Scan this article:

For all the talk of AI and digitisation in medicine, here’s a reality check: nearly 1 in 4 U.S. patients still receive their scans on physical media.

It's a multibillion-dollar problem hiding in plain sight, costing billions in duplicate scans, delayed treatments and lost medical imaging records.

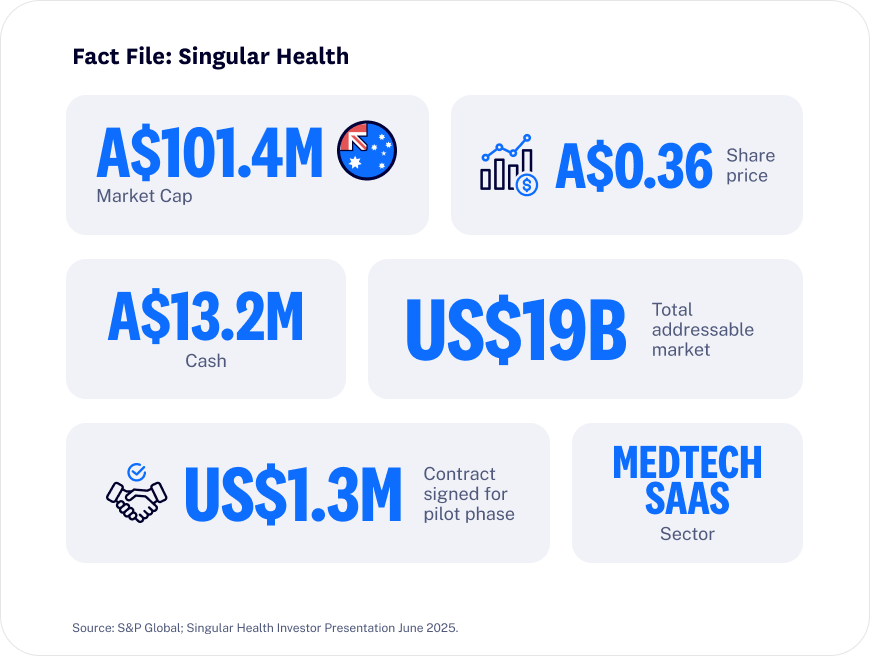

Singular Health (ASX:SHG), a $100m market cap medtech from Western Australia, believes it has the solution to solve the global problem. In fact, it’s not just belief anymore – it recently landed a US$1.3 million commercial deal with one of the biggest names in U.S. healthcare.

Here’s the story behind Singular Health’s quest to reinvent medical imaging globally – and why investors should take notice.

Why Medical Imaging Is Broken and What It Costs

Let’s start this Deep Dive with some context on the problem Singular Health is solving.

Imagine this: You get a critical MRI scan at your local hospital, urgently needing a diagnosis. Days later, you travel across town to see a specialist – only to find out they never received your scans. Your diagnosis stalls, anxiety mounts and you're told you'll probably have to repeat the procedure and reschedule your specialist appointment.

This is the problem commonly faced by patients in the U.S. and multiple other countries.

Despite rapid advancements in healthcare technology, medical imaging data remains trapped in outdated, siloed systems known as Picture Archiving and Communication Systems (PACS).

These legacy systems, installed on-site, rarely communicate smoothly with other hospitals or doctors.

For patients, that means repeatedly taking the same expensive, time-consuming scans just because hospitals can’t share data properly.

Global Costs of Imaging Inefficiency

In the U.S. alone, duplicate scans cost the healthcare system around US$30 billion every year. Globally, tens of billions more are wasted due to inefficient image sharing and data loss.

And all of it – the waste, the delays, the stress – stems from one simple thing: outdated infrastructure.

That’s where Singular Health saw an opening.

Singular Health’s Rise From Perth to the U.S.

Founded in 2017 in Perth, Singular Health began with a bold idea: to make medical imaging more intuitive and accessible for both doctors and patients.

The company’s early tools helped users visualise scans in 3D, offering a more hands-on way to understand the human body.

But as the team looked closer, they saw a bigger problem: medical images like CTs and MRIs were trapped inside legacy systems that didn’t talk to each other. And unless someone fixed that, nothing else could move forward.

3DICOMTM: Singular Health’s Flagship Software

To solve that problem, Singular built 3DICOMTM – a cloud-based platform that helps healthcare providers access, view and share medical scans to other doctors and institutions.

It turns medical scans into FDA-cleared interactive 3D images and lets doctors securely share them using Singular’s proprietary MFTP technology – a key feature that meets strict data privacy rules like HIPAA, SOC2, and ISO27001.

Today, Singular Health is in active discussions with Aussie organisations about the use of 3DICOMTM. It has also been piloted in tertiary educational settings in countries includingSaudi Arabia.

Its first major commercial rollout? Puerto Rico – marking Singular’s entry into the U.S. healthcare market, and what could be the start of something much bigger. 3DICOMTM will also be tested in some of PNS’ sites across Florida and Texas.

Leveraging AI Capabilities in 3DICOMTM

3DICOMTM also goes a step further in terms of tech capability. Singular Health is building an AI-in-the-Cloud marketplace to support users of 3DICOMTM.

This marketplace is a growing library of AI tools that run directly on medical images as they’re shared to help reduce unnecessary repeat scans, assist in earlier detection, reduce misdiagnosis, and support doctors in prioritising high-risk patients faster.

It’s part of SHG’s vision to improve outcomes across healthcare networks by putting smarter, more accessible tools into the hands of every clinician.

Last year, the company exited its 3D printing business, which was sold for $450,000 .

The move streamlined Singular Health’s operations and reinforced its core mission to become a globally scalable SaaS business.

How the U.S. Healthcare System Benefits Singular Health

And it’s a decision that’s paid off.

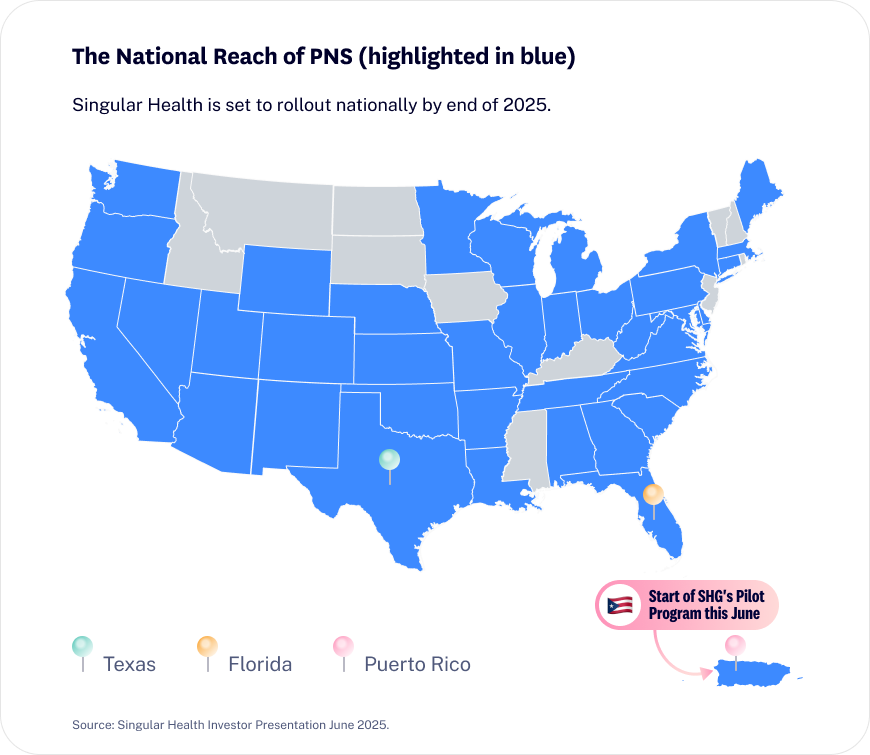

Last week, Singular Health announced a transformative US$1.3 million commercial contract with Provider Network Solutions (PNS), a major Managed Service Organisation (MSO) managing healthcare plans for 3.7 million members across multiple U.S. states.

What an MSO is and Why it Matters

To understand why this U.S. deal is such a big deal, it helps to know what an MSO actually is.

In the U.S., healthcare isn’t centrally managed. Doctors and clinics operate independently, but still need help with things like admin, billing, IT systems and compliance. That’s where MSOs come in.

MSOs don’t deliver medical care – they manage the behind-the-scenes operations that keep providers running smoothly. That includes the adoption of new technology aimed at streamlining operational efficiency and cutting unnecessary costs.

For Singular Health, this segment of the U.S. Healthcare Industry is its key target market.

PNS: Singular Health’s Partner and Investor

Which brings us to Provider Network Solutions (PNS) – the MSO that just signed Singular’s biggest deal yet.

PNS supports healthcare providers managing 3.7 million patients across multiple states.

When it brings on a new platform like 3DICOMTM, it has the potential to deploy it across a large, distributed network of doctors — fast.

And PNS is just one of hundreds of MSOs in the U.S. – the MSO market is estimated to be worth US$46.8 billion and is expected to grow at a ~13% CAGR over the next five years, citing further opportunity for Singular Health.

Starting Off With Puerto Rico

This US$1.3 million contract is just the start of it. It’s pretty much a paid pilot phase, starting in Puerto Rico and various sites across Florida and Texas, where PNS will begin rolling out 3DICOMTM across its network of physicians.

If successful, this pilot becomes the case study – unlocking the rest of PNS’s footprint across the mainland U.S. Each new region would represent another commercial rollout opportunity, with many already mapped out (as shown in the accompanying graphic).

And Singular doesn’t need to sell clinic-by-clinic. That’s the beauty of working with an MSO: win once, scale many times over.

Breakdown of the US$1.3 million PNS Deal

- 1,000 physician licences for Singular’s flagship 3DICOMTM MD software.

- Priced at US$800 per physician annually (totalling $800,000).

- US$500,000 in upfront development and integration fees, specifically tailored to PNS’s clinical and compliance needs.

This landmark deal validates Singular Health’s commercial strategy and positions the company for broader global rollout.

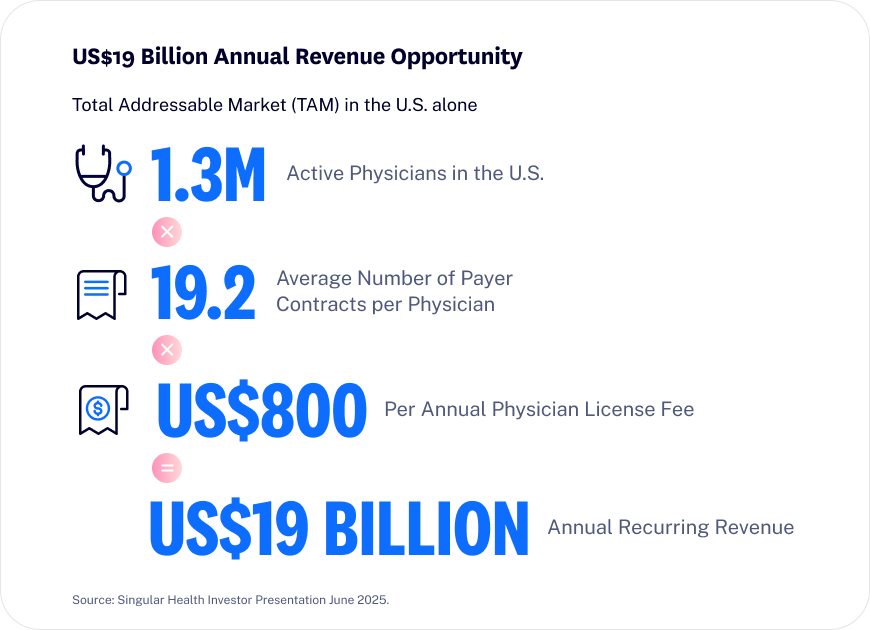

SHG’s Real Opportunity: US$19 Billion in ARR

Now let’s talk growth numbers.

Under the deal structure, MSOs pay Singular Health US$800 per physician license to use 3DICOMTM. Multiply that by hundreds – or thousands – of doctors, and the potential revenue starts to scale quickly.

SHG to show in 2026 a pathway to US$30m in revenue

The U.S. is home to over 1 million practising physicians. Multiply this by 19 payer contracts per physicians and US$800 per license, and you get a massive US$19B annual recurring revenue (ARR) opportunity.

Singular won’t reach every doctor straight away, but it’s aiming for national expansion by the end of the year – which Singular expects could bring in ~US$30 million in annual revenue by 2026 and a clear pathway towards a meaningful share of its US$19B target market.

What SHG’s Numbers Look Like

We’ve covered the product, the partner and the path ahead. But how does Singular Health stack up financially? Here are some key figures from its latest investor update (June 2025):

- Debt-free and well-funded: Following its A$8 million capital raise last week, Singular Health currently holds over A$13 million in cash. This gives it breathing room to support the U.S. rollout and ongoing development.

- Leaner and more focused: Following its shift in focus to a pure software model, Singular now runs with lower fixed costs and a streamlined operating structure – allowing more flexibility to scale as demand ramps up.

- U.S. deal not yet recognised in income statement: The US$1.3 million PNS contract – which includes recurring license fees and upfront development income – was signed this month and is not yet reflected in these numbers. Investors should expect a material uplift in SHG’s revenue once this deal is recorded.

Long story short – Singular Health is currently in a strong financial position to develop its 3DICOMTM business model.

And given the recent change in business model – don’t forget, Singular divested from its 3D printing business just last September – we can’t exactly use its past financial performance as any indication of future performance.

But on that note, this also means investors can expect to see change. Its recent US$1.3 million contract alone could see Singular record its highest-ever level of annual revenue in history.

What SHG Investors Could Watch Out For

Singular Health has built an impressive product and landed a credible first partner. But like any early-stage business model, investors should note that the road ahead isn’t without risk.

- Execution risk: Rolling out across multiple U.S. states – each with its own regulations, stakeholders and workflows – is a big task. Puerto Rico, Florida and Texas may be the starting points but national scale will require tight operational execution.

- Customer concentration: Right now, PNS is Singular Health’s only major commercial customer. While the pipeline may be growing, the current model depends heavily on one contract. Diversifying that base will be key for Singular’s long-term outlook.

- Competitive pressure: Management believes 3DICOMTM is a first-of-its-kind product, but the broader healthcare software space is full of legacy vendors with deep pockets. If SHG gains traction, it could invite competition from much larger players.

- Timing mismatch: SaaS rollouts take time. Even with a signed contract, investors shouldn’t expect overnight financial results. It may be several quarters before recurring revenue flows through in a meaningful way.

- Capital requirements: SHG is well funded for now. But if growth takes off – and particularly if it needs to expand its U.S. presence quickly – it may need more capital down the line, which could lead to share dilution for existing investors.

In short, there’s a lot to like here. But the next 6 to 12 months will be critical in determining how the story plays out.

The Final Diagnosis on Singular Health

Singular Health (ASX:SHG) isn’t just building software – it’s going after one of the most expensive corners of modern medicine.

Its 3DICOMTM platform is taking aim at a global imaging market plagued by inefficiency and outdated tech. And now, with a US$1.3 million U.S. contract already signed, SHG isn’t just talking – it’s executing.

Puerto Rico is just the beginning. With millions of physicians across the U.S. and billions in potential software revenue up for grabs, Singular is positioning itself as a disruptive first mover in a massive untapped market.

It’s early. It’s ambitious. But if this small-cap can deliver – the upside could be enormous.

- The Problem: Medical imaging is stuck in the past, costing billions in repeat scans and delays.

- The Solution: 3DICOM™ – secure, cloud-based software that makes scans sharable and usable.

- The Deal: US$1.3m pilot with U.S. healthcare MSO, potentially expanding to nationwide rollout.

- The Opportunity: Up to US$19B in recurring software revenue.

- The Risk: Execution, customer concentration and scale.

This article reflects information accurate as of 24 June 2025.

Superhero Markets Pty Ltd has a commercial arrangement with Singular Health Group (ABN 58 639 242 765) and investors should be aware this arrangement may influence the objectivity of the information presented. Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. Singular Health Group’s products are offered independently and nothing included in the information presented should be considered an endorsement or guarantee of their products and services by Superhero.

As always, it is essential to conduct your own research and due diligence before making any investment decisions. Superhero does not provide financial advice that considers your personal objectives, financial situation or particular needs. All investments carry risk so please consider carefully before investing. Remember that past performance is not indicative of future performance. Graphics, charts and graphs provided for illustrative purposes only.

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)