7 August with the transaction set to complete by 20 August.

Why it matters:

This is a big moment for Australia’s proptech scene. CoStar’s move signals growing international appetite for local real estate platforms, just as rate cuts and rising listings breathe life back into the housing market. The deal puts a spotlight on the strategic value of digital p

What’s next:

All eyes on the Federal Court’s decision on 6 August. If the green light comes through, Domain will disappear from the ASX by 7 August with payment to shareholders expected by 20 August.

WiseTech’s Strategic Leap 🌐

The result:

WiseTech declined 1.74% today after the company completed its largest ever acquisition, finalising the over US$2.1 billion (A$3.25 billion) takeover of Texas based supply chain software firm e2Open. The takeover was fully funded by a new loan from a group of banks, known as a syndicated debt facility.

Why it matters:

This is a big global push. e2Open adds new products, a strong customer base and little overlap with WiseTech’s existing business – strengthening its position in global logistics tech. But with a multi-billion dollar loan now on the books, investors will be watching how the company manages debt and delivers on integration.

What’s next:

WiseTech will update its FY25 guidance on 27 August. Key things to watch: how the e2Open integration is tracking, whether cost synergies are coming through and how debt repayments will be handled.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.