Scan this article:

Our AU Market overview

What happened

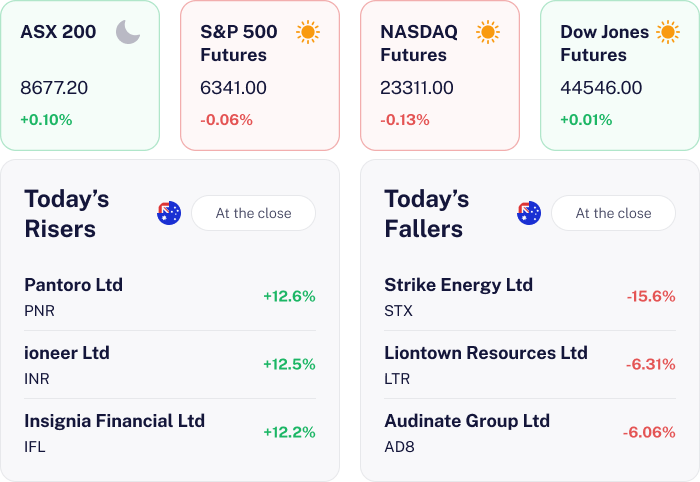

The ASX 200 edged up 0.10% today as gains in major miners and select healthcare stocks helped offset continued weakness in the big banks, which remained under pressure after yesterday’s sharp sell off.

Investor sentiment was supported by a positive lead from U.S. markets overnight and anticipation around the Reserve Bank of Australia’s meeting minutes, which hinted at possible rate cuts following soft domestic jobs data.

This mix of sector rotation and policy expectations drove the market’s modest rebound.

Why it matters for investors

Miners and healthcare stocks are currently shining while the banking sector’s struggles highlight ongoing challenges in the financial landscape. CBA, Australia’s largest publicly-listed company, is now 0.1% off the technical threshold for a correction.

Keeping an eye on these sector dynamics can help investors navigate the market’s twists and turns.

US Outlook

Wall Street is treading water ahead of a packed earnings week, with futures flat across the board despite the Nasdaq and S&P 500 both hitting record highs yesterday. The focus is firmly on Big Tech, with Alphabet and Tesla reporting Wednesday – key tests for AI hype and growth expectations. Analysts remain cautious amid trade tensions with the EU and renewed scrutiny of Tesla’s core business.

💰 U.S. Private Equity Makes a Play for IFL

The news

Insignia Financial shares surged over 12% after announcing a binding agreement for US-based private equity firm CC Capital to acquire 100% of its issued shares for A$4.80 per share – a 56.9% premium to its pre-bid price in December 2024.

The deal values IFL at more than A$3.3 billion and is expected to close in the first half of 2026, subject to shareholder and regulatory approvals.

Why it means for investors

The takeover follows months of speculation and a competitive bidding process. A 56.9% premium signals confidence in Insignia’s transformation efforts post-MLC integration and reflects a broader trend of private equity targeting undervalued ASX-listed financials. The board’s unanimous support adds credibility to the deal’s likelihood of success.

For existing IFL shareholders, the offer represents a substantial return above recent trading levels – locking in value that the market had not yet fully priced in. If completed, it will result in a full cash exit for retail holders.

What’s next

Key upcoming catalysts include shareholder and regulatory votes, with approvals required from APRA, FIRB and the ACCC. The market will watch for any competing bids or changes in regulatory sentiment, as well as Insignia’s ongoing operational performance as it continues to execute its strategy pending deal completion.

🛒 Reject Shop bows out after Canadian buyout

The news

The Reject Shop has officially completed its acquisition by Canadian retailer Dollarama, with implementation finalised today. Shareholders received A$5.91 per share, along with a fully franked special dividend of A$0.77 paid on 14 July.

TRS shares have been suspended and will be removed from the ASX at the close of trade on 23 July. The stock last traded at A$6.68, near its 52-week high.

Why it means for investors

With TRS now delisted, investors seeking exposure to value-focused retail may turn to names like Kogan.com (ASX:KGN), Harvey Norman (ASX:HVN) or Premier Investments (ASX:PMV), all of which target budget-conscious consumers in a shifting retail environment.

The deal also underscores broader interest in defensive and discount-led retail models amid ongoing cost-of-living pressures.

What’s next

Focus will now turn to how remaining retailers navigate the current environment, especially around inventory levels, promotional activity and margins. Upcoming earnings and consumer confidence data will be key to assessing retail sector resilience through the second half of the year.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.