Scan this article:

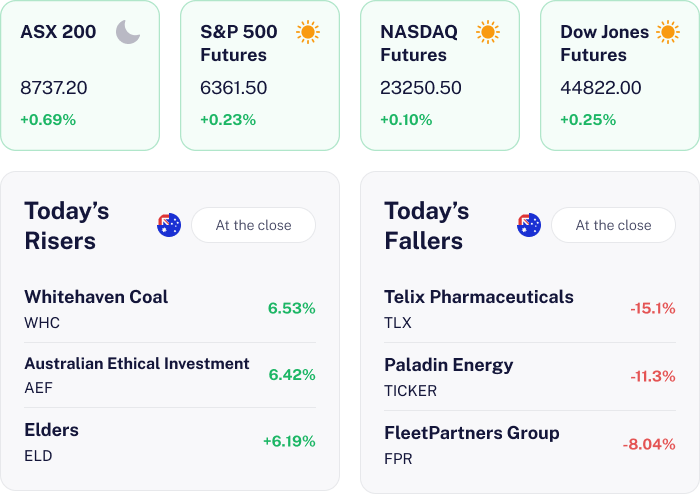

Our AU Market overview

What happened

The ASX 200 rose 0.69% today as strong gains in gold stocks and major miners drove the market higher, supported by a rally in iron ore prices after Beijing announced a US$170 billion stimulus package. Energy shares like Ampol also jumped on solid earnings results, while improved global sentiment followed a major U.S. tariff deal with Japan and progress in U.S.-China trade talks.

Why it matters for investors

Today’s uptick in the ASX 200 highlights the positive impact of global economic developments on Australian markets, especially in the resources sector. The rally in commodity prices and favourable international trade dynamics offer a promising outlook for Investors focusing on mining and energy stocks.

However, the Reserve Bank’s cautious stance on rate cuts suggests markets should remain vigilant about potential shifts in monetary policy that could influence market conditions.

US Outlook

US futures are trading higher, reflecting optimism ahead of today’s session as Investors anticipate supportive economic data including steady jobless claims and resilient PMI readings. Awaiting Fed Chair Powell’s speech for policy cues, positive overnight momentum and stable commodity prices further underpin sentiment for Australian Investors trading U.S. equities.

🌧️ Regulatory Clouds Loom Over Telix

The news

Telix Pharmaceuticals shares plunged over 15% today, making it the largest decliner on the ASX 200. The sharp drop followed news that the company received a subpoena from the U.S. Securities and Exchange Commission seeking information about disclosures related to its prostate cancer therapeutic candidates.

Telix stated the request is a fact finding inquiry and does not impact its commercial or late stage assets, including Illuccix, which remains the company’s main revenue driver. The stock hit A$21.21, its lowest since November last year, despite reporting strong Q2 revenue of US$204 million, up 63% year over year.

Why it means for investors

This development is significant as it introduces regulatory uncertainty for a company that has been delivering robust financial growth and is highly rated by analysts.

The SEC investigation could weigh on sentiment and overshadow recent operational momentum, especially given Telix’s reliance on U.S. markets and regulatory clarity for its pipeline.

What’s next

Analysts will be watching for further updates from Telix regarding the SEC inquiry as well as any impact on its prostate cancer pipeline. Near term catalysts include additional regulatory disclosures, upcoming earnings and continued sales performance of Illuccix. The outcome of the SEC process and management’s communication will be key to restoring confidence.

💥 Uranium Prices Under Pressure

The news

Paladin Energy shares declined 11.26% today after the company released its June quarter update, highlighting a ramp up at the Langer Heinrich Mine with production guidance of 4 to 4.4 million pounds of uranium oxide for the 2026 financial year.

Sales are forecast at 3.8 to 4.2 million pounds, with production costs between US$44 and US$48 per pound. Paladin expects to realise about US$71 per pound under existing contracts, below the current uranium spot price of US$80 per pound. Capital and exploration expenditure is guided at US$26 to US$32 million.

Why it means for investors

The drop reflects investor concerns about the cost structure and realised pricing lagging the spot market, despite the operational ramp up. The uranium sector remains volatile, with sentiment sensitive to production costs and contract pricing. Paladin’s negative PE ratio, well below historical averages, signals ongoing profitability challenges.

What’s next

Key catalysts ahead include the completion of the Langer Heinrich ramp up by year end and the transition to full operations next financial year. Market focus will remain on Paladin’s ability to control costs and capture higher uranium prices through future contract negotiations.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.