Scan this article:

Our AU Market overview

What happened

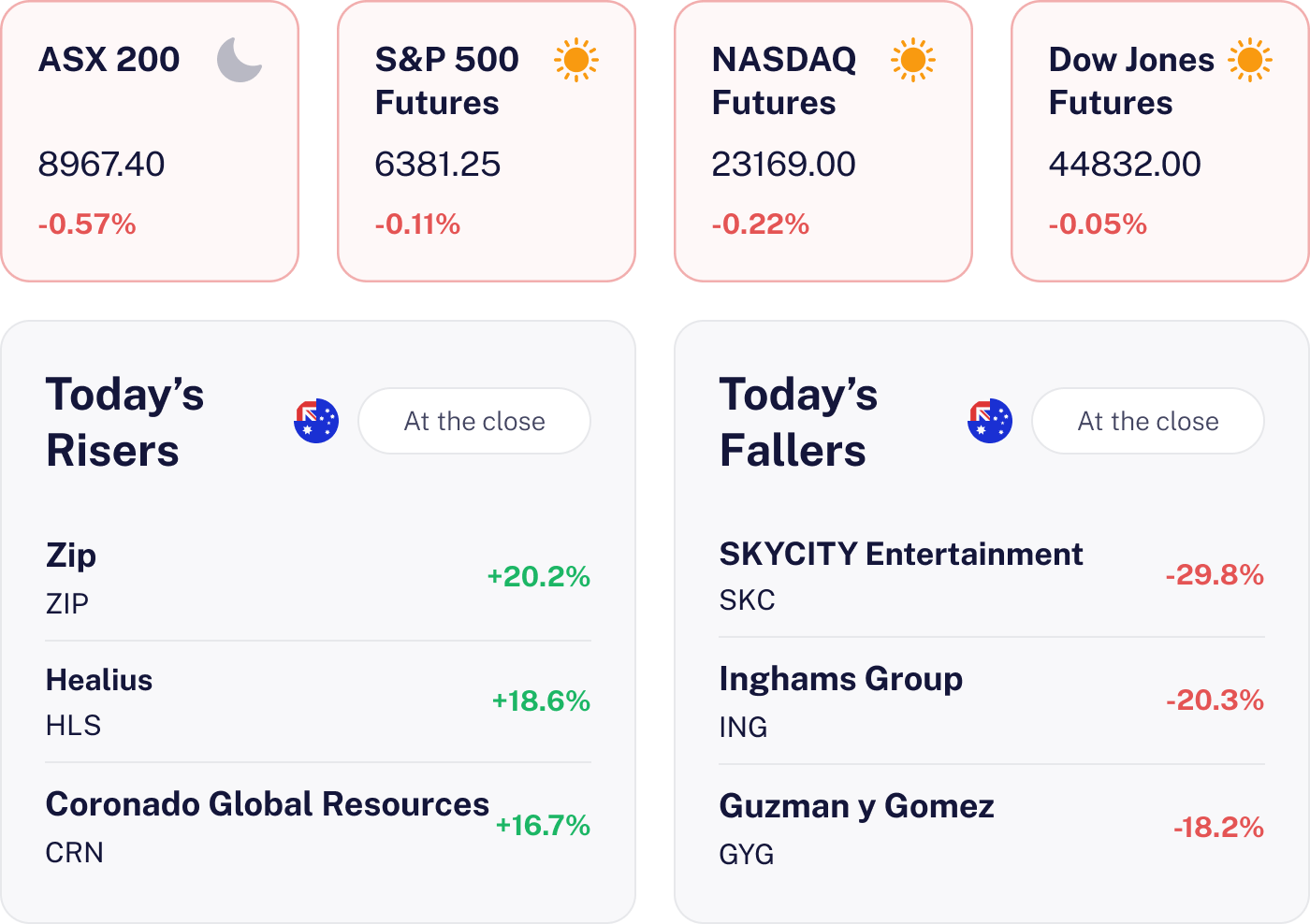

The market slipped 0.57% after hitting record highs earlier, as global equity weakness and U.S. Federal Reserve caution spooked investors. Major banks saw mixed results, while healthcare lagged with CSL down 3.35%. Energy stocks shone, buoyed by rising oil prices.

Why it matters for investors

This dip highlights the impact of global cues and sector shifts on local stocks. With volatility high, keeping an eye on international trends and sector performances is key for navigating these choppy waters.

U.S. outlook

U.S. markets are set for a cautious start, with futures slightly down as investors brace for Fed Chair Powell’s insights at the Jackson Hole Symposium. Persistent inflation pressures and softer economic momentum add to the uncertainty. While no major earnings or geopolitical shifts are expected today, Australian investors should keep an eye on Powell’s speech for clues on future rate policies, as this could sway market sentiment.

Guzman y Gomez Shares Plunge on Cautious Outlook 🌯

The result

Guzman y Gomez shares sank more than 18% as muted FY26 guidance spooked investors, triggering a sharp sell-off. That reaction came despite a strong FY25 performance, with network sales up 23% and NPAT surging 151.8% to A$14.5 million.

Why it matters

The market is laser focused on future growth, and GYG’s cautious outlook has dented confidence in its expansion plans. This highlights the sensitivity of the fast casual sector to consumer sentiment and operational risks, especially as GYG expands internationally.

What’s next

Investors will keep an eye on early FY26 trading updates and any strategic shifts. Potential changes in major shareholder positions and dividend policies could also sway sentiment. Keep your eyes peeled for any signs of stabilisation or further volatility.

Zip Co Soars on Nasdaq Buzz 🤩

The result

Zip Co rocketed over 20% following impressive FY25 results and the buzz of a potential Nasdaq listing. The company’s cash EBTDA soared to A$170.3 million, marking a 147% rise. Investors were clearly excited as trading volumes surged alongside the stock price.

Why it matters

Zip’s stellar performance highlights its transformation into a global BNPL powerhouse, with over 80% of earnings from the U.S. market. This Nasdaq listing consideration could pave the way for other Aussie fintechs eyeing international growth. The company’s operational improvements and strategic U.S. focus are setting a high bar in a competitive sector.

What’s next

Eyes are on the potential Nasdaq listing, which could further boost Zip’s profile. Investors should watch for continued U.S. expansion and the next earnings report for sustained growth. Any regulatory changes in the BNPL space could also impact Zip’s journey. Keep your superhero capes ready for more action!

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.