Scan this article:

Our AU Market overview

What happened

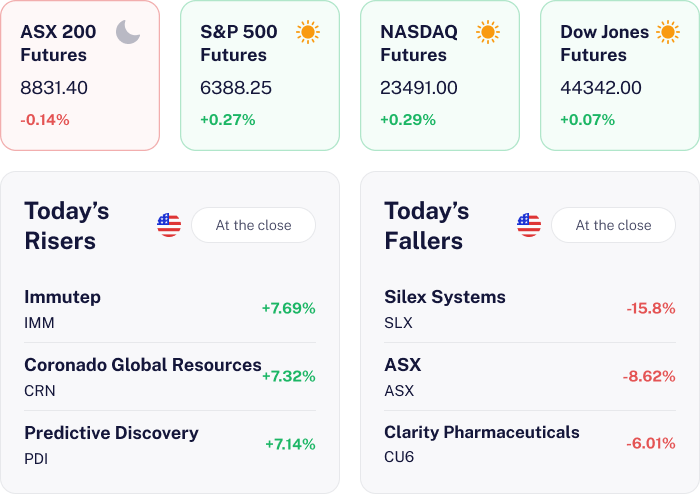

The ASX 200 took a breather, slipping 0.14% after hitting record highs earlier in the week. A sharp drop in ASX’s shares due to an unexpected A$35 million cost increase weighed heavily. Investors shifted focus from banks to mining and healthcare stocks amid interest rate concerns and resilient earnings in these sectors.

Why it matters for investors

This dip underscores the market’s sensitivity to company specific news. The sector rotation highlights the importance of strategic positioning, as investors seek stability in mining and healthcare amidst economic uncertainties. Keep an eye on these trends to navigate potential risks and opportunities.

U.S. outlook

U.S. futures are positive, supported by strong second quarter GDP growth of 3.0% and a sharply narrower trade deficit. This upbeat backdrop sets the stage for potential gains in the S&P 500, Nasdaq and Dow Jones Industrial Average during the upcoming session.

ASX Plummets on Costly Glitch 💸

The result

ASX Ltd’s shares nosedived 8.6% to A$64.32 by 11am AEST, making it the biggest loser on the Australian market. The drop was sparked by news of up to A$35 million in extra costs due to an ASIC inquiry and yesterday’s technical glitch that temporarily erased A$400 million from TPG Telecom’s market cap.

Why it matters

This is the latest in a string of operational stumbles for ASX. The ASIC inquiry, launched after the failed CHESS replacement and other system failures, will examine the exchange’s internal controls with a public report to follow. The back-to-back missteps have raised fresh questions about the ASX’s credibility as Australia’s primary market operator.

What’s next

Investors will eye updates on the ASIC probe, potential reforms, and the next earnings report to gauge the financial impact. Changes in market structure and regulatory policies could also sway ASX’s future trajectory.

AMP Up Despite Profit Drop 📊

The result

AMP Ltd reported a statutory net profit after tax of A$98 million, missing consensus estimates, but underlying profit rose to A$131 million or up 9.2% year on year. Despite an initial 3% drop, shares rebounded to trade up 4.8% at A$1.75. The board declared a 2.0 cent dividend, 20% franked.

Why it matters

While the result missed expectations, UBS analysts flagged improving trends at AMP Bank, highlighting a stable net interest margin and reaffirmed cost guidance. The market appears willing to look past the weaker first half in favour of a stronger second half. AMP announced a board refresh, appointing Linda Elkins from Colonial First State.

What’s next

Looking ahead, AMP is focusing on digital banking expansion and exploring new revenue streams. Investors should watch for updates on litigation costs and dividend policies, while keeping an eye on broader sector trends and macroeconomic factors.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.