Scan this article:

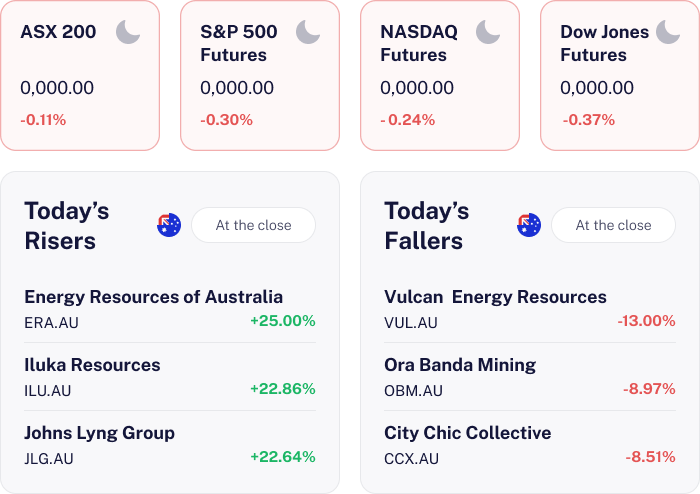

Our AU Market overview

- The ASX 200 closed down slightly as investors reacted to escalating global trade tensions.

- Johns Lyng Group surged over 22% after announcing a takeover by Pacific Equity Partners, valuing the company at A$1.3 billion and offering shareholders A$4 per share in cash.

- Lynas Rare Earths surged over 16% due to a sector wide boost from MP Materials multibillion dollar agreement with the US Department of Defence, highlighting increased demand for rare earths.

What happened

The ASX 200 closed down slightly as U.S. President Donald Trump announced plans for a blanket 15-20% tariff, up from 10%.

This uncertainty weighed on sentiment, despite overnight gains on Wall Street, where investors largely shrugged off tariff news and tech stocks continued to rally.

Resource stocks outperformed with BHP, Fortescue and Rio Tinto all up, supported by firmer commodity prices and a rebound in iron ore. In contrast, healthcare lagged, with the sector down nearly 1% as CSL slipped 0.6%.

U.S. Outlook

U.S. stock futures are down across the board – reflecting jitters over Trump’s tariff threats and the broader trade outlook.

But not all sectors are rattled. Nvidia has reclaimed its title as the world’s most valuable company, topping a US$4 trillion (A$6 trillion) market cap. The move is fuelled by surging demand for its new Blackwell AI chips and continued hyperscaler investment in infrastructure.

Bitcoin has also smashed through US$118,000, driven by Trump’s crypto-friendly policy rhetoric and fresh institutional flows

🏗️ Building Blocks of Success

The news

Johns Lyng Group surged over 22% after announcing it has agreed to a takeover by U.S. private equity firm Pacific Equity Partners through its subsidiary Sherwood BidCo.

The deal values the company at over A$1.1 billion in equity, with an enterprise value of A$1.3 billion and offers shareholders A$4 per share in cash. The board described the offer as an attractive transaction that recognises the value of Johns Lyng’s integrated building services operations across AU, NZ and the U.S.

What it means for investors

The offer lands at a hefty premium to recent trading, locking in immediate value for shareholders. It also puts a spotlight on the strength of Johns Lyng’s diversified business, sticky client base and dominant position in insurance-related repairs. A surge in the share price says it all – the market’s backing the deal, especially with cash on the table in a jittery environment.

What’s next

Looking ahead, the focus will shift to shareholder and regulatory approvals required to complete the scheme. There may also be speculation about competing bids or revised terms, though the board’s endorsement suggests a high likelihood of completion. If successful, Johns Lyng will transition from the ASX 200 to private ownership, with implications for index composition and peer valuations.

🌟 Rare Earths Shine Brightly

The news

Lynas Rare Earths surged over 16% today, significantly outperforming the broader market.

The rally was sparked by a sharp move in U.S. listed MP Materials, which soared over 51% after announcing a multibillion dollar agreement with the U.S. Department of Defence to build a new magnet plant and expand rare earths capacity.

This comes before Lynas’s next earnings report, scheduled for 24 July 2025.

What it means for investors

Lynas shares jumped as investors backed the growing strategic value of rare earths in clean energy and defence. With the U.S. pushing to secure supply and cut reliance on China, Aussie producers like Lynas – operating in WA and Malaysia – are in the spotlight. Today’s move signals confidence in long-term demand, powered by electrification, renewables and geopolitics.

What’s next

The sector remains sensitive to regulatory changes, technological advances in recycling and shifts in global trade policy. Continued U.S. government support for domestic rare earth capacity and potential new contracts could serve as further catalysts for Lynas’s share performance

Become a part of

our investor community

Why you should join us:

- Join free and invest with no monthly account fees.

- Fund your account in real time with PayID.

- Get investing with brokerage from $2. Other fees may apply for U.S. shares.

Read our latest articles

Make knowledge your superpower and up your skills and know-how with our news, educational tools and resources.

![The top ASX lithium stocks by trade volume and performance [2023]](https://www.superhero.com.au/wp-content/uploads/2023/06/24-03_blog_news_toplithiumstocks_hero@2x-1024x796.jpg)