Scan this article:

Our AU Market overview

What happened

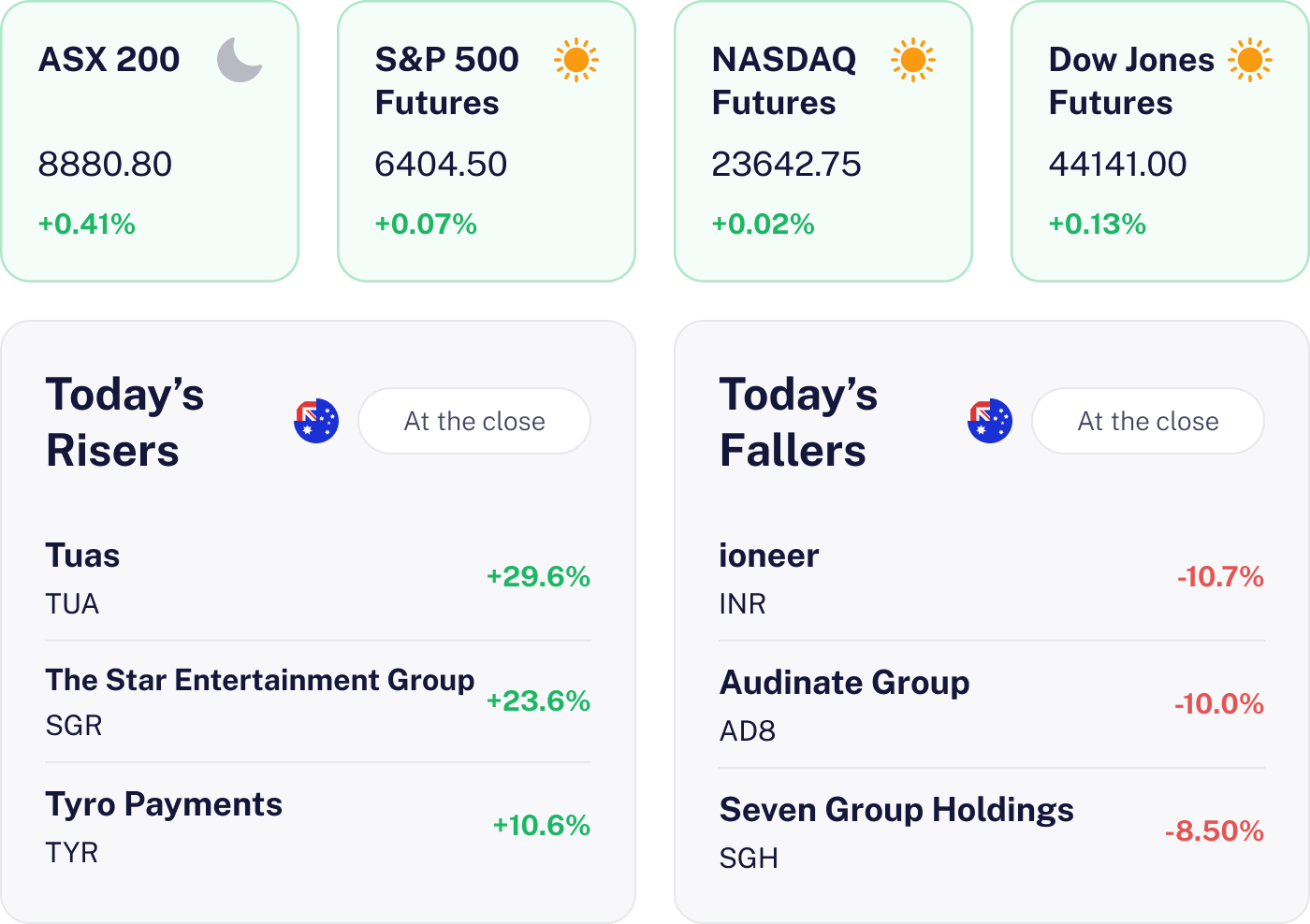

The market edged up by 0.41%, reaching a record high of 8,880. This boost was largely driven by the RBA’s decision to cut rates by 25 basis points to 3.60% as easing inflation and a push to spur household spending took centre stage. The central bank flagged that while labour market conditions have softened, they remain tight by historical standards, and it stands ready to adjust policy if global risks threaten Australia’s growth and inflation outlook.

Why it matters for investors

Lower rates can enhance equity valuations and reduce funding costs, benefiting sectors like housing and consumer goods. However, the RBA’s softer growth outlook suggests a greater focus on balance sheet strength. Upcoming labour data will be crucial in assessing further rate cuts, impacting banks and cyclicals. With the market near record highs, earnings delivery and positioning are key to navigating potential volatility.

U.S. outlook

The U.S. market is set for a cautiously positive start, with futures showing slight gains. With a light economic calendar today, market movements may hinge on sentiment and previous momentum. Australian investors should watch for any surprises from Fed insights, as these could sway market dynamics in the absence of major earnings or geopolitical catalysts.

Life360 Soars on Subscription Revenue Surge 🚀

The result

Life360 soared on a strong June quarter update, climbing over 14% intraday to A$43.34 before settling around A$41.00. The company reported a 36% YoY increase in revenue to A$115.4m, driven by a 38% surge in core subscription revenue to A$82.9m.

Why it matters

Life360’s robust subscription growth underscores its success in monetising high value plans, boosting unit economics. The demand for parental safety apps remains strong, supporting revenue durability. Investors are gravitating towards growth stocks with clear value propositions, showcasing Life360’s appeal in the consumer subscription tech sector.

What’s next

Investors should watch for the September quarter update, focusing on subscriber net adds, churn and ARPU trends. The new CEO’s strategic direction and potential product enhancements could further drive growth. Keep an eye on profitability metrics to validate the implied operating leverage.

Seven Group Plummets on Weak Guidance

The result

SGH shares dropped 8.5% today, making it the worst performer on the ASX 200. While the Kerry Stokes–backed group reported a 5% rise in statutory net profit to $486 million and lifted its final dividend to 32c per share, the FY26 guidance disappointed. The company expects only low-to-mid single-digit EBIT growth, which UBS says is 5% below consensus estimates.

Why it matters

While FY25 performance was solid – driven by WesTrac and Boral – the FY26 outlook fell short. UBS noted expected drags from Beach Energy and Coates, which may offset gains elsewhere. After a strong run post-Boral acquisition and rebrand, the softer guidance suggests earnings momentum could moderate. For investors, this raises questions about the group’s ability to lift margins across all divisions in a more complex macro environment.

What’s next

Investors should keep an eye on management’s future updates, particularly regarding Beach Energy and Coates. SGH’s next scheduled report on 12 August 2025, could provide further clarity. Despite the current dip, UBS remains bullish with a A$60 target, suggesting potential upside if challenges are managed effectively.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.