Scan this article:

Our AU Market overview

What happened

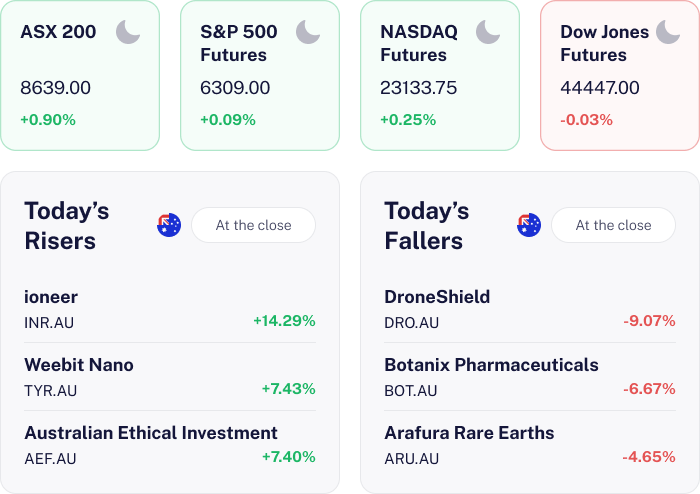

The ASX 200 climbed 0.90% today as strong gains in major banks like CBA and Westpac lifted the market, reflecting broad based optimism among Superheroes. Positive momentum from Wall Street overnight boosted sentiment, while higher oil and gold prices supported energy and mining stocks.

Despite a weaker than expected jobs report showing Australia’s unemployment rate rising to 4.3%, investors appeared to focus on global cues and resilient corporate updates, driving the index near record highs.

Why it matters for investors

For Superheroes, today’s market movements highlight the power of global influences and sector specific trends in shaping the ASX 200’s trajectory. The robust performance of financials and resources suggests confidence in these sectors, despite domestic economic challenges.

With the increase in unemployment rate, analysts now have stronger expectations for a rate cut at the RBA’s next meeting.

US Outlook

U.S. futures are modestly positive, reflecting cautious optimism ahead of today’s US$ retail sales and inventories data, ongoing Fed commentary and stable mortgage rates.

Quarterly Earnings season is beginning to ramp up, with Netflix among those due to report later today.

📝 An even better offer than Betr’s

The news

The bidding war for PointsBet is heating up. Japanese entertainment group MIXI has officially returned with a fresh $1.20 per share all-cash offer – and this time, it’s got board backing and early momentum. The Japanese tech giant has already locked in support from key shareholders, reigniting takeover buzz around the sports betting stock.

It’s the latest move in a fierce bidding war with rival suitor Betr, which launched a competing all-share offer that it claims is worth $1.22 per PointsBet share. But PointsBet says the real value is closer to $1.03, based on Betr’s recent share price performance.

Why it means for investors

MIXI’s cash bid comes with fewer strings attached – no regulatory hurdles and a clear 50.1% minimum acceptance condition. After the failure of its $402m scheme bid in June, MIXI is making good on its promise to return with an off-market tilt.

What’s next

The PointsBet board has unanimously recommended MIXI’s offer. Shareholders will now weigh the certainty of cash versus the volatility of Betr equity. The race for control is on and volumes in PBH could spike as the deadline nears.

🩻 Clarity’s Vision Gets Sharper

The news

Clarity Pharmaceuticals gained 2.3% today after completing enrolment in a phase 2 diagnostic trial for its prostate cancer imaging agent. Shares had jumped more than 9% earlier in the session before settling higher.

The trial focuses on detecting cancer recurrence in men with low PSA levels post-prostatectomy – a tough-to-diagnose group. Progress here boosts confidence in Clarity’s pipeline, especially in a market hungry for precision oncology plays.

Why it means for investors

Clarity is still pre-revenue, with a net loss of A$48.7m in the past year and a market cap around A$889m. But today’s move shows that biotech momentum can still attract speculative capital on trial milestones.

What’s next

Investors will be watching for efficacy data and regulatory updates as the study progresses. Any signs of commercial viability could drive further upside.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.